As healthcare organizations transition to value-based care, maintaining financial stability becomes increasingly challenging. To succeed in this evolving landscape, providers must not only deliver high-quality care but also manage financial operations with precision. Revenue Cycle Management (RCM) plays a critical role in this process, streamlining billing, claims, and reimbursements to ensure accurate and timely compensation. By aligning financial operations with patient outcomes, value-based RCM supports the dual objectives of enhanced care and sustainable revenue.

RCM ensures that accurate information is collected, patients are billed appropriately for services rendered, and payments are processed efficiently with third-party payers. The complexity of revenue cycle management stems from the financial burden placed on providers, who often incur service costs upfront while experiencing payment delays from insurers or patients. Increasing costs, shrinking margins, and rising patient financial responsibility under high-deductible plans add to the strain. Many healthcare organizations are addressing these challenges by outsourcing RCM functions, improving both revenue collection and operational efficiency. As the payment landscape shifts, with greater patient responsibility and an expanded role for government payers, healthcare entities must continuously adapt their RCM strategies to ensure long-term viability.

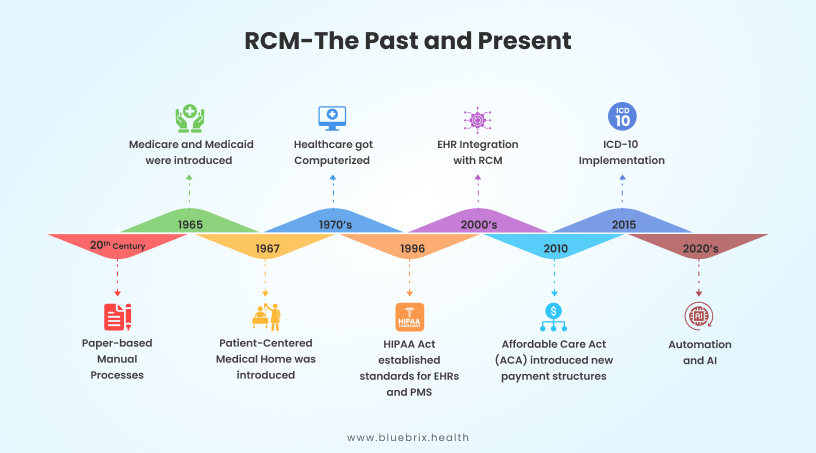

The history of RCM dates back to the early days of healthcare administration, when manual, paper-based systems were used for collecting patient information, filing claims, and tracking payments. These processes were prone to errors and often resulted in delayed payments. Paper checks would take 30 to 45 days to clear. In the 1970s, the introduction of computer technology enabled faster, more accurate claims processing, standardizing billing codes and improving reimbursement systems.

The 1996 implementation of HIPAA set new standards for electronic healthcare transactions and data security, driving the adoption of electronic billing systems. With the integration of Electronic Health Records (EHRs) and Practice Management Systems (PMS), healthcare organizations increased efficiency and reduced errors in their financial processes.

Today, RCM continues to evolve with technological advancements and regulatory framework shifts. Modern revenue cycle management platforms, integrated with EHRs, enable smoother billing processes and real-time communication between providers and payers. A key part of this evolution is using Electronic Remittance Advice (ERA) and Electronic Data Interchange (EDI) transactions. The EDI 837 is used to electronically submit healthcare claims, ensuring HIPAA compliance and faster transmission of patient claim information. The EDI 835, also known as the ERA, is employed to provide detailed payment information related to these claims, including remittance and adjustment details. By automating these processes, RCM systems reduce manual errors, accelerate payment cycles, and provide real-time visibility into financial data, which is essential for value-based care. This shift places greater emphasis on efficiency, transparency, and outcome-based reimbursement models, ensuring a seamless flow of information between providers and payers.

What makes Value-based RCM a critical component of healthcare?

Revenue Cycle Management is crucial because it directly impacts a healthcare organization’s financial viability. Efficient RCM ensures timely reimbursements, reduces claim denials, improves cash flow, and minimizes administrative burdens. Additionally, it enhances the patient experience by providing accurate billing, preventing errors, and ensuring clear communication about financial responsibilities.

As healthcare shifts from fee-for-service to value-based care, aligning RCM with these models is essential for success. RCM systems now need to capture data on outcomes, patient satisfaction, and overall value, rather than just services rendered. This requires RCM platforms to integrate with population health tools and care management systems, ensuring that providers are rewarded based on patient outcomes and cost efficiency rather than volume of services.

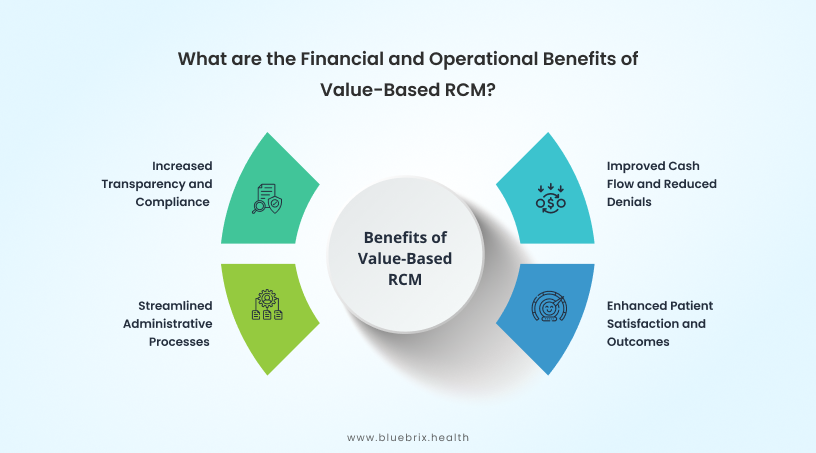

What are the Financial and Operational Benefits of Value-Based RCM?

Value-Based RCM offers significant financial and operational advantages. It improves reimbursement accuracy by aligning payments with outcomes, reducing billing errors, and minimizing claim denials. This boosts cash flow, reduces administrative tasks, and increases revenue. Operationally, it streamlines workflows, optimizes resources, and enhances patient satisfaction, fostering stronger provider relationships and long-term financial stability.

Improved Cash Flow and Reduced Denials

Effective Revenue Cycle Management (RCM) systems ensure that claims are accurately filed, leading to fewer denials. By improving claim scrubbing processes and ensuring proper coding, organizations can reduce their claim denial rates to below 5% and thus accelerate payment collection. For example, by implementing denial management solutions, healthcare providers can identify common denial patterns and address them proactively, improving their cash flow. This allows them to maintain financial stability while reducing administrative overheads.

A hospital integrated an AI-driven denial management system, reducing its denial rate by 15% and increasing monthly revenue collection by 2-3%.

Enhanced Patient Satisfaction and Outcomes

RCM systems, especially those supporting value-based care, help enhance patient satisfaction by ensuring smoother interactions between patients and healthcare providers. Timely and accurate billing, along with transparent cost estimates, reduces patient stress, and builds trust. Educating patients about treatment plans and expenses has been shown to improve adherence to treatment, which leads to better health outcomes.

A healthcare provider enhanced patient communication through an RCM portal, leading to a 20% improvement in patient satisfaction scores.

