Is your practice struggling with a growing number of overdue invoices? An A/R aging report is a crucial tool for managing your revenue cycle. This guide helps revenue cycle professionals interpret aging reports to identify red flags and implement effective solutions, ensuring healthier cash flow and financial stability for your practice.

Running a successful healthcare practice is a complex juggling act. Providing top-notch patient care often goes hand-in-hand with the equally critical, yet sometimes daunting, task of revenue cycle management (RCM). At the heart of RCM lies the Accounts Receivable (A/R) aging report, a vital tool that, when interpreted correctly, can reveal the financial health of your practice and highlight potential trouble spots.

With over 20 years of experience in the US RCM services segment, we’ve seen firsthand how a keen understanding of the aging report can be a game-changer for private multi-specialty practices, physician groups, and ambulatory surgery centers (ASCs). This guide will provide practical insights for revenue cycle professionals and practice owners to effectively interpret their aging reports, uncover operational issues behind delayed payments, and take proactive steps to ensure financial stability.

Understanding the A/R Aging Report

An A/R aging report is a categorized list of outstanding balances, showing how long each has been due. Typically, these invoices are grouped into “buckets,” representing timeframes such as 0-30 days, 31-60 days, 61-90 days, 91-120 days, and >120 days past due. This report provides a snapshot of your practice’s outstanding revenue and helps you identify trends in payment collection.

The Impact of Aging Buckets: >60, >90 Days

The aging of receivables directly impacts the financial well-being of any healthcare practice. Here’s why those >60 and >90 day buckets are critical:

- >60 Days: When receivables start accumulating in the 60+ day bucket, it’s a warning sign. It suggests potential issues in the billing process, such as delays in claim submission, coding errors, or initial denials. This delay can strain cash flow and hinder the practice’s ability to invest in necessary resources.

- >90 Days: Receivables aged over 90 days are a significant cause for concern. The likelihood of collecting payment decreases substantially as time goes on. High balances in this bucket often indicate serious issues like unresolved denials, payer disputes, or internal workflow inefficiencies. Aggressive follow-up and escalation are essential at this stage.

For instance, consider a general surgery practice with $5 million in annual revenue. If they have $750,000 (15%) of their A/R aged over 90 days, this represents a substantial portion of revenue tied up and at risk of non-collection and crossing the TFL. This could directly impact their ability to invest in new surgical equipment or hire additional staff.

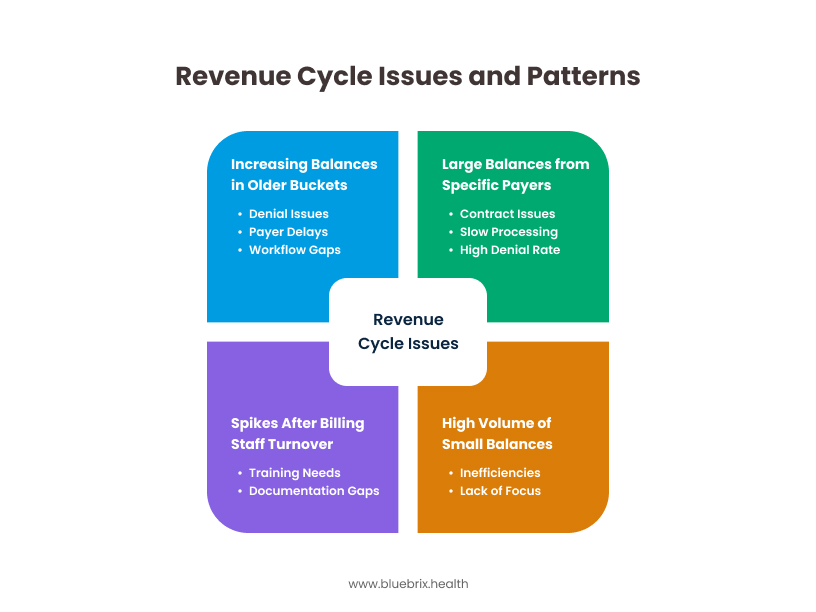

Patterns That Signal Revenue Cycle Issues

Analyzing the aging report for specific patterns can reveal underlying problems within the revenue cycle:

- Increasing Balances in Older Buckets: A consistent increase in the percentage of receivables in the >60 and >90 day buckets signals a deteriorating collection process. This could be due to:

- Denial Issues: High denial rates lead to delayed payments and increased A/R days. Look for patterns in denial codes to pinpoint specific problems (e.g., coding errors, lack of pre-authorization). For example, if a cardiology practice sees a spike in denials for “lack of medical necessity,” it indicates a need for better documentation and pre-authorization processes.

