The American healthcare landscape is defined by an accelerating pace of policy change. The One Big Beautiful Bill Act (OBBBA), officially H.R. 1, represents the latest, and one of the most significant, legislative events in this ongoing evolution. Passed by the House on May 22, 2025, the OBBBA is not an isolated piece of legislation but a critical data point in a broader trend of regulatory shifts that are reshaping the financial and operational foundations of the entire healthcare ecosystem. For healthcare decision-makers, a reactive, change-by-change approach is no longer a viable strategy. Long-term success now depends on a proactive posture built on foundational resilience, operational agility, and a strategic, technology-enabled approach to care coordination.

This article positions the OBBBA as a microcosm of the current legislative environment—one characterized by both sweeping reforms and profound uncertainty. It argues that the new executive mandate is to move beyond mere compliance with policy and to strategically leverage technology, organizational structure, and operational intelligence to not only survive but to thrive amidst perpetual change. The future belongs to those who view policy fluctuations not as a burden but as an opportunity to build a more robust and responsive enterprise.

Part I: The new legislative reality

A bill by any other name: unpacking the One Big Beautiful Bill Act

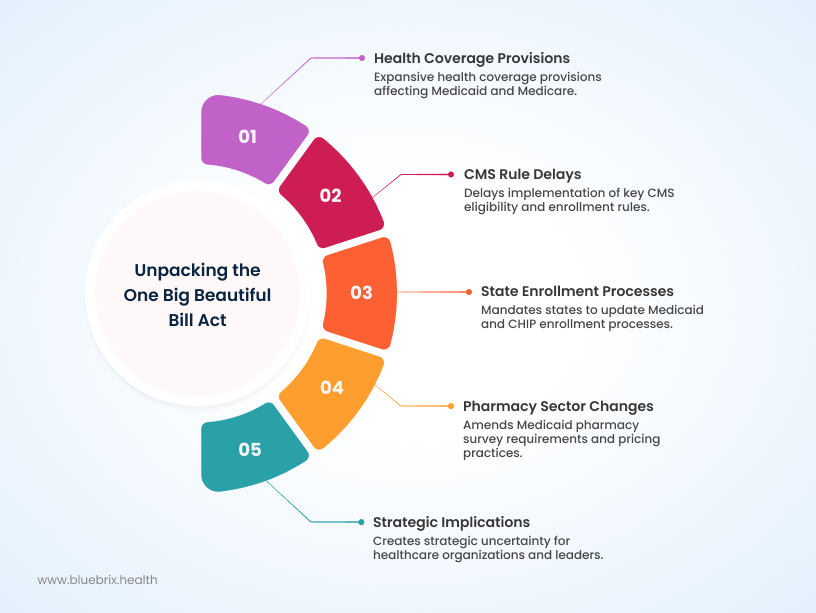

While colloquially known as the One Big Beautiful Bill Act, the legislation formally passed by the House of Representatives as H.R. 1 on May 22, 2025, provides for budget reconciliation and contains far-reaching health coverage provisions. Another concurrent piece of legislation, the Protecting Health Care for All Patients Act of 2023 (H.R. 485), also passed the House and is relevant to this discussion, particularly for its provisions related to quality-of-life metrics. These bills illustrate a dynamic and often unpredictable legislative environment where policy changes can emerge rapidly.

The OBBBA’s health coverage provisions, included in Titles IV and XI, are tied to the budget for fiscal year 2025 and directly impact Medicaid, the State Children’s Health Insurance Program (CHIP), private health insurance, and Medicare. A central theme of the bill is its direct intervention in the administrative and regulatory processes governed by the Centers for Medicare & Medicaid Services (CMS). The OBBBA would delay or prohibit the implementation of three key final rules: the eligibility and enrollment final rule, the Medicare Savings Programs final rule, and the nursing home staffing final rule. The delay of the Medicaid eligibility and enrollment rule is particularly noteworthy, postponing its implementation until September 30, 2034, effectively reversing CMS’s administrative simplification efforts for more than a decade.