Streamlined Administrative Processes

Streamlining administrative workflows reduces inefficiencies and boosts operational performance. Automated RCM solutions can centralize billing, claims, and patient management, significantly cutting down the time spent on manual tasks. As a result, providers can focus on delivering care instead of handling paperwork.

A multi-specialty clinic introduced a workflow management system that integrated all its billing processes. This reduced claim processing time by 30%, enabling staff to manage higher patient volumes without increasing operational costs.

Increased Transparency and Compliance

Advanced RCM systems provide real-time data analytics and reporting, ensuring that healthcare organizations comply with payer requirements and government regulations. This not only reduces the risk of penalties but also fosters trust with stakeholders by providing transparency in financial operations.

Key components

Revenue Cycle Management typically involves a series of interconnected steps designed to ensure the financial health of healthcare providers. These steps, which range from patient registration to final payment collection, can vary in number and detail depending on the specific needs and workflows of each hospital or healthcare provider. While some organizations may follow a 7-step process, others may implement up to 17 or more steps based on the complexity of their care pathways and payer relationships. Tailoring RCM processes to align with a provider’s unique care model is essential for maximizing efficiency and revenue capture.

Let’s take a look at the following 12-step RCM process:

Payer credentialing

Payer credentialing is the process where healthcare providers are validated by insurance companies to ensure they are qualified and authorized to bill for services. For example, if a newly licensed physician joins a practice, the practice must ensure they are credentialed with Medicare and commercial payers before submitting claims. Additionally, price negotiation plays a critical role in payer credentialing, especially for hospital groups. Beyond just meeting the qualification standards, hospitals often negotiate reimbursement rates with payers to ensure sustainable pricing for services. These negotiations help align hospital rates with the costs of care delivery while ensuring that the payer’s terms are beneficial for both parties.

Patient registration and scheduling

Patient registration involves collecting demographic information, insurance details, and consent forms. Scheduling organizes the patient’s visit. For example, practices can use online portals for patients to self-register and schedule their appointments, reducing administrative work and errors.

Authorization verification

Before services are rendered, some procedures require prior authorization from the payer to ensure coverage. For example, before performing a surgery, the healthcare provider must verify that the insurance company has authorized the procedure to avoid denied claims. Similarly, procedures like MRIs often require prior authorization to guarantee payment, avoiding denials after the service is performed.

Eligibility and benefits verification

This process confirms the patient’s insurance coverage and the benefits available for specific services. For example, verifying a patient’s insurance before surgery ensures they are covered and helps determine their out-of-pocket expenses. Eligibility and benefits verification can be done manually or in real-time:

• Manual : In manual verification, staff contact insurance providers directly via phone or fax to confirm coverage. It is more time-consuming but sometimes necessary when automation tools are unavailable. This is common for smaller practices with fewer resources for automation.

• Real-time eligibility : This involves using electronic systems to instantly verify a patient’s insurance coverage and benefits in real-time, ensuring the services they require are covered before they are performed.

Comprehensive medical coding

Accurate medical coding is essential for correctly describing services and treatments for insurance claims. Using ICD-10 codes for diagnoses and CPT codes for procedures ensures that the right data is submitted, reducing the likelihood of claim denials. Coding also plays a key role in risk stratification, helping to categorize patients based on their health risks, which directly impacts reimbursement rates. Additionally, it ensures that both facility fees (e.g., hospital or clinic charges) and professional fees (e.g., doctor services) are appropriately billed, which is critical for achieving full compensation.

Documentation

Comprehensive documentation supports accurate coding and provides a complete clinical picture of the patient’s encounter. It is critical for reducing claim denials, as payers require clear, detailed records to justify services provided. Documentation must include relevant patient history, treatment plans, and outcomes to ensure accuracy in coding and to support proper billing. This helps mitigate discrepancies between what was documented and what was coded, ultimately improving claims approval rates.

Charge capture

Charge capture refers to documenting all services provided during a patient encounter so they can be billed. For example, during surgery, every service and supply used must be recorded to ensure the hospital gets reimbursed for the full cost. Charge capture ensures that all billable services provided to a patient are recorded and passed on for claims submission. For instance, missed charges from additional treatments performed during an outpatient visit can lead to lost revenue.

Claims submission

Once services are coded, claims are submitted to payers for reimbursement. This step involves preparing and submitting claims to payers for the services rendered. Accurate claims submission ensures faster reimbursement. Submitting clean claims (without errors) reduces the chances of denials and rejections. Claims submission can be done manually or electronically:

• Manual claims submission : In manual claims submission, healthcare providers prepare and submit claims on paper, typically using forms like the CMS-1500. Once services are coded, the provider or billing team physically fills out the form and submits it via mail to the payer. This process requires meticulous attention to detail, as errors in manual forms can lead to delays or claim denials. Manual submission is often slower, with extended processing times compared to electronic methods. Properly filling out claims and avoiding common mistakes ensures faster reimbursement and reduces the chances of claim rejection.

• Electronic claims submission : Electronic claims submission, also known as e-claim submission, uses Electronic Data Interchange (EDI) to send claims to payers electronically. After coding services, claims are submitted through integrated RCM platforms or specialized billing software. Electronic claims submission ensures faster processing, real-time tracking, and immediate validation of claims. Submitting clean claims electronically, without errors, significantly reduces the risk of denials and rejections, as the system automatically detects discrepancies before submission. This method is increasingly preferred due to its efficiency and accuracy in facilitating faster reimbursements.

Payment posting

Payment processing involves recording payments received from payers and patients, updating accounts, and ensuring proper billing.

• Manual payment processing: In manual payment processing, payments are recorded by manually entering data from paper checks or Explanation of Benefits (EOBs) into the billing system. This method is time-consuming and prone to human error but may be necessary in situations where digital payment systems are unavailable.

• Electronic payment processing: Electronic payment processing utilizes Electronic Remittance Advice (ERA) to automatically post payments into the billing system. This process significantly reduces the chances of errors and speeds up the payment posting process. It allows for real-time tracking and updating of accounts, ensuring faster and more accurate payment postings.

Reconciliation

Reconciliation ensures that the payment received matches the expected reimbursement. This involves comparing the posted payment against the expected amount from the payer. Any discrepancies, such as underpayments or overpayments, are flagged for further investigation. Reconciliation is critical in ensuring that the financial records align with the payments received, helping to identify potential errors or follow-up actions required to recover missing payments.

Denial management

Denial management involves reviewing and correcting claims that have been denied by insurers. When claims are denied, denial management identifies the reasons and addresses them to get the claims reprocessed. For instance, if a claim is denied due to incorrect coding, the healthcare provider must adjust the claim and resubmit it.

AR follow-up

Accounts Receivable (AR) follow-up is the process of monitoring outstanding claims and ensuring payments are collected. This step is critical for minimizing delays in cash flow and may involve contacting payers for outstanding payments. For example, dedicated staff might follow up on unpaid claims after 15 days to prevent revenue loss.

Patient statements

Patient statements are invoices sent to patients for any remaining balance after insurance has paid. These statements provide an itemized list of services rendered and any balances due. Patient statements include a breakdown of services, insurance payments, and the patient’s responsibility. For example, after insurance has paid its portion, a patient statement is sent to the patient detailing their remaining financial responsibility.

Patient collection

This is the final step in RCM, where any remaining balances are collected from the patient. Effective patient collection strategies, such as offering flexible payment plans, can increase revenue and ensure timely payments.

Major challenges

What are the major challenges in revenue cycle management?

