U.S. healthcare organizations burn over $1 trillion annually on administrative costs—much of it tied to revenue cycle dysfunction. Claims pile up. Payments lag. Staff chase paperwork instead of supporting patients.

For many practices, building RCM in-house is financially challenging. Technology infrastructure, billing software, compliance updates, and ongoing staff training require substantial upfront investment. Billing specialists typically command six-figure salaries, and most practices need multiple specialists to handle volume effectively. Administrative teams spend significant time on billing codes and documentation—time that could support patient care. Compliance errors can result in thousands in lost revenue.

Outsourced RCM offers an alternative. It reduces the need for in-house billing staff, minimizes technology infrastructure costs, and transfers compliance responsibility to specialists. Your team can focus on patient care while RCM experts handle revenue operations. For practices without the resources or scale to maintain robust in-house billing departments, outsourcing transforms RCM from a burden into a strategic advantage—when you choose the right partner.

But not all RCM services are equal. The market will surpass $238 billion by 2030, with vendors offering varying capabilities and specializations. Choose well, and you unlock efficiency and improved collections. Choose poorly, and you’re contractually stuck with misaligned service.

This guide evaluates the top 7 RCM service providers to look out for in 2026—what each does well, and who they’re built for.

Let’s find your fit.

1. blueBriX

blueBriX specializes in revenue cycle management services tailored for healthcare providers across behavioral health, integrated care, and diverse specialties. Their services streamline billing and collections, reduce denials, and accelerate reimbursements, helping practices achieve superior financial performance while reducing administrative overhead.

Service scope

- Comprehensive billing cycle management from patient prior authorization through payment collections

- Provider credentialing, enrollment, and payer contract optimization services ensuring seamless reimbursement pathways and maximized rates

- Specialty-specific workflows designed for behavioral health and complex care settings

- Denial management programs that significantly reduce claim rejections almost 90%

- Accounts receivable follow-up and recovery tailored to client needs

- Transparent financial reporting with personalized data insights

- Flexible and scalable services for small practices to multi-site organizations

- Regulatory compliance and audit readiness support

- Dedicated client support for fast onboarding and ongoing optimization

Core strengths

- Over two decades of domain expertise in healthcare billing complexities and payer requirements, ensuring updated compliance with evolving regulations and policies

- Coders proficient in value-based care, including risk adjustment, HCC models (ICD-10-CM V24-V28), and behavioral health specifics like psychotherapy CPT codes

- A native, EHR-agnostic platform enabling seamless integration with any existing system for maximum flexibility

- Comprehensive expertise gap analysis on existing RCM processes to identify inefficiencies and improvement opportunities

- Robust integration with major clearinghouses to streamline claims processing and accelerate reimbursements

- Customizable workflows designed to fit unique practice needs, enhancing operational efficiency and accuracy

- Actionable insights into financial performance through advanced analytics and transparent reporting

- Strong forte on data security and regulatory compliance, safeguarding patient information and fostering trust

- Proven success in reducing accounts receivable days by up to 70%, significantly improving cash flow

- Scalable cloud infrastructure that dynamically adjusts to practice growth and evolving operational demands

Best suited for

- Behavioral health providers: Providers with specialized billing needs

- Integrated care systems: Systems requiring coordinated revenue cycle workflows

- Growing practices: Practices seeking scalable RCM solutions

- Multi-site organizations: Organizations needing centralized billing and reporting

- Multi-specialty groups: Versatile coding and payer management for diverse provider mixes

- Primary care practices: Streamlined RCM for high-volume outpatient billing

2. R1 RCM

R1 RCM delivers end-to-end outsourced revenue cycle management services to hospitals, health systems, and physician groups, focusing on cost reduction and revenue recovery. Their comprehensive approach handles everything from patient intake through final collections, eliminating the need for in-house billing teams while maximizing reimbursements.

Service scope

- Patient registration and financial clearance

- Insurance verification and prior authorization

- Charge capture, coding, and clinical documentation

- Claims submission and scrubbing

- Payment posting, denials management, and AR recovery

- Patient collections and underpayment recovery

- Performance reporting and revenue analytics

Core strengths

- Expert handling of complex claims and payer relationships with experience managing denials and payer requirements

- Dedicated denials and AR recovery specialists focused on resolving rejected claims and aged receivables

- Coders manage ICD-10 and CPT for claims, supporting denial reduction.

- Scalable services supporting enterprise health systems with flexible capacity to handle volume fluctuations and multi-facility operations seamlessly

- Compliance management across all regulatory requirements, ensuring HIPAA adherence, accurate coding, and audit readiness for reduced risk exposure

Best suited for

- Large health systems: Enterprise-scale outsourcing for 95 of top 100 US systems

- Hospitals: Comprehensive revenue cycle management reducing operational costs

- Physician groups: Billing support handling high-volume claims and denials

Note: Small independent practices or solo practitioners may find R1’s enterprise-focused model and pricing structure misaligned with their operational scale. Providers seeking hands-on, personalized account management typical of smaller RCM vendors might experience less direct engagement given R1’s focus on large health system operations.

3. Oracle Cerner

Oracle Cerner provides revenue cycle management services primarily for hospitals and health systems, with an emphasis on integrating clinical and financial data to improve billing accuracy. Their approach connects patient care documentation directly to revenue cycle workflows, helping acute care providers reduce billing errors and accelerate reimbursement timelines.

