Healthcare systems commonly lose 4-5% of their revenue due to revenue leakage. Missed charges can easily be lost if no reconciliation process is in place to match patient encounters to submitted claims. The pattern is consistent: procedures get documented in the EHR, patients receive care, but charges never reach the billing system. No alerts fire. No error messages appear. The systems look functional while revenue disappears. Discovery happens during audits sometimes months later when finance teams manually reconcile encounters against billed services.

In this blog, we’ll discuss why EHR-billing integration failures happen, how to identify them in your organization, what they’re actually costing you, and what truly integrated revenue cycle management looks like.

The integration blind spot

Modern healthcare runs on a foundational assumption: integrated systems mean complete, reliable data flow. Your EHR vendor confirms integration with billing. Your billing platform confirms integration with payers. On paper, you have a connected ecosystem.

In reality, you have dozens of point-to-point connections where data can disappear without anyone noticing.

Even sophisticated EHR-billing integrations from major vendors have silent failure points. A charge capture interface might transfer 98% of transactions successfully while quietly dropping 2% due to formatting mismatches, timeout errors, or field mapping issues that generate no error logs. An eligibility check works perfectly for most payers but fails silently for specific plans because of API differences.

What makes this dangerous is the silence. Traditional IT failures announce themselves: systems crash, users get error messages, help desk tickets pile up. Integration failures are different. The systems appear to be working. Staff complete their workflows normally. It’s only later sometimes after several months that problems surface.

By then, the revenue is gone.

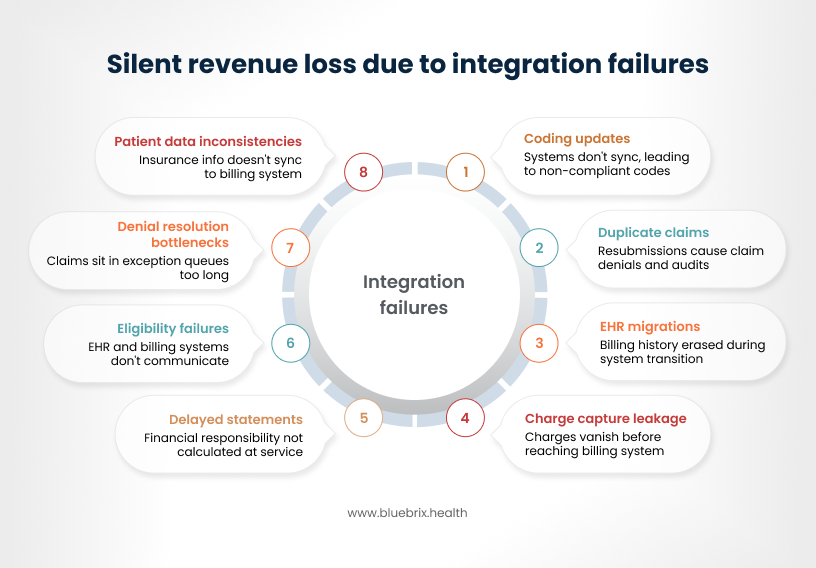

These aren’t abstract technical glitches—they’re specific, recurring failure points that silently drain revenue every single day. Understanding where these failures occur is the first step toward fixing them.

Charge capture that never makes it to billing

Clinicians meticulously document procedures, but those critical charges often vanish before reaching your billing system. Manual charge entry significantly increases error rates compared to automated systems, and the problem extends far beyond simple typos. Clinical staff may inadvertently miss procedures, overlook essential modifiers for higher reimbursement, or input incorrect units of service. Even when captured in your EHR, these charges can linger in an intermediate state, failing to sync with your billing platform. This isn’t a minor issue; charge capture leakage alone costs organizations 3-5% of their net annual revenue. For example, a surgeon’s detailed documentation of a complex intervention becomes financially futile when the specific modifier needed to justify higher reimbursement never bridges the gap from the clinical note to the final claim form.

EHR migrations that erase your billing history

Legacy EHR systems aren’t built to automatically feed clinical codes into modern billing platforms. When you migrate to a new system, data might get corrupted during the transition or simply doesn’t transfer at all. You lose encounter histories, and suddenly you’re facing manual re-entry for thousands of records. That means delays, errors, and missed filing deadlines with payers who don’t care about your IT problems.

Even when data does transfer, payer feeds often timestamp information differently than your new system expects, so legitimate claims get rejected as duplicates or marked as stale dated. Some practices discover 18 months of charge data never reached their billing system after a migration—by the time they figure it out, the filing window has closed.