Revenue Cycle Management faces numerous challenges in managing financial operations effectively. Key challenges include inaccurate patient data, delayed or denied claims, and navigating complex regulatory requirements. Poor coordination between clinical and administrative teams further complicates revenue collection, leading to inefficiencies and revenue leakage.

Let’s explore the challenges in detail:

Inaccurate patient information and data entry errors

Errors in entering patient data, such as misspelled names or incorrect insurance details, can lead to claim rejections and delays. For example, an incorrect date of birth or insurance policy number often results in claim denials, requiring time-consuming corrections before resubmission, which delays revenue collection.

Coding challenges

• Upcoding : This occurs when a provider bills for a higher-level service than what was rendered. While it may seem like a way to increase revenue, upcoding is illegal and can result in severe penalties, audits, and potential legal action. Incorrect upcoding impacts cash flow negatively by causing claim rejections or delays due to audits.

• Downcoding : On the other hand, downcoding occurs when a provider bills for a lower level of service than was provided. This can result in underpayments and reduced cash flow, as the provider is not compensated for the full extent of services rendered. This could lead to significant revenue loss over time.

• Incorrect diagnosis and procedure codes : Incorrect diagnosis (ICD-10) or procedure (CPT) codes are another common coding challenge. Selecting the wrong code, either through human error or outdated systems, can lead to claim denials or delays. These errors impact cash flow as rejected claims require resubmission and delay reimbursement.

Claim denials

Denials occur after a claim is processed by the payer but is found not payable due to various reasons. Claims could be denied due to coding mistakes, missing documentation, or failure to meet payer requirements. A report indicated that two-thirds of denied claims are potentially recoverable, but addressing these requires a structured approach, adding to the administrative burden. Here are some common reasons for claim denials:

• TFL: Timely Filing Limit or TFL can be different for different payers. To avoid denials due to TFL, claims can be filed within 24 hours of service and submitted to the payer on the same day.

• Incorrect or Incomplete Patient Information : Errors in patient demographics, such as wrong name, date of birth, or insurance details, can result in denials.

• Insurance Coverage Issues : If the patient’s insurance coverage has lapsed or the service provided is not covered under their plan, the claim is denied.

• Prior Authorization Not Obtained : Many services require prior authorization from the insurer. If this is not done, the claim can be denied.

• Duplicate Claims : Submitting the same claim more than once for the same service can lead to automatic denial.

• Medical Necessity Denials : If the payer determines that the service provided was not medically necessary based on documentation, the claim may be denied.

Claim rejections

Rejections happen before the claim is processed. They are most often caused by incorrect or incomplete data. Missing or inaccurate patient information, such as invalid codes, errors in demographics, or incorrect formatting can lead to claim rejections. Unlike denials, rejected claims must be corrected and resubmitted before they can be processed.

Timely payments and collections

Delayed payments occur when healthcare providers fail to submit claims promptly or when payers take time to process them. Payment delays strain cash flow, making it difficult for healthcare organizations to maintain financial stability. Implementing robust denial management and follow-up strategies can mitigate this.

Increasing administrative costs and complexity

RCM requires extensive documentation, coding, and claims follow-ups, leading to rising administrative costs. The introduction of complex regulatory requirements further increases operational costs, pushing healthcare providers to optimize efficiency without sacrificing service quality.

Staffing and retention issues

Maintaining a skilled workforce in revenue cycle management is another challenge. Turnover rates among administrative staff contribute to inefficiencies. The demand for experienced coders, billers, and administrative staff increases hiring costs, while training new employees slows productivity.

Revenue leakage

RCM systems can suffer from revenue leakage due to undercharging, incorrect coding, or missed follow-ups on denied claims. This leads to loss of potential revenue.

Regulatory compliance

Keeping up with changing healthcare regulations and payer rules is a constant challenge. Failure to comply can result in penalties, claim denials, and delayed reimbursements.

Data security

With the increasing use of digital RCM solutions, healthcare providers must address cybersecurity concerns and ensure the protection of sensitive patient data.

Patient financial responsibility

As more healthcare costs shift to patients, collecting payments from them can be difficult. Providers must improve transparency and offer flexible payment options to encourage timely payments.

Rising patient expectations

Patients today expect transparency in billing, faster claim resolutions, and seamless interactions with healthcare providers. RCM systems are increasingly pressured to provide more patient-centric services, such as easier bill payment options and real-time updates on claim statuses.

As healthcare transitions to Value-Based Care, RCM systems must adapt to new payment models focused on patient outcomes rather than service volume. This shift introduces revenue volatility, increased administrative burdens, and the need for real-time data management. Providers may struggle with aligning traditional RCM processes to value based care, resulting in financial risks, such as unpredictable reimbursements and difficulty tracking care outcomes.

Resistance to change

Transitioning from fee-for-service to value based care is met with resistance, particularly from staff used to legacy systems. The implementation of VBC requires changes in billing, coding, and reimbursement procedures, necessitating retraining and the adoption of new technologies.

Alignment with quality metrics

As healthcare shifts to value-based care (VBC), providers must align RCM processes with quality metrics such as patient outcomes. Traditional fee-for-service models focus on volume, but VBC requires tracking outcomes and patient satisfaction to secure reimbursements, adding new layers of complexity.

Complex data management

Value based care requires the integration of patient data across multiple sources to ensure proper billing and compliance. Managing this complex data is challenging, especially for organizations with outdated systems. RCM systems need upgrades to support interoperability and real-time data sharing.

Delayed payments

Under VBC, payments are often tied to long-term patient outcomes, meaning payments may be delayed for months or even years. Providers need to invest in tracking systems that ensure accurate reporting of outcomes, which is crucial for timely reimbursements.

Increased administrative burden

The Value Based Care model introduces additional administrative tasks such as data reporting, quality checks, and outcome tracking. Healthcare organizations must process more complex documentation to comply with VBC regulations, which increases administrative burden and costs

To succeed in this evolving landscape, healthcare organizations must overhaul their RCM systems, invest in technology, and embrace process redesign to ensure financial stability and operational efficiency.

Role of Technology

Technology plays a transformative role in Revenue Cycle Management, driving efficiency and innovation across healthcare organizations. AI and automation streamline repetitive tasks, reduce human error, and boost scalability by allowing systems to manage larger account volumes without compromising accuracy. Analytics provide actionable insights, helping optimize revenue processes and compliance. Interoperability ensures seamless data sharing across platforms, improving decision-making and patient care coordination. These advancements not only enhance the financial stability of healthcare organizations but also contribute to better patient outcomes by reducing administrative delays and improving overall system adaptability. Let’s explore some of these technologies transforming RCM in today’s healthcare ecosystem.

Electronic health records (EHR) integration

EHR integration is pivotal in Value-Based Care (VBC) models as it ensures the seamless sharing of clinical data across providers and payers. In revenue cycle management, integrated EHR systems provide accurate, real-time patient data, which minimizes coding errors, supports timely claims submissions, and ensures faster reimbursement. For example, AI-powered electronic health records help predict patient health outcomes and automate coding, leading to fewer denied claims.

Health information exchanges (HIEs)

HIEs enable healthcare providers to exchange patient data across systems, improving care coordination and reducing redundant tests and services. In the context of revenue cycle management, HIEs offer real-time access to patients’ medical histories, streamlining billing and improving claims accuracy by reducing administrative delays. For instance, AI-based predictive models in HIEs can analyze patterns and optimize the reimbursement process.