Additionally, the bill mandates that states establish a process to obtain updated address information for Medicaid and CHIP enrollees from managed care entities, beginning on January 1, 2027. It also requires the Department of Health and Human Services (HHS) to create a system to prevent simultaneous multi-state enrollment in Medicaid and CHIP by October 1, 2029. In the pharmacy sector, the OBBBA amends Medicaid pharmacy survey requirements and prohibits the use of spread pricing by Pharmacy Benefit Managers (PBMs) within Medicaid.

These provisions, especially the long-term delay of CMS final rules, signal a fundamental shift in the policy landscape. CMS has historically driven administrative simplification and modernization through its rulemaking process, as seen in efforts to streamline enrollment and billing. However, the OBBBA demonstrates that legislative policy, often driven by budget reconciliation and partisan priorities, can directly counteract and reverse the direction of executive-branch regulatory work. This dynamic creates a layer of systemic uncertainty for healthcare organizations. Leaders must now operate in an environment where the regulatory foundations they are building upon can be removed or delayed with a single legislative action. This instability necessitates a strategic approach built for rapid, fundamental changes, not just incremental adjustments. The challenge is not just to adapt to a new rule but to navigate a policy ecosystem where the very rules of engagement are in constant flux.

The ripple effect: who gets affected and how

The OBBBA’s provisions, coupled with other recent legislative and regulatory actions, create a complex and often contradictory set of pressures on the healthcare industry.

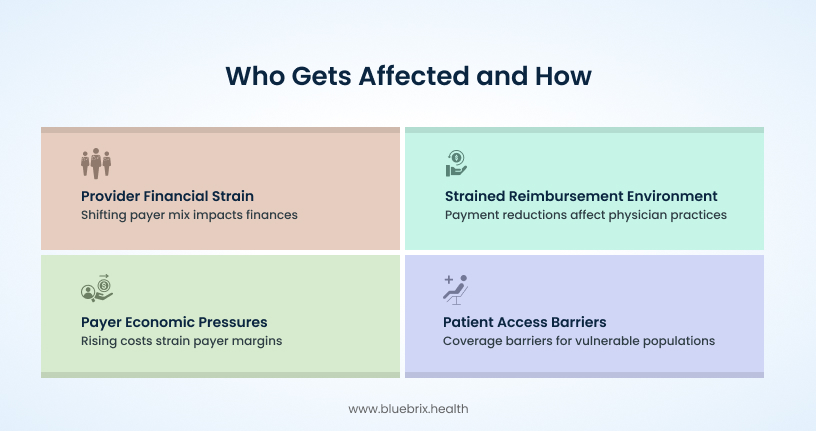

Providers: hospitals and physician practices

Hospitals face ongoing financial pressures from a shifting payer mix. While the Affordable Care Act (ACA) helped improve hospitals’ payer mix by reducing the number of uninsured patients, the OBBBA’s impact on Medicaid eligibility processes, combined with ongoing redeterminations, could reverse some of this progress. The bill’s delay of Medicaid disproportionate share hospital (DSH) allotment reductions offers temporary financial relief, but it also underscores the long-term uncertainty in funding streams that many hospitals rely on.

For physician practices, the OBBBA adds to an already strained reimbursement environment. Proposed changes from the 2025 Medicare Physician Fee Schedule, such as a decrease in the conversion factor and the removal of a specific billing code (G0511) for Rural Health Clinics (RHCs) and Federally Qualified Health Centers (FQHCs), are projected to lead to substantial payment reductions. For example, the removal of code G0511 could result in a 14% reduction in reimbursements for these facilities. These financial pressures are compounded by the Inflation Reduction Act (IRA), which has wide-ranging implications for drug pricing and research and development that also affect physician practice viability.

Payers: insurers and health plans

Payer economics are under significant strain, as highlighted by McKinsey’s predictions of the lowest estimated margins in a decade for the payer segment. Medicare Advantage (MA) plans, in particular, are grappling with rising costs linked to the IRA, which imposes a new $2,000 out-of-pocket cap for prescription drugs and expands low-income subsidies, thereby increasing plan liability. The OBBBA’s changes to Medicaid eligibility, in addition to federal legislation allowing states to resume eligibility redeterminations, create significant challenges for Medicaid managed care organizations. The slow pace at which states can readjust managed care rates due to a lack of real-time data further exacerbates the financial strain on these plans.