Duplicate claims and orphaned charges

Duplicate claims happen when staff resubmit without checking status first, mistype dates or procedures, or bill the same CPT code twice for one visit. System glitches during batch uploads generate accidental duplicates no one catches until it’s too late. Your clearinghouse might catch some, but when duplicates reach the insurer, they deny the claim outright. Now you’re explaining why they received it twice, which raises fraud flags and triggers audits. Poor coordination between coders and billers working in silos leads to uncoordinated submissions for the same service.

On the flip side, EHR-to-billing sync failures create “orphan” charges that never reach payers at all. Your staff has no visibility into which charges have actually been billed versus which are still sitting in limbo, so revenue just disappears without anyone noticing until it’s too late to recover.

Coding updates trapped between systems

ICD-10 and CPT codes update regularly, but your systems don’t sync. For FY 2026, ICD-10-CM added 614 new codes and CPT introduced 288 new codes including remote monitoring and AI-augmented therapy billing. Your EHR gets patched with the latest version while your billing software runs last quarter’s codes. Clinicians document using current standards, but charges flow to billing with outdated codes that payers immediately flag as non-compliant. You have no central audit log, so you can’t identify which records used incorrect versions until denials arrive. This gap costs you fixing it improves coding accuracy by just 2-3%, translating to up to $5M recovered annually for larger systems. E/M coding levels documented by clinicians don’t align with what billing software recognizes due to unpatched decision-making tables, and that discrepancy costs you $50-100 per encounter.

Patient data inconsistencies in billing system

Your patient updates their insurance information in the patient portal, but that change never syncs to your billing system. Now when you submit a claim, the payer can’t find the patient in their system because the member ID doesn’t match. Demographic inconsistencies like a missing middle initial, a transposed digit in a date of birth cause “patient not found” errors that delay claims by 7-14 days while staff manually research and correct the information.

Denial resolution bottlenecks

Denied claims land somewhere in your workflow, but it’s not always clear who owns them. Is it your billing team? The clearinghouse? An outsourced vendor? That ambiguity means claims can sit in exception queues longer than they should. Teams naturally prioritize high-dollar denials and urgent cases, so smaller claims get pushed down the list.

A denial lands in an exception queue somewhere, no automated escalation exists to flag it, and by the time someone discovers it, the claim is 120+ days old and past the appeal deadline. You’re not just losing the original revenue—you’re burning money on the administrative chaos these gaps create.

When patient eligibility becomes a moving target

Patient eligibility verification fails when EHR and billing systems don’t communicate effectively, especially as patients frequently maintain multiple insurance plans through different employers, switch coverage during job transitions, or carry both primary and secondary insurance. When eligibility is checked in the EHR at scheduling, critical details about coverage changes such as a patient switching from one employer’s plan to another, adding a spouse’s insurance as primary, or losing Medicaid eligibility often fail to sync with the billing system.

Staff may verify current insurance in one system while the other retains outdated information, leading to claims submitted to the wrong payer, services provided without proper authorization, and patients receiving unexpected bills because their actual coverage wasn’t reflected across both platforms. This integration gap forces manual workarounds, increases claim denials, delays revenue, and creates billing disputes that damage patient trust.

Delayed patient statement generation

When EHR and billing systems don’t integrate effectively, patient financial responsibility isn’t calculated at the point of service, causing statements to be delayed until after multiple visits have accumulated. Patients then receive a single consolidated bill for two or three appointments at once, suddenly owing large sums in deductibles and copays that could have been managed through smaller incremental payments. This creates payment difficulties, higher bad debt rates, and patient frustration as they’re blindsided by unexpectedly large bills, they had no opportunity to budget for when services were rendered.

Root cause analysis: Why integration failures happen

Understanding the financial impact is one thing; understanding why these failures persist is another. The root causes run deeper than simple technical incompatibility—they’re embedded in how healthcare IT ecosystems evolved, how vendors operate, and how market forces are making the problem worse, not better.

The fragmentation trap

Most healthcare organizations built their revenue cycle by adopting “best-of-breed” point solutions rather than integrated platforms. One vendor handles coding, another does claim scrubbing, a third manages payment posting, and yet another runs patient billing. Each vendor automates only their narrow segment, leaving the gaps between systems to be bridged manually. About a quarter of healthcare organizations still rely on manual processes for revenue cycle management despite technological advances, creating costly inefficiencies.

Why integration is so hard

Legacy EHR systems weren’t designed for real-time data exchange; they were built to store clinical documentation, not orchestrate financial workflows. Proprietary data formats don’t align with modern interoperability standards. FHIR adoption in outpatient settings reached 64% by 2024, but many enterprise systems still struggle with full implementation. Each vendor integration requires custom APIs, creating cost and liability vendors resist. When data disappears between systems, no single vendor accepts responsibility—everyone points fingers.