Use of APIs for data interoperability

APIs play a critical role in RCM by connecting disparate healthcare systems, enabling secure and real-time data sharing between providers, payers, and patients. In value based care, APIs enhance data interoperability, allowing for continuous monitoring of patient outcomes and timely claims processing. For example, API-driven platforms streamline pre-authorization checks and automate eligibility verifications, significantly reducing the time for reimbursement.

AI and automation

AI and automation are transforming revenue cycle management by automating time-consuming tasks such as claims scrubbing, billing, and coding. In VBC, where patient outcomes dictate reimbursements, AI helps identify billing inconsistencies, forecast financial performance, and ensure compliance with value-based contracts. For instance, Robotic Process Automation (RPA) can automatically verify claims, reducing denials and speeding up the revenue cycle.

Analytics and reporting tools

Advanced analytics tools are essential in VBC-driven RCM, providing actionable insights into patient outcomes and financial performance. These tools help healthcare organizations optimize resource allocation, predict revenue cycles, and ensure compliance with regulatory requirements. Analytics can track patient outcomes, linking clinical performance to financial incentives, ensuring that providers are rewarded for delivering quality care.

Patient portals and engagement

Patient portals are transforming the way patients interact with healthcare providers, directly impacting Revenue Cycle Management (RCM). These digital tools enable patients to access their medical records, view billing statements, and make payments online, reducing administrative overhead for providers. Enhanced transparency helps patients understand their financial obligations, leading to more timely payments. Furthermore, patient portals encourage engagement through automated reminders and direct messaging, fostering better patient-provider communication. By improving patient satisfaction and reducing billing errors, patient portals contribute to a more efficient RCM process, ensuring better revenue capture.

Telemedicine integration

Telemedicine has grown significantly, requiring updates to traditional RCM systems to handle billing for virtual visits. The integration of telemedicine into RCM workflows ensures that telehealth services are correctly coded and billed, ensuring compliance with regulatory guidelines and varying state laws. This technology reduces the need for in-person visits, minimizing operational costs while still capturing revenue. RCM systems must adapt to track outcomes from virtual care and ensure timely reimbursement for services, aligning with the goals of value-based care.

Risk-based contracts

In a value-based care landscape, healthcare providers increasingly engage in risk-based contracts that reward positive patient outcomes over the volume of services provided. Technology-enabled RCM systems are crucial in managing these contracts by tracking patient outcomes, managing shared savings, and ensuring that providers are reimbursed appropriately. They help providers navigate complex payment models like capitation and bundled payments, reducing financial risks and improving long-term revenue stability.

As the healthcare industry continues to embrace value-based care models, technology remains pivotal in ensuring that RCM adapts to new payment models, making it more efficient and effective.

RCM KPIs

Revenue cycle management (RCM) Key Performance Indicators (KPIs) are metrics that healthcare organizations use to assess the effectiveness and efficiency of their financial processes. These KPIs cover various aspects of the revenue cycle, from patient registration and medical billing to claim processing and payment collection. Monitoring RCM KPIs is crucial because they provide insights into an organization’s financial health, helping identify bottlenecks, inefficiencies, and areas for improvement.

1. Financial efficiency

Cost to collect

Description: Measures the cost incurred to collect revenue.

Calculation: Total cost of collections / Total revenue.

Benchmark: Industry standard is typically between 2%-3%.

Relevance: High costs reduce profitability.

Achieved By: Optimizing billing processes and reducing denials.

Net collection rate (NCR)

Description: Measures revenue collected against the collectible amount.

Calculation: (Payments ÷ Collectible charges).

Benchmark: 95% or higher.

Relevance: Reflects revenue realization potential.

Achieved By: Efficient claim handling and minimizing write-offs.

Cash collections as a percentage of net patient service revenue

Description: Measures collected revenue relative to services provided.

Calculation: Total cash collections ÷ Net patient service revenue.

Benchmark: Typically above 95%.

Relevance: Indicates revenue cycle efficiency.

Achieved By: Improving payment follow-up and reducing denials.

Gross collection rate(GCR)

Description: Total cash collected as a percentage of gross charges.

Benchmark: 60-70%.

Calculation: (Total cash collections / Total gross charges) × 100.

Relevance: Indicates how much of the gross charges are being collected.

Achieved By: Improve payer negotiations and reduce billing errors.

Revenue realization rate (RRR)

Description: Measures how much of billed revenue is realized.

Calculation: Realized revenue ÷ Total billed revenue.

Benchmark: 95%-100%.

Relevance: Shows financial health and billing effectiveness.

Achieved By: Optimizing collections and minimizing adjustments.

2. Claims & billing performance

Clean claim rate

Description: Percentage of claims paid without resubmission.

Calculation: Clean claims ÷ Total claims submitted.

Benchmark: 90%-95%.

Relevance: Reduces administrative overhead.

Achieved By: Accurate coding and data entry.

First pass yield

Description: Percentage of claims paid on the first submission.

Calculation: First-pass claims paid ÷ Total claims submitted.

Benchmark: 90%-95%.

Relevance: A higher rate reduces rework and administrative cost.

Achieved By: Improving claim accuracy and completeness.

Denial rate

Description: Percentage of claims denied by payers.

Calculation: Denied claims ÷ Total claims submitted.

Benchmark: <10%.

Relevance: High denial rates delay revenue collection.

Achieved By: Pre-claim verification and appeals management.

Resolve rate

Description: Percentage of claims resolved on first attempt.

Calculation: Resolved claims ÷ Total claims submitted.

Benchmark: 90%-95%.

Relevance: Indicates efficiency in claims processing.

Achieved By: Ensuring accurate claims submission.

Underpayment recovery rate

Description: Percentage of underpayments successfully recovered.

Calculation: (Recovered underpayments / Total underpayments) × 100.

Benchmark: Aim for 80-90%.

Relevance: Ensures revenue integrity.

Achieved By: Use robust audit and appeals processes.

Denial rate by reason code

Description: Tracks claim denials by specific reason codes.

Calculation: (Number of denials by reason code / Total claims) × 100.

Benchmark: Aim for less than 5%.

Relevance: Identifies areas causing payment delays.

Achieved By: Implement targeted interventions for common denial reasons.

3. Accounts receivable (A/R) management

Days in accounts receivable (A/R)

Description: Average days to collect payment.

Calculation: (A/R ÷ Average daily charges).

Benchmark: 30-40 days.

Relevance: Indicates efficiency in cash collection.

Achieved By: Reducing claim denials and timely follow-up.

Aged accounts receivable (A/R) rate

Description: The percentage of receivables that are past due.

Calculation: Total A/R over 90 days ÷ Total A/R.

Benchmark: <15%.

Relevance: High aging affects liquidity.

Achieved By: Following up on unpaid claims regularly.

Discharges not fully billed (DNFB)

Description: Accounts with discharged patients but incomplete billing.

Calculation: (Total unbilled discharges ÷ Total discharges).

Benchmark: Less than 3% of total discharges.

Relevance: Delays cash flow.

Achieved By: Streamlining discharge billing processes.

Discharged not submitted to payer (DNSP)

Description: Claims ready but not yet submitted.

Calculation: (Discharged but not submitted ÷ Total discharges).

Benchmark: <2%.