Patients

The patient experience under this new legislative environment is a mixed picture. While the IRA’s provisions, such as the $2,000 out-of-pocket cap for Medicare Part D prescription drugs, may provide some relief for those with high medication costs, other policies could create new barriers. The OBBBA’s delay of simplified Medicaid enrollment rules, coupled with ongoing redeterminations, could lead to increased barriers to coverage for vulnerable populations. A significant protection for patients, however, comes from the Protecting Health Care for All Patients Act, which prohibits the use of quality-adjusted life years (QALYs) in federal health programs. This measure aims to prevent the devaluation of a person’s life based on disability or age.

The combined effects of the OBBBA, the IRA, and existing CMS mandates are creating a system of contradictory incentives that simultaneously push for price caps and innovation, expand coverage while limiting eligibility, and increase administrative burden while demanding greater efficiency. This places providers and payers in a difficult position where they are mandated to transition to value-based care, which rewards quality and coordinated care, yet face financial and administrative headwinds from conflicting policies. The great challenge identified in recent research—where health policy and medical practice collide due to lack of coordination—is now a systemic reality. Organizations must develop a perpetual pivot strategy to succeed, not by adapting to one policy, but by building the operational DNA to handle a constant flow of fragmented and sometimes conflicting mandates.

Part II: The road ahead: risks and the imperative of readiness

Mapping the risks: financial, operational, and strategic

The confluence of legislative and market pressures creates a dynamic risk profile for all healthcare stakeholders.

Financial risks

The ongoing uncertainty around Medicaid redeterminations and the rise of the individual market mean that providers’ payer mixes will remain in a state of flux. This requires sophisticated financial modeling and revenue cycle management capabilities to ensure organizational viability. Concurrently, the combination of reduced Medicare payments, IRA-driven payer pressures, and persistent high inflation places a significant financial strain on both payers and providers. The push for higher reimbursement rates, which hospitals may seek to offset inflation, will likely face resistance from payers also under pressure, creating a tense negotiating environment.

Operational risks

The administrative burden on healthcare organizations has reached a critical point. Past policies like the HITECH Act mandated technology adoption, increasing short-term costs and requiring significant workflow changes. New regulatory shifts, such as CMS changes to billing codes, further complicate daily operations. This administrative complexity, exacerbated by documentation requirements in electronic health records (EHRs), can lead to physician burnout and a less efficient care environment. The complexity of navigating a fragmented regulatory landscape also increases the risk of non-compliance, which can result in significant financial penalties under laws like the False Claims Act and HIPAA.

Strategic risks

Policy decisions, particularly those related to pricing, have strategic long-term implications for the entire industry. As the Pharmaceutical Research and Manufacturers of America (PhRMA) argues, government price-setting policies, such as those in the IRA, can disincentivize research and development, particularly for small-molecule drugs. This could lead to a long-term decline in the availability of new treatments for patients. Furthermore, the high stress, burnout, and administrative complexity resulting from these policy shifts may contribute to talent attrition, compounding existing labor shortages and jeopardizing the quality of patient care.

The readiness imperative: beyond mere compliance

Organizational readiness for change (ORC) is not merely an abstract concept; it is the key link between plans, actual participation, and real results when adopting new practices. It encompasses the psychological and behavioral preparedness of an organization’s members to embrace new initiatives. A comprehensive readiness assessment requires a go/no-go decision based on the viability of a new effort, evaluating critical factors such as significant capacity gaps and deep commitment gaps among key leaders.

In the current environment, the challenge of perpetual change is an organizational one—the ability of an enterprise to adapt its internal culture and operational processes faster than external policy shifts. The OBBBA’s multi-year delay of key CMS rules could be a deceptive challenge. An organization that misinterprets this delay as a reprieve from action, failing to invest in change readiness, risks strategic complacency. Such a misstep can lead to a boiling frog scenario where the organization is caught unprepared when delayed or unexpected policies eventually take effect. The true imperative is to build resilience, which is the ability to not just survive but to bounce forward from constant change. This means embedding compliance and operational agility into the core DNA of the organization, regardless of the legislative timetable. The financial and strategic risks of a reactive approach far outweigh the costs of building a proactive, future-ready enterprise.