Industry trends making it worse in 2025–2026

Staffing shortage: Experienced RCM teams are retiring faster than they can be replaced, making manual coordination between systems unsustainable. Organizations can’t simply hire their way out of integration problems.

Regulatory complexity explosion: New requirements for prior authorization, coverage policies, and reporting demand real-time system synchronization. Fragmented tools can’t adapt fast enough when each vendor operates on different update cycles.

Payer rule changes: Authorization requirements and coverage policies now update monthly. When you’re juggling six to eight vendors with different update schedules, coordination failures multiply exponentially.

Patient cost-sharing growth: Higher deductibles and copays require transparent, real-time cost estimates at the point of service. Fragmented systems create billing confusion that tanks collection rates—patient collection rates for patient responsibility have declined to 47.8% in recent years, down from 54.8% in 2021.

Margin compression: The median operating margin for hospitals held above 4.5% throughout 2024, but many hospitals continue to fall short of the 8-9% pre-pandemic operating cash flow margin norms. These thin margins leave zero tolerance for the 15-20% operational inefficiency burden that fragmented systems create.

The data migration myth

Many leaders think: “We’ll just upgrade systems and everything will sync.” Reality check: data migration projects routinely suffer from incomplete field mapping, timestamp misalignment, lost records, orphaned charges, and duplicate entries created during transitions. Recovery takes months and costs are substantial often exceeding the original integration budget.

The reality-check: What integration failures cost you right now

Hidden integration gaps between EHR and billing systems actively drain revenue through concrete, measurable losses that erode margins, strain operations, and compound silently over time. While most healthcare executives recognize integration challenges exist, few grasp the staggering scale of revenue leakage and operational waste these gaps create. The numbers reveal a harsh reality: organizations are hemorrhaging millions annually—not from obvious catastrophic failures, but from the accumulated impact of thousands of small integration breakdowns that go undetected until they’ve already damaged the bottom line.

The cascade effect: How one integration failure compounds

Integration failures don’t happen in isolation—they snowball. Here’s the typical pattern: A radiology charge doesn’t flow from the imaging system to the EHR. No automated alert flags the missing charge, so the claim goes out incomplete or isn’t billed at all. Revenue walks out the door unnoticed among thousands of daily transactions.

Months later, an audit catches the pattern of missing charges. By then, filing deadlines have passed, write-offs are already taken, and leadership sees unexplained margin pressure but can’t pinpoint why. The problem and its consequences are separated by time and disconnected systems, making it nearly impossible to connect the dots without sophisticated analytics most organizations don’t have.

Operational cost layers

Beyond lost revenue, integration gaps create expensive operational burdens. Staff burn 40+ hours monthly just coordinating between vendors and reconciling data discrepancies. When frustrated billing staff leave, replacement costs typically range from one to two times their annual salary when factoring in recruitment, training, and lost institutional knowledge.

Custom integrations frequently cost five to six figures per connection, plus ongoing maintenance expenses as systems evolve. Organizations get trapped in an escalating cycle of integration costs that never fully solve the problem.

Compliance risk adds more exposure. When payer audits discover services billed without proper authorization because the EHR didn’t communicate pre-cert requirements to billing—you face recoupment demands, penalties, and damaged payer relationships.

Days in A/R tell the story clearly: fragmented systems slow claims processing to 45-60 days versus the 30-40 day benchmark. That cash flow delay constrains working capital and increases borrowing costs.

Patient collections also suffer. When billing systems can’t show patients what they owe at checkout, confusion leads to lower payment rates down to 47.8% from 54.8% in 2021.

Denial rate reality

Claim denial rates reveal the true cost. While many organizations struggle with double-digit denial rates, top performers achieve rates several times lower through better integration. Best-in-class operations maintain denial rates well below industry norms.

Here’s the key insight: 30-40% of denial volume traces directly to integration gaps—eligibility failures, missing authorizations, outdated fee schedules, duplicate claims, and data re-entry errors.

For a mid-sized hospital processing thousands of claims monthly, closing integration gaps could prevent hundreds of denials each month, potentially recovering seven figures annually. The path from double-digit denial rates to 5% isn’t about working harder; it’s about eliminating the system failures creating preventable denials.