Relevance: Delays revenue collection.

Achieved By: Streamlining claim submission workflows.

4. Operational efficiency

Charge lag

Description: The time between service provision and billing.

Calculation: Service date to billing submission date.

Benchmark: Less than 3 days.

Relevance: Delayed billing impacts cash flow.

Achieved By: Automating and streamlining billing processes.

Coding accuracy rate

Description: Percentage of medical codes accurately assigned.

Calculation: (Correct codes / Total codes) × 100.

Benchmark: 95%+ accuracy.

Relevance: Directly impacts claim approval rates.

Achieved By: Continuous coder training and auditing systems.

Clinical documentation improvement (CDI) metrics

Description: Measures the quality and completeness of clinical documentation.

Calculation: Percentage of records meeting documentation standards.

Benchmark: Varies but aims for 90%+ compliance.

Relevance: Accurate documentation ensures correct coding and billing.

Achieved By: Implement CDI programs with AI tools for assistance.

Coding turnaround time

Description: The time taken to assign codes to patient records.

Calculation: Average time from discharge to coding completion.

Benchmark: 24-48 hours.

Relevance: Affects billing cycles and cash flow.

Achieved By: Use real-time coding tools and optimize workflow.

5. Patient centric KPIs

Patient satisfaction score

Description: Measures patient satisfaction with care services.

Calculation: Based on survey responses, often scored on a scale of 1-5 or 1-10.

Benchmark: Aim for 85%+ satisfaction.

Relevance: Directly impacts patient retention and revenue.

Achieved By: Use feedback loops to continuously improve services.

Patient payment collection rate

Description: Portion of payments collected directly from patients.

Calculation: Patient payments ÷ Total patient balances.

Benchmark: Varies by practice.

Relevance: Indicates financial engagement of patients.

Achieved By: Offering multiple payment methods and transparency.

Patient registration accuracy rate

Description: Measures the percentage of correctly registered patients.

Calculation: (Number of correct registrations / Total registrations) × 100.

Benchmark: Aim for 98% or higher.

Relevance: Ensures accurate data capture, reducing claim rejections.

Achieved By: Regular staff training and technology-driven validation tools.

6. Insurance & authorization management

Insurance verification turnaround time

Description: Time taken to verify a patient’s insurance information.

Calculation: Average time from patient registration to insurance verification.

Benchmark: 24 hours or less.

Relevance: Reduces delays in claim submission and improves cash flow.

Achieved By: Automating insurance verification and streamlining communication.

Pre-authorization rate

Description: Percentage of services requiring and receiving pre-authorization.

Calculation: (Number of pre-authorizations received / Number of required) × 100.

Benchmark: 100% for services requiring authorization.

Relevance: Prevents claim denials due to lack of pre-approval.

Achieved By: Implement tracking systems for pre-authorizations.

7. Scheduling & resource utilization

Patient schedule occupied rate

Description: Measures clinic scheduling efficiency.

Calculation: Occupied slots ÷ Available slots.

Benchmark: 85%-95%.

Relevance: Affects revenue generation capacity.

Achieved By: Efficient scheduling and managing no-shows.

Average referral rates

Description: The number of referrals given to specialists or external providers.

Calculation: Total referrals / Total patients.

Benchmark: Varies by specialty but should reflect efficient patient management.

Relevance: Indicates patient flow and network utilization.

Achieved By: Enhance referral management through EHR integration.

8. Others

POS (Place of Service) cash collections

Description: Payments collected at the point of service.

Calculation: Total POS collections ÷ Total revenue.

Benchmark: Varies by practice.

Relevance: Improves cash flow and reduces A/R days.

Achieved By: Training staff and offering multiple payment options.

Revenue per encounter

Description: Revenue generated per patient encounter.

Calculation: Total revenue ÷ Total patient encounters.

Benchmark: Varies by specialty.

Relevance: Indicates service profitability.

Achieved By: Optimizing coding and service mix.

Bad debt rate

Description: Portion of receivables considered uncollectible.

Calculation: Bad debts ÷ Total revenue.

Benchmark: <2%-3%.

Relevance: Affects overall profitability.

Achieved By: Pre-payment policies and patient education.

Point-of-service and upfront collection rate

Description: Percentage of upfront collections.

Calculation: Upfront payments ÷ Total collections.

Benchmark: 20%-30%.

Relevance: Reduces bad debt and A/R days.

Achieved By: Improving front-end processes.

Tracking these KPIs ensures that healthcare organizations can optimize cash flow, reduce denials, and minimize operational costs, which ultimately supports sustainability and profitability. KPIs like coding accuracy, claim denial rates, and collection efficiency directly affect the timely reimbursement for services rendered. Therefore, consistent monitoring helps improve financial performance and ensures the organization is running smoothly with fewer financial surprises. That said, all of the above KPIs may not be relevant for your healthcare organization.

Best practices

Effective revenue cycle management (RCM) in value-based care (VBC)

requires integrating financial operations with the overall goal of improving patient outcomes while reducing costs. Here are some practices to ensure efficiency and sustainability in this evolving healthcare model:

Upfront patient information collection

Collecting accurate patient demographics and financial data at the beginning of care is essential to prevent claim denials and delays.

Insurance verification

Verifying insurance coverage before services are rendered helps eliminate denials due to ineligible plans. Practices should verify coverage details, copays, deductibles, and coverage limitations.

Pre-authorization and eligibility checks

Pre-authorization ensures that the necessary approval is obtained from insurers for specific procedures. A common best practice is setting up automated systems to streamline pre-authorization requests, improving efficiency, and reducing manual errors.

Coding and documentation improvement

Accurate coding is vital for timely reimbursements. Ensuring that medical records are complete and coded correctly prevents claim rejections. High-quality documentation ensures accurate coding, which is critical in value based care to avoid reimbursement delays. Training staff on coding updates (e.g., ICD-10 changes) and improving clinical documentation enhances coding accuracy, reduces errors and boosts compliance that are crucial in value-based care models.

Timely billing and claim submission

Submitting claims promptly is a key factor in maintaining cash flow. Best practices include automating medical billing workflows and setting submission deadlines. Timely submission prevents unnecessary delays in reimbursement.

Prevent/manage claim denials

Preemptive steps such as upfront patient information collection, accurate coding, and eligibility checks reduce denials. Automated systems that verify patient data before submission minimize errors. Implementing a structured denial management process will help identify root causes of denials. For example, analyzing denial trends helps to address recurring issues and resubmit corrected claims promptly.

Streamline processes for efficiency

Optimizing RCM processes involves eliminating bottlenecks to improve cash flow. This can be done by automating claims management, ensuring accurate coding, and integrating systems like Electronic Health Records (EHR) with RCM. For example, automating claim scrubbing reduces errors in billing, leading to faster reimbursements. Additionally, centralized billing systems ensure consistent and efficient processing of claims, minimizing delays.

Enhance patient engagement and communication

Effective communication ensures patients understand their financial responsibilities, improving timely payments. A robust patient engagement strategy includes reaching out through preferred communication channels, such as emails, texts, or patient portals. Engaging patients in their billing and payment processes reduces outstanding balances. For instance, sending real-time payment reminders and offering various payment options can boost collections. Transparency in patient responsibility also fosters trust and quicker payments.