A proactive culture is not a matter of chance; it is a matter of strategic design. It requires continuous investment in staff education and training to ensure that teams are well-versed in current regulations and best practices. Organizations must also leverage technology to gain real-time updates on regulatory changes and to manage compliance more effectively. Building a dedicated compliance team or appointing a compliance officer is essential for overseeing these efforts, developing internal audit programs, and fostering a culture of adherence to all applicable laws and regulations.

Part III: The strategic keystone: technology as an enabler of resilience

The central role of technology in care coordination

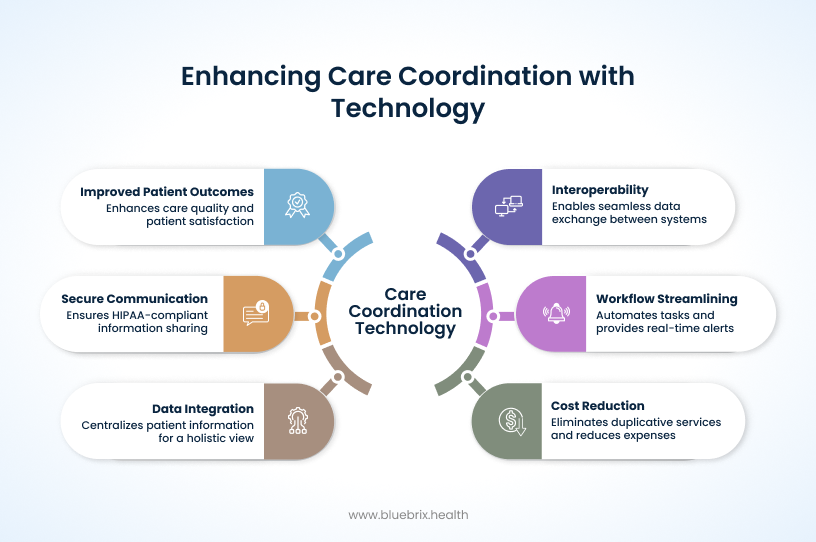

In a healthcare system that has historically focused on volume and is now under pressure to shift to value-based care, the fragmentation of services and data is a major hindrance. Poor information exchange leads to duplicated tests, avoidable emergency department visits, and higher costs. Care coordination technology emerges as a strategic solution to this systemic problem.

Modern care coordination platforms, powered by advanced interoperability and data integration, enable the seamless exchange of patient health information between disparate systems and providers. This allows for a holistic view of the patient’s journey, encompassing clinical, demographic, and claims history, including medication lists, care plans, and lab results. By centralizing this data, organizations can make more accurate medical decisions, reduce errors, and minimize administrative costs and burdens on staff.

These systems streamline workflows with automated task management, real-time alerts for new data, and efficient referral management. They also facilitate secure, HIPAA-compliant communication and collaboration among care teams, allowing them to instantly share information and work on patient care plans within a single, secure environment. The value proposition of technology-driven care coordination is clear: it directly supports the goals of value-based care by improving outcomes, enhancing patient satisfaction, and reducing overall costs by eliminating duplicative services and improving adherence to care plans. Furthermore, it helps to mitigate physician burnout by reducing the manual burden of data collection and communication.

Common care coordination challenges, their specific technology solutions and their strategic benefits:

- Data silos & fragmented records → FHIR-based APIs and centralized data management enable a full patient view, reduce errors and costs, and unlock analytics.

- Inefficient referrals→ Referral and task management systems streamline processes, ensure timely appointments, and improve patient engagement.

- Lack of real-time visibility → Automated alerts and secure messaging provide instant, HIPAA-compliant communication and reduce unnecessary follow-ups.

- Compliance & data security risk → Access controls and audit trails safeguard patient data, support HIPAA compliance, and monitor user activity.