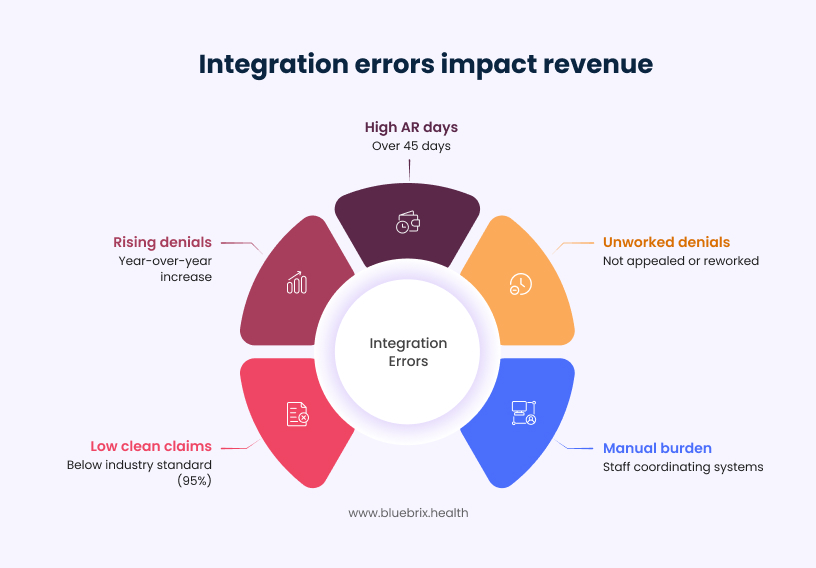

The integration error audit: Five red flags your organization is losing revenue

While integration challenges are widely seen across the industry, their presence and severity vary by organization. A thorough audit helps uncover how well your systems are actually working together. Below are five indicators that point to potential communication gaps.

Red flag #1: Clean claim rate below 95%

The industry standard benchmark for Clean Claim Rate is 95%, though providers should aim for a 98% clean claims rate for optimal performance. If your rate falls below 90%, integration errors are likely driving 15-20% of your denials. Dig deeper: where do denials originate? Charge capture failures? Eligibility verification gaps? Coding misalignment between systems?

Red flag #2: Denial rate rising year-over-year

Initial claim denials hit 11.8% in 2024 up from 10.2% just a few years earlier. If yours exceeds 12%, investigate how many data-related versus coverage or medical necessity issues are. Research indicates that 30-40% of most organizations’ denial volume is directly traceable to system integration gaps; these are recurring, preventable denials that integration could eliminate.

Red flag #3: Days in A/R over 45 days

A low AR (30-40 days) indicates a more efficient collection process. Delays beyond 45 days often signal slow claims submission from batching and manual review delays, eligibility re-checks required because bad data entered the system, or exception handling bottlenecks with no automated escalation.

Red flag #4: Manual coordination burden

Do you have staff whose entire job is “coordinating between systems”? Are eligibility checks done manually or offline? Do you re-enter patient and bill data across multiple platforms? Every manual touchpoint is an error insertion point and a staff burnout accelerator. If your team spends 40+ hours monthly just making systems talk to each other, integration failure is costing you far more than you realize.

Red flag #5: Most denials go unworked

Ask your team: “Of the denials we receive, what percentage actually gets appealed or reworked?” Each denied claim costs an average of $25–$30 to rework, and appeals can take weeks. If most denials aren’t being touched, it signals fragmented accountability—vendor gaps that nobody owns. This is permanent revenue loss, written off silently.

Ohio Valley Asthma Allergy Institute cuts AR days by 70% with blueBriX

A high-volume specialty practice replaced manual billing processes with blueBriX’s innovative solutions, achieving a 99% clean claim rate.

Read the full case studyWhat modern integration actually looks like

The technology to solve integration problems isn’t waiting to be developed; it’s already deployed and delivering results at leading organizations. The gap is implementation, not innovation. Modern interoperability standards have matured significantly, moving from theoretical frameworks to practical, deployed solutions that enable real-time data exchange across previously siloed systems.

FHIR & real-time APIs

FHIR (Fast Healthcare Interoperability Resources) was established as a nationwide standard for access, exchange, and use of data for healthcare delivery organizations in 2020, and by 2025, FHIR has evolved from an experimental framework to the global standard for healthcare data exchange. Modern FHIR-based systems use RESTful APIs for real-time eligibility checks, claim status updates, and payer data synchronization delivering updates in under 15 minutes compared to the batch or daily models of legacy systems.

The integration stack that works

Successful integration requires seamless data flow across four critical touchpoints: EHR to billing for real-time charge capture (not batch processing), billing to payer eligibility using live API feeds (not manual lookups), payer to billing for real-time claim status updates (not “check status” portals), and billing to patient engagement for transparent cost estimates aligned across all channels.