Patient financial education

Educating patients about their financial responsibilities improves transparency and reduces unpaid bills. Offering financial literacy resources, such as explaining insurance benefits, co-pays, and out-of-pocket costs, helps patients better understand their financial obligations. For example, providing patients with online tools or seminars on managing medical billing expenses can empower them to make informed decisions about their care.

Staff training and development

Regular training enhances the skills of revenue cycle management staff in handling billing complexities, coding updates, and new regulatory requirements. For example, training in the use of coding software or understanding payer-specific requirements can reduce claim denials. Investing in upskilling staff ensures they stay current with healthcare and payer changes, ultimately streamlining revenue collection processes.

Identify high-risk patients

In Value-Based Care, high-risk patients are those who are more likely to require costly treatments due to chronic conditions. Early identification helps prioritize care coordination and improve outcomes. Using predictive analytics to track patients’ health data helps flag potential high-risk individuals, allowing providers to intervene early and reduce unnecessary costs.

Identify high outstanding payers

Analyzing payer performance helps identify those responsible for delayed or denied payments. RCM teams can create payer scorecards to monitor patterns and address issues quickly. For instance, regular reviews of outstanding claims by payer allow teams to escalate delayed payments or renegotiate contracts with problematic insurers.

Establish performance metrics

Set KPIs such as first-pass claim acceptance rates and days in accounts receivable. For example, monitoring denial rates helps ensure consistent cash flow and identify areas for improvement.

Strengthen care coordination

Effective RCM in value-based care requires collaboration between providers to avoid duplicated services, ensuring optimal patient outcomes. For instance, using shared electronic health records promotes seamless care coordination. Streamlined communication between different healthcare providers ensures timely care transitions. For example, coordination between primary care physicians and specialists reduces duplicated services, cutting unnecessary costs.

Implement population health management

Analyzing population health data helps identify high-risk patients and target preventive care, reducing hospital readmissions and enhancing care management. For example, stratifying patients based on risk enables tailored interventions.

Invest in advanced RCM technology

Using AI-driven RCM platforms can automate claim submissions, improve coding accuracy, and generate real-time analytics for decision-making. For instance, AI can automate denial follow-up workflows, speeding up reimbursements.

Invest in robust data analytics

Real-time data insights allow healthcare organizations to track RCM performance, identify bottlenecks, and forecast revenue. Regularly analyzing data on denial rates, payment times, and collection efficiency can guide process improvements in a VBC framework. For example, tracking claim rejection rates and turnaround times can guide process improvements.

Align financial incentives with quality goals

In value based care, aligning incentives with quality measures (e.g., patient outcomes) is key. Offering bonuses for achieving care milestones, such as reducing readmissions, aligns financial goals with patient care.

Stay updated with regulatory compliance

Healthcare providers must stay compliant with HIPAA, MACRA, and other laws. For instance, proactive auditing of medical records for compliance helps avoid fines and interruptions in revenue flow. Regularly monitor regulatory changes such as CMS guidelines, changes in Medicare rules etc. ensures compliance and timely payments.

Collaborate with payers

Proactive payer collaboration improves contract negotiation outcomes and ensures clear communication regarding coverage policies. For example, frequent reviews of payer contract performance and joint efforts to improve billing accuracy reduce friction.

Use performance-based contracting with payers

In VBC, contracts are often tied to patient outcomes. For example, practices can adopt shared-risk models where payers reward providers for meeting care quality benchmarks such as reducing hospital readmissions.

Real-time financial reporting

Real-time financial reporting in RCM enables value-based care providers to monitor financial performance, control costs, and improve operational efficiency. It supports better decision-making by offering up-to-date data on patient care costs and revenue collection. Additionally, it helps identify financial risks early, allowing organizations to take timely corrective actions. Real-time reporting also ensures alignment with VBC objectives, such as enhancing patient outcomes and minimizing wasteful spending, while automating processes to boost productivity and accelerate cash flow.

Claims denial report

This report highlights the percentage of denied claims and categorizes the reasons for denials. It helps providers identify recurring issues in claim submissions and optimize processes to reduce denial rates, ultimately improving cash flow and revenue capture.

Accounts receivable (A/R) aging report

This report categorizes unpaid claims based on how long they have been outstanding. It helps identify overdue accounts, prioritize collections, and improve cash flow by focusing on high-risk, older receivables.

Cost-to-collect report

This report calculates the cost of collecting payments from patients and payers. It enables providers to assess the efficiency of their RCM processes and identify areas to cut costs, which is critical for maintaining profitability in value-based care (VBC) models.

Patient payment report

This tracks patient payments and outstanding balances. Providers use this report to monitor patient financial responsibility and follow up with patients on overdue payments, improving the overall collection rate.

Revenue and utilization report

This report analyzes revenue against resource utilization, helping providers evaluate the cost-effectiveness of their services in a VBC model. It ensures that care delivery aligns with financial sustainability.

Payment forecast reports

These reports predict future revenue based on historical billing data and payment patterns. They help healthcare providers project cash flow, plan resource allocation, and ensure financial stability in a value-based care (VBC) environment.

E&M level frequency

This report tracks the frequency at which Evaluation & Management (E&M) codes are billed. Monitoring E&M levels ensures appropriate coding and billing practices, minimizing under- or over-coding issues, which can lead to revenue loss or audits.

Physician target report

This report monitors each physician’s productivity, revenue generation, and achievement of financial targets. It helps in tracking individual performance and aligning it with overall organizational goals.

Automated claim transition

This process ensures that claims move through the medical billing process efficiently, from submission to payment, with minimal manual intervention. The report tracks the status and success of automated claims, reducing errors and speeding up reimbursement.

RCM strategies for niche specialties

How to strategize value-based revenue cycle management for niche specialties?

There’s no one-size-fits-all strategy for RCM. Each medical specialty faces specific challenges with respect to RCM and hence, require special focus on specific areas for success. The following table gives an idea on strategizing revenue cycle management for niche specialties:

| Sl No | Specialization | Key challenge(s) | Best practice(s) |

|---|---|---|---|

| 1 | Behavioral health | Prior authorization delays

Inconsistent documentation Varying insurance coverage for mental health services |

Implement real-time eligibility checks to verify coverage.

Standardize documentation to ensure accuracy and compliance. Train staff in navigating behavioral health-specific regulations and insurance guidelines to minimize delays. |

| 2 | Dental practices | Medical coding

Limited familiarity with insurance processing High claim denial rates due to incomplete documentation |

Invest in training for dental-specific coding and claims submission.

Utilize automated tools for charge capture and verification. Regularly review denials to identify patterns and correct claim issues. |

| 3 | Ophthalmology | High denial rates

Complex procedure coding Difficulty maintaining compliance with ever-changing regulations |

Conduct frequent coding audits and ensure staff is trained in ophthalmology-specific procedures.

Implement robust denial management processes to promptly address claim rejections. Ensure up-to-date compliance with new regulations by regularly reviewing coding policies and reimbursement guidelines. |

| 4 | Cardiology & cardiovascular surgery | Complex coding for advanced procedures | Ensure precise coding for diagnostics and surgical interventions.

Emphasize insurance eligibility verification for costly treatments. |

| 5 | Critical care | High denial rates due to unclear documentation | Strong documentation protocols.

Real-time claim tracking. |

| 6 | Dermatology | Frequent coding errors for procedures | Automation

Train staff on dermatology-specific codes and billing guidelines. |

| 7 | Diagnostic radiology | Managing high volumes of imaging claims | Use automated systems for faster claim submission.