- Payer Delays: Delays in payer processing can significantly impact A/R. Identify slow-paying payers and track their payment patterns to anticipate and address potential issues.

- Workflow Gaps: Inefficient internal workflows, such as inadequate follow-up on outstanding claims or lack of clear responsibility for A/R management, contribute to aging receivables.

- Large Balances from Specific Payers: Consistently large outstanding balances from certain payers may indicate contract issues, slow processing, or a high denial rate from those payers. This requires focused attention and communication with the payer.

- High Volume of Small Balances in Older Buckets: While individually small, a large number of these can collectively represent a significant amount of uncollected revenue. This often points to inefficiencies in patient collections or a lack of focus on smaller claims.

- Spikes After Billing Staff Turnover: Changes in billing staff can disrupt processes and lead to delays or errors, resulting in increased aging. This highlights the need for proper training and documentation.

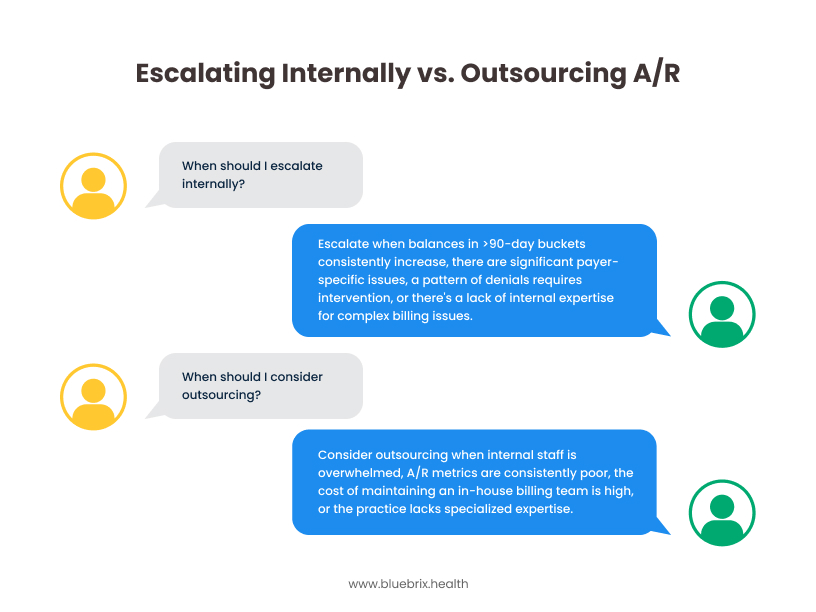

When to Escalate or Outsource A/R

Knowing when to escalate internally or outsource A/R is crucial for effective management:

- Escalation:

- Consistently increasing balances in >90-day buckets.

- Significant payer-specific issues that internal teams can’t resolve.

- A pattern of denials that require clinical or administrative intervention

- Lack of internal expertise to address complex billing issues.

- Outsourcing: For practices with small internal billing teams or those facing significant RCM challenges, outsourcing RCM can be a viable solution. Consider outsourcing when:

- Internal staff is overwhelmed and unable to keep up with billing demands.

- A/R metrics are consistently poor.

- The cost of maintaining an in-house billing team is high.

- The practice lacks specialized expertise in areas like denial management or coding.

For example, a multi-specialty practice with 40 providers and $20 million in annual revenue might consider outsourcing their A/R follow-up and denial management to improve their collection rate and free up internal staff to focus on patient care.

For example, a multi-specialty practice with 40 providers and $20 million in annual revenue might consider outsourcing their A/R follow-up and denial management to improve their collection rate and free up internal staff to focus on patient care.