Why organizations struggle with FHIR adoption

Despite FHIR’s promise, adoption faces persistent barriers. Staff resist change after years of training on fragmented systems. Budget constraints make integration costs feel prohibitive since they’re front-loaded. Legacy EHRs weren’t built for FHIR and require expensive upgrades. Vendor lock-in makes switching costs too high, trapping organizations with outdated technology.

Yet regulatory pressure is forcing change. Impacted payers have until primarily January 1, 2027, to meet FHIR-based API requirements under CMS rules with prior authorization decisions required within 72 hours for urgent requests and seven days for standard requests beginning in 2026. The HTI-1 Final Rule requires support for USCDI v3 via FHIR APIs by January 2025, and patient transparency mandates are tightening. These aren’t optional upgrades, they’re compliance requirements. Organizations investing in integrated systems now gain a 12-18 month competitive advantage before market forces make the change unavoidable. The window to modernize strategically rather than reactively is closing fast.

Understanding the regulatory timeline is critical, but compliance alone won’t solve integration challenges. The real question is: what does the transition from fragmented systems to unified operations actually look like?

The path forward: From fragmentation to unified RCM excellence

The gap between knowing integration is necessary and achieving it successfully comes down to approach. Healthcare organizations that have successfully eliminated integration failures share a common strategy: they stopped trying to connect disparate point solutions and instead consolidated onto platforms purpose-built for end-to-end revenue cycle management. This fundamental shift from fragmentation to unification is what separates organizations still fighting integration fires from those experiencing seamless revenue capture.

What integrated care coordination + RCM solves

Instead of chasing point solutions, blueBriX delivers a unified platform where clinical workflows and billing operations converge seamlessly with existing EHR systems. No rip-and-replace, no ongoing errors. blueBriX eliminates integration failures, ensuring day-one billing accuracy across care coordination, eligibility, and claims.

Staying ahead of CPT code changes for care coordination revenue

blueBriX keeps your billing perpetually aligned with the latest CPT updates, ensuring every care coordination activity gets paid under current rules. When AMA/CMS releases new codes for programs like chronic care management (CCM: e.g., 99487 complex, 99490 non-complex) or principal care management (PCM: 99424-99427), the platform automatically updates your charge masters, templates, and payer rules, so emerging reimbursable services trigger accurate billing from day one—no missed revenue from outdated logic or compliance risks.

Patient financial responsibility & statement management

blueBriX calculates exact patient responsibility at prior authorization—factoring deductibles, copays, coinsurance, and out-of-pocket maximums and issues clear, itemized statements immediately after each visit. Patients get transparent breakdowns when balances are fresh and affordable, encouraging prompt payments via integrated portals, texts, or plans, which boosts cash flow and minimizes A/R aging.

Real-time charge capture solution

blueBriX aggregates patient data from scheduling, intake, and documentation in real-time. Every clinical encounter generates precise charges instantly, bypassing batch delays that let revenue vanish, with automated daily monitoring and reconciliation for zero gaps.

Eligibility & authorization management

blueBriX verifies coverage and secures prior authorizations pre-service via real-time payer feeds, slashing staff hours wasted on manual checks each month. Two-way EHR sync keeps eligibility current, preventing denials from stale data.

Unified visibility dashboard

blueBriX provides a client-facing dashboard tracking your revenue cycle end-to-end, from charge capture to payer adjudication. It spots bottlenecks, flags anomalies, and delivers proactive alerts—turning data into actionable performance gains without internal effort.

Single point of accountability as your RCM solution

Drawing on two decades of revenue cycle expertise, blueBriX manages the full continuum—ensuring nothing gets lost between systems. The result: clearer answers, faster resolutions, and consistent improvement in reimbursement speed and collection rates.

How blueBriX delivers integration excellence

blueBriX combines DevOps agility with value-based healthcare through a cloud-agnostic, integration-first platform featuring pre-built APIs and scalable infrastructure. It seamlessly connects with common EHR and practice management systems right from implementation—no custom coding required.

Key platform advantages

Zero custom integration costs: Skip the $50,000–$200,000 per-vendor fees by leveraging blueBriX’s pre-integrated architecture, which unifies revenue cycle workflows without point-to-point hassles.

Staff time savings: Automates data reconciliation across systems, eliminating 40+ hours monthly that practices waste on vendor coordination and error fixes.

Built-in scalability: Cloud infrastructure auto-scales billing and claims processes as your practice grows, maintaining efficiency without downtime or rework.

The path forward eliminates fragmentation through platforms built for integration from day one.