Pre-authorization for high-cost imaging. |

| 8 | Ear, nose & throat (ENT) | Varied procedures and billing inconsistencies | Consistent procedure documentation.

Pre-authorization for surgeries. |

| 9 | Emergency medicine | Frequent underpayments and claim denials. | Focus on coding accuracy.

Documentation for high-volume emergency visits. |

| 10 | Family medicine | Broad range of services with variable reimbursements. | Streamline billing with accurate coding for preventive services. |

| 11 | Gastroenterology | Denials for screenings and procedures. | Pre-authorizations.

Improved patient communications on eligibility. |

| 12 | General surgery | Complicated coding and pre-approvals. | Focus on coding specificity. Ensure pre-authorization compliance. |

| 13 | Geriatrics | Managing claims for chronic conditions. | Streamline processes for long-term care claims and chronic condition coding. |

| 14 | Interventional radiology | Complex coding and high rejection rates. | Prioritize training on specialty-specific codes.

Pre-authorization for complex procedures. |

| 15 | Long-term care | Claims for extended care services. | Focus on accurate coding for long-term conditions and ensuring proper coverage verification. |

| 16 | Medical oncology | Expensive treatments with high denial rates. | Secure pre-authorizations and ensure detailed documentation for treatments. |

| 17 | Mental health | Coding complexity for therapy sessions. | Train staff on mental health codes and reduce denied claims through pre-authorizations. |

| 18 | Multi-specialty | Managing varied claim types. | Centralized RCM system to handle the complexity of multi-specialty billing. |

| 19 | Neonatal care | Specialized care with complicated billing. | Implement precise coding and ensure pre-authorizations for specialized procedures. |

| 20 | Nephrology | Frequent claims for dialysis and chronic care. | Optimize coding for recurring services and manage chronic care authorizations. |

| 21 | Neurology & neurosurgery | Complex procedures and detailed coding requirements. | Strong documentation and timely filing of claims with specialized coding. |

| 22 | Nuclear medicine | High-cost imaging and treatments. | Secure pre-authorizations and ensure accurate coding. |

| 23 | Obstetrics & gynecology (OB/GYN) | Complicated prenatal and delivery billing. | Maintain documentation of every stage of treatment, including prenatal visits and delivery. |

| 24 | Occupational therapy | Multiple visits and inconsistent reimbursements. | Standardize documentation for therapy progress and focus on pre-authorizations for continued treatment. |

| 25 | Orthopedics | Coding complexity for joint replacements and physical therapy. | Train staff on updated codes and secure pre-approvals for surgery and therapy. |

| 26 | Otolaryngology (ENT) | Coding errors for sinus surgeries and audiology. | Ensure correct coding and focus on reducing denials with clear documentation. |

| 27 | Pain management | Complex coding for various treatments. | Focus on pre-authorization and coding specificity for injections and procedures. |

| 28 | Pediatrics | Managing claims for routine care and vaccinations. | Streamline coding for pediatric preventive care and ensure accurate billing for vaccination programs. |

| 29 | Physical therapy | Inconsistent claim approvals for therapy sessions. | Focus on documentation of therapy progress and streamline pre-authorizations. |

| 30 | Plastic & reconstructive surgery | Denials for cosmetic versus medical necessity claims. | Focus on clear documentation distinguishing between medical and cosmetic procedures. |

| 31 | Podiatry | Coding for specialized procedures like diabetic foot care. | Train staff on specific podiatry codes and ensure pre-authorizations for procedures. |

| 32 | Psychiatry | Frequent insurance denials for mental health sessions. | Pre-authorization for therapy and accurate coding of sessions. |

| 33 | Pulmonology | High-cost treatments and coding complexity. | Secure pre-authorizations for expensive treatments and focus on coding for chronic conditions like asthma and COPD. |

| 34 | Radiology | Complex claim submissions for high-tech imaging. | Use automated systems for imaging claims and ensure accurate coding. |

| 35 | Reproductive medicine | Coding for fertility treatments. | Ensure precise coding for assisted reproductive treatments and handle insurance claim complexities for fertility services. |

| 36 | Sleep management | Frequent denials for sleep studies. | Pre-authorization for sleep studies and accurate coding of follow-up treatments. |

| 37 | Urgent care | High claim volumes with frequent coding errors. | Implement an automated claim submission system and train staff on coding for common urgent care procedures. |

| 38 | Urology | Complicated coding for surgical and diagnostic procedures. | Pre-authorization for high-cost treatments and ensure accurate coding of diagnostic tests. |

| 39 | Vascular surgery | Denials for complex surgical procedures. | Ensure documentation and coding compliance for vascular interventions. |

| 40 | Weight management | Inconsistent approvals for weight-loss surgeries. | Pre-authorization and proper documentation of medical necessity. |

While pre-authorization, coding accuracy, documentation and automation are the common processes that work for most of the specialties above, an adaptable, scalable and secure RCM solution or outsourcing RCM to a competent 3rd party can help ensure fewer denials and consistent cash flow.

Why blueBriX RCM?

blueBriX’s highly adaptable and scalable RCM services can streamline operations, reduce costs, and ensure quicker reimbursements. Below is a breakdown of how blueBriX can provide robust RCM solutions to healthcare organizations globally across various specialties.

Customizable UI & workflow

The blueBriX platform includes a UI and workflow configurator, allowing healthcare organizations to customize their RCM processes to match their specific operational needs. This customization can enhance efficiency and user experience. blueBriX revenue cycle management enables providers to customize workflows to meet your unique organizational needs, aligning billing processes with individual specialties. For example, a behavioral health provider might need different claim submission timelines compared to an ophthalmologist. Custom workflows allow healthcare organizations to stay compliant while ensuring quicker revenue generation.

Rule leveraging and customization

By leveraging advanced billing rules and customizing them to specific payer and patient demographics, blueBriX ensures that claims are processed accurately. This reduces claim denials and improves payment timelines. For instance, automated rules can be set to catch discrepancies before claims are submitted, cutting down the back-and-forth that leads to delays.

Increase the medical billing visibility

blueBriX enhances medical billing transparency through real-time dashboards and reporting tools. This allows healthcare organizations to monitor claim statuses, track denials, and gauge revenue performance. For example, a dental clinic can view detailed reports on unprocessed claims and take immediate action to avoid delays.

Reduce billing errors and denials

By employing automation, blueBriX minimizes human errors in coding and billing submissions. For example, incorrect coding in a cardiology practice can lead to substantial denials; blueBriX can identify these errors before submission, drastically reducing denial rates.

Increase claims paid on first submission

Through optimized coding practices and data validation, blueBriX ensures that a higher percentage of claims are accepted on the first submission. This is crucial for specialties like oncology, where complex treatment plans often result in denied claims. blueBriX ensures smoother processing from the start, resulting in faster reimbursements.

Increase organization efficiency

With blueBriX, administrative tasks like insurance verification, patient data entry, and claim follow-up are streamlined, allowing staff to focus on patient care. This increase in efficiency reduces overhead costs and accelerates revenue. For example, a multi-specialty clinic using blueBriX may see administrative tasks cut by 30%.

Speeds up the cash flow process

By reducing time spent on claim rejections and follow-ups, blueBriX accelerates cash flow for healthcare organizations. Faster revenue collection is essential for maintaining operational stability, especially for small healthcare practices or niche specialties like behavioral health, where delays can strain cash flow.