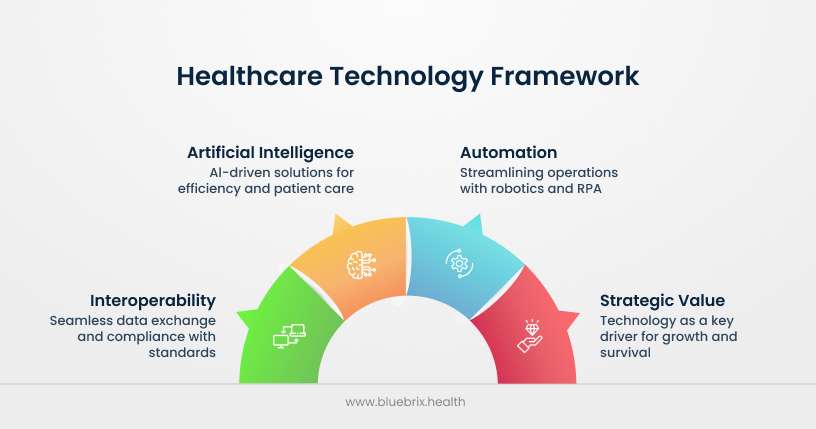

Future-proofing with technology: from interoperability to intelligence

Interoperability is no longer a goal for healthcare organizations; it is a foundational requirement. The ability to seamlessly exchange data, adhering to standards like HL7 and FHIR, is the starting point for all other technological advancements. This foundation must include robust data governance, access controls, and audit trails to ensure compliance with laws like HIPAA.

The next wave of innovation is centered on the rise of artificial intelligence (AI) and automation. The adoption of advanced technologies, especially Generative AI, is a top trend for 2025 and beyond, with a significant majority of healthcare organizations pursuing proofs-of-concept or implementing solutions. AI has the potential to streamline operations, reduce administrative burden, and transform patient care. This includes leveraging AI for tasks like analyzing pathology slides, acting as a virtual co-worker, and creating patient-centric AI models that prioritize fairness and security.

McKinsey highlights that payers are actively looking to AI and other technologies to improve efficiency and drive growth in the face of significant financial pressures. The Health Services and Technology (HST) sector, which includes software platforms and data analytics businesses, is projected to be the fastest-growing segment, with a substantial portion of that growth attributed to the widespread adoption of AI. Autonomous systems and robotics are also moving from pilot projects to practical applications, from last-mile medication delivery to virtual assistants, while robotic process automation (RPA) can streamline administrative tasks like medical billing and coding.

In an environment of shrinking margins and increased administrative complexity, technology—especially AI and interoperability—is no longer a cost center but a strategic lever for survival and growth. The only way for organizations to reconcile the competing pressures of cost containment and the transition to value-based care is through a fundamental shift in their operational models. Technology offers a path to reduce the cost of compliance and administration, thereby unlocking the capital needed to invest in and benefit from value-based care models. This creates a stark division between organizations that view technology as a compliance burden and those that see it as a strategic enabler for the future.

Part IV: The future-ready playbook: a strategic Blueprint

Financial resilience in a dynamic market

To navigate the financial volatility of the current healthcare landscape, organizations must develop sophisticated strategies. As reimbursement models change, it is crucial to become more adept at contract negotiations with payers. For self-funded employers, reference-based pricing (RBP), which sets reimbursement rates as a percentage of Medicare rates, offers a promising solution for cost control. This approach can also serve as a key point of collaboration between providers and payers seeking to align on cost-saving initiatives.

The rise of high-deductible health plans and Health Savings Accounts (HSAs) has made patients more financially responsible for their care. This trend requires providers to respond with greater price transparency and clear billing practices, which helps to build trust and long-term relationships. Policies that encourage this consumerism, such as the use of advanced explanations of benefits (EOBs), empower individuals to make more informed choices and reduce financial uncertainty.

Operational agility and workforce empowerment

A mindset that acknowledges and embraces change is crucial for building a resilient organization. Leaders must actively empower their teams to embrace change by investing in comprehensive training and resources, especially as new technologies and protocols emerge. Addressing the critical issue of burnout is a long-term strategic investment in the workforce. Strategies such as encouraging self-care, cultivating a supportive environment with open communication, and providing mental health resources are essential for building a resilient team that can thrive despite the demanding nature of the work.

Advocacy and leadership in a time of change

Organizations cannot afford to be passive recipients of policy. They must become proactive advocates, engaging with policymakers and industry associations like the American Hospital Association (AHA). Advocacy is critical for ensuring that future reforms support hospital operations and patient care without creating an overwhelming administrative burden. The most effective advocacy will come from collaborations between providers, payers, and technology partners who can form a strategic coalition and speak with a unified voice to influence policy decisions.