Tools and KPIs to Monitor Weekly

To proactively manage A/R, it’s essential to track key performance indicators (KPIs) weekly:

- Days Sales Outstanding (DSO): This metric measures the average number of days it takes to collect payments. A high DSO indicates slow collections.

- A/R Aging by Bucket: Monitor the percentage of A/R in each aging bucket to identify trends.

- Collection Rate: This is the percentage of billable charges that are actually collected.

- Denial Rate: Track the percentage of claims denied by payers. Analyze denial codes to understand the reasons for denials.

- Clean Claim Rate: The percentage of claims that are accepted by payers on the first submission.

- Payer Mix: Understanding the distribution of payments by payer helps identify potential issues with specific payers.

Tools like RCM portals and dashboards can provide real-time visibility into these KPIs, enabling proactive intervention. For example, blueBriX, Athenahealth, eClinicalWorks (eCW), NextGen, and Kareo are some of the EHR/PM systems that offer reporting functionalities to track these KPIs.

How to Communicate A/R Risks

Effective communication of A/R risks is crucial for all stakeholders:

- To Practice Owners/CFOs: Present a clear and concise summary of key A/R metrics, highlighting trends and potential financial implications. Use data visualizations to make the information easily digestible. Focus on the ROI of RCM improvements.

- To Revenue Cycle Directors/Billing Managers: Provide detailed reports on A/R aging, denial analysis, and payer performance. Facilitate discussions on action plans to address identified issues.

- To Clinical Staff: Educate clinical staff on the importance of accurate and timely documentation for clean claim submission.

How RCM outsourcing addresses high denial rates and A/R aging in a multi-specialty practice to improve revenue cycle performance?

A 25-provider orthopedic group with $15 million in annual revenue was struggling with an increasing DSO and a high denial rate. An analysis of their A/R aging report revealed that over 40% of their receivables were aged over 60 days, with a significant portion attributed to denials related to coding errors and lack of pre-authorization for certain procedures. By implementing a coding audit, providing additional training to their coding staff, and streamlining their pre-authorization process, they were able to reduce their denial rate by 15% and improve their DSO by 10 days within six months. This resulted in a significant improvement in their cash flow and overall financial health.

Conclusion

The A/R aging report is more than just a list of outstanding invoices; it’s a powerful diagnostic tool for uncovering the financial health of your practice. By understanding the implications of aging buckets, recognizing key patterns, and proactively addressing issues, healthcare providers can optimize their revenue cycle, improve cash flow, and ensure long-term financial stability. For practices facing complex RCM challenges, especially those in high-volume, complex payer mix environments like California, Texas, Florida, New York, and Illinois, outsourcing to a trusted RCM partner with a proven track record can provide the expertise and resources needed to navigate the complexities of healthcare billing and collections. With 20 years of experience in the US RCM services segment, we are committed to helping practices achieve their financial goals and focus on what matters most: providing excellent patient care.

Tired of high denial rates and aging receivables? blueBriX’s RCM services can help you recover over 90% of claims within a few weeks. With blueBriX’s expert RCM and medical billing services, streamline your billing and collections processes and focus on patient care. Contact us today to learn more. Schedule a free demo to see how we can transform your revenue cycle.

Frequently Asked Questions

blueBriX is designed to address key A/R challenges faced by private multi-specialty practices, physician groups, and ASCs, including high denial rates, a large percentage of receivables aged over 45 days, and reporting gaps that hinder effective tracking of A/R performance.

blueBriX helps to streamline denial management by providing tools and processes to identify denial patterns, analyze root causes, and efficiently appeal denied claims. This helps reduce rework and improves the clean claim rate.

Yes. blueBriX focuses on proactive A/R follow-up to ensure timely payment from payers and patients, reducing the number of days receivables are outstanding and improving cash flow.

Absolutely. blueBriX offers comprehensive revenue reporting and insights, providing leadership dashboards and KPI reviews to track A/R metrics, identify trends, and make data-driven decisions.

blueBriX is designed for integration readiness and can work with various EHR/PM systems, including Athenahealth, eClinicalWorks (eCW), NextGen, Kareo, AdvancedMD, and DrChrono.