Reduce overtreatment

blueBriX helps reduce overtreatment by aligning RCM processes with value-based care metrics. It ensures that services provided align with what’s reimbursable and necessary for patient outcomes. For example, by cross-referencing treatment plans with reimbursement structures, blueBriX helps avoid costly and unnecessary procedures.

Reduce the operational costs

Through process automation, rule-based decision-making, and efficient billing practices, blueBriX can lower operational costs by reducing the need for manual claim management and expensive administrative overhead. Specialty practices like ophthalmology, which handle large volumes of patients, benefit from streamlined processes that cut labor costs.

Preferred clearinghouse integration

blueBriX seamlessly integrates with preferred clearinghouses, ensuring timely claim submissions and tracking. This reduces the likelihood of delayed payments and helps maintain a smooth revenue stream, which is especially critical for high-volume practices like dental clinics.

Automated workflow management

blueBriX provides an automated deployment interface that allows for seamless deployment of RCM processes. This helps in reducing manual interventions and errors, thus streamlining the entire billing and collection process.

Prototype development and testing

The platform offers sandbox accounts for alpha and beta testing, enabling healthcare organizations to build functional prototypes and gather client feedback. This ensures that any new RCM process is thoroughly tested before full-scale implementation.

Integration capabilities

blueBriX allows for easy integration with third-party systems and IoT devices. This means that healthcare organizations can integrate their RCM processes with other existing systems, such as Electronic Health Records (EHR), to ensure seamless data flow and process efficiency. The platform can integrate with many vendors and clearinghouses, providing flexibility in managing different aspects of RCM.

Security and compliance

blueBriX adheres to multiple regulatory standards across different regions, including ISO, GDPR, HIPAA, and more. This ensures that the RCM processes are compliant with industry regulations, thus reducing the risk of legal issues and ensuring data security.

Scalability

The platform is designed to scale, allowing healthcare organizations to grow their RCM processes as their practice expands. This scalability ensures that the RCM processes can handle increasing volumes of claims and billing without compromising on efficiency.

Training and implementation support

blueBriX offers training and implementation support, which can help healthcare organizations quickly get up to speed with their RCM processes. This reduces the learning curve and ensures that the staff is well-equipped to handle RCM tasks.

Multi-level review and approval processes

The platform includes multi-level review and approval processes at each stage of the software life cycle. This ensures that any RCM process or feature undergoes rigorous scrutiny before implementation, thereby enhancing the reliability and effectiveness of the RCM system.

Insurance ties and claims processing

blueEHR supports the management of insurance claims and processing, ensuring smooth handling and submission of claims.

Customizable forms

PHMC can control and customize forms to fit their specific practice or process needs, enhancing data collection and billing accuracy.

Advanced healthcare platform

As an advanced healthcare platform, blueEHR provides a robust framework for managing various RCM tasks efficiently.

Data management and analytics

With a robust data management and analytics layer, blueBriX provides healthcare organizations with insights into their revenue cycle. This can help in identifying bottlenecks, monitoring performance, and making data-driven decisions to optimize revenue. The analytics module is flexible and allows customers to access and manipulate their data for better financial insights and decision-making.

Data lake access

Customers have access to data lakes and data models, allowing them to use their own business intelligence (BI) tools to build custom models and analytics.

blueBriX sets itself apart from competitors with a robust technology suite designed to drive significant process improvements across the entire revenue cycle. Leveraging its customizable and scalable RCM solutions, blueBriX empowers healthcare organizations of all sizes and specialties to achieve financial stability while staying focused on delivering value-based care. By integrating advanced technologies, blueBriX tailors its solutions to meet the unique needs of each provider, streamlining operations and enhancing financial outcomes. This comprehensive approach ensures that healthcare organizations can optimize every facet of their revenue cycle, allowing them to prioritize high-quality patient care without compromising on financial performance.

Future of RCM in value-based care

As the healthcare industry shifts toward value-based care, RCM is evolving to meet new demands. The traditional fee-for-service model, where providers are compensated based on the volume of services, is giving way to a model that rewards the quality of care provided. This transformation requires RCM processes to become more integrated with patient outcomes, compliance, and efficient care delivery. In this section, we explore the future trends in RCM for value-based care, highlighting advancements and strategies that will shape healthcare organizations’ financial health.

Automation and AI-driven RCM

Automation and artificial intelligence are playing a growing role in optimizing RCM. AI-driven tools improve medical billing accuracy, claim management, and predictive analytics, allowing for proactive management of denials and rejections. For example, AI algorithms can identify patterns in claim rejections, helping providers avoid future errors. Additionally, automated bots can streamline pre-authorization processes, reducing administrative time.

Behavioral health clinics can use AI-based RCM solutions to track patient payments and insurance claims, reducing operational costs and errors.

Patient-centric billing and transparency

With the rise of value-based care, patient satisfaction is paramount. Patient-centric billing systems offer transparent and easy-to-understand invoices, giving patients clear breakdowns of their healthcare costs. By integrating patient portals, patients can track their financial obligations, apply for payment plans, or use real-time estimators to calculate out-of-pocket expenses. This focus on transparency helps build trust and ensures faster payments.

A patient undergoing elective surgery can view their estimated cost in advance, compare insurance coverage, and choose affordable payment options.

Integration of clinical and financial data

The future of revenue cycle management will see greater integration between clinical and financial data to ensure that billing reflects the quality and outcomes of care. This integration is essential for tracking metrics such as bundled payments or accountable care organization (ACO) reimbursements. By tying financial outcomes to clinical results, healthcare organizations can improve risk-sharing and payment models, ensuring that they are rewarded for quality, not just quantity.

A hospital participating in an ACO can monitor clinical outcomes and align them with reimbursement rates for conditions like diabetes or heart disease, ensuring that quality care is rewarded.

Enhanced compliance and risk management

As regulatory environments evolve under value-based care, there is increasing pressure to ensure compliance with government programs such as Medicare and Medicaid. Advanced RCM systems can monitor compliance automatically, flagging issues related to coding accuracy,HIPAA violations , or fraudulent claims. This helps mitigate financial risk while staying compliant with evolving regulations.

A small rural clinic adopts a compliance-integrated RCM solution that automatically checks claims for Medicare adherence, preventing penalties and costly rejections.

Telehealth and remote care integration

With the exponential growth of telehealth services, RCM processes are adapting to include remote care billing. Telemedicine reimbursement policies are constantly changing, and RCM systems will need to be agile to handle the nuances of coding, eligibility verification, and cross-state licensing. Providers will need to invest in systems that can support seamless integration of remote care into their billing workflows.

During the COVID-19 pandemic, many primary care practices used telehealth services and integrated RCM systems to ensure timely and accurate reimbursement for virtual visits.

Focus on social determinants of health (SDOH)

One of the key future trends in RCM for value-based care is the increasing focus on Social Determinants of Health. SDOH include factors such as housing, education, income, and access to nutritious food, all of which can significantly impact patient outcomes and healthcare costs. To succeed in a value-based care model, RCM systems must incorporate SDOH data to provide a more comprehensive understanding of patient health. This allows healthcare providers to better predict patient risks, tailor care plans, and improve outcomes, ultimately leading to better reimbursement rates under value-based contracts.