Service scope

- Patient registration and insurance eligibility verification

- Charge capture and coding support to ensure accurate claims

- Claims submission and electronic claim scrubbing

- Payment posting and denial management to maximize revenue recovery

- Patient billing and collections management

- Detailed analytics and financial performance reporting

Core strengths

- Accurate billing from combined clinical and financial information reduces billing errors and denials, helping clients maintain an average of 36.5 days in AR

- Experienced teams handling contract management and patient accounting with proven operational expertise

- Clinical data linkage aids charge capture and coding compliance

- Scalable services supporting large hospitals and health systems with enterprise-level capacity

- Built-in knowledge of payer rules and regulatory compliance ensuring audit readiness and risk reduction

Best suited for

- Large hospitals and health systems: Managing high patient volumes and complex billing needs

- Acute care providers: Requiring tightly coordinated clinical and financial workflows

Note: Small to mid-sized independent practices and specialty clinics may find Oracle Cerner’s services better suited to hospital-scale operations. Organizations without existing Oracle/Cerner clinical systems may face integration challenges. Practices seeking vendor-agnostic RCM services should consider providers with broader system compatibility.

4. CureMD

CureMD delivers comprehensive revenue cycle management services focused on maximizing provider revenue while reducing operational complexity. Their approach centers on proactive denial management, accelerated collections, and systematic accounts receivable optimization to drive sustainable financial improvements.

Service scope

- End-to-end billing and collections management

- Denial management to reduce claim rejections and accelerate resolution

- Insurance verification and prior authorization support

- ERA processing and timely payment posting

- Accounts receivable follow-up and underpayment recovery

- Patient billing and collections assistance

Core strengths

- Complimentary financial audits that identify revenue leakage and operational inefficiencies to provide a clear action plan

- Transparent performance tracking via real-time dashboards and monthly reporting on key metrics such as claim acceptance rates, days in A/R, and denial trends

- Coding audits and scrubbing ensure ICD-10/CPT adherence

- Expert payer relationship management maintaining communication

- Accelerated cash flow with systematic claim scrubbing, timely submission, and aggressive follow-up protocols

Best suited for

- Independent practices: Smaller physician offices benefit from complete billing cycle management that reduces denials and clears accounts receivable backlogs

- Multi-specialty groups: Practices with complex coding needs across departments receive tailored billing workflows and payer management

- High-growth and expanding practices: Scalable services support increasing patient volumes without the need for additional billing staff or training

Note: Practices seeking deep specialty focus in niche areas like behavioral health or post-acute care should evaluate vendors with dedicated expertise in those sectors.

5. Athenahealth

Athenahealth offers comprehensive revenue cycle management services aimed at optimizing financial performance while reducing administrative burden. Their approach covers the entire revenue cycle, helping practices and health systems improve reimbursement rates and cash flow.

Service scope

- Patient registration and insurance verification

- Co-pay collection and prior authorization management

- Charge entry, coding, and claim scrubbing to reduce errors

- Claims submission via integrated clearinghouse

- Payment posting, denials resolution, and zero-pay recovery

- Real-time performance reporting with revenue cycle KPIs

Core strengths

- Integrated clearinghouse services that enhance workflow efficiency and reduce claim rejections

- Transparent reporting platforms providing financial insights and performance visibility

- Expert authorization management and fast denials resolution to accelerate reimbursements

- Scalable solutions adaptable to various practice sizes, from independent clinics to large health systems

Best suited for

- Large practices and health systems: Gain consolidated financial data and workflow standardization across multiple locations

- Growing organizations: Leverage flexibility to handle expansion and evolving reimbursement models

- Independent Practices: Benefit from simplified billing, coding, and denial management tailored to smaller operations

Note: Practices deeply invested in non-Athenahealth EHR systems may experience workflow friction. Organizations requiring highly specialized billing expertise in narrow clinical niches (such as behavioral health or post-acute care) should consider vendors with dedicated focus in those areas. Very small practices may find more cost-effective options with vendors targeting their specific size.

6. Netsmart

Netsmart provides specialized revenue cycle management services tailored mainly for behavioral health, human services, and post-acute care providers. Their RCM approach focuses on improving revenue through dedicated billing services, streamlined claims processing, and enhanced financial reporting designed to meet the unique needs of these sectors.

Service scope

- Comprehensive billing administration covering claims submission to payment collections

- Denials management and follow-up to maximize reimbursement

- Accounts receivable management aimed at reducing aging balances, achieving an average 11% reduction in overall AR

- Provider credentialing and enrollment services to ensure smooth payer interactions

- Integrated clearinghouse services for electronic claim submission and payer connectivity

- Detailed compliance and regulatory reporting tailored to requirements

Core strengths

- Increase cash collections and decrease AR days by leveraging automation and follow-ups

- Strong denials reduction programs resulting in higher clean claim rates

- Credentialing support that reduces administrative workloads and payer onboarding delays

- High claim acceptance rates supported by automated scrubbing and claims accuracy processes

Best suited for

- Behavioral health providers: Specialized RCM addressing unique payer and regulatory challenges of mental health and addiction treatment facilities

- Post-acute care organizations: Efficient billing workflows optimized for skilled nursing, home health, and rehabilitation centers

- Growing practices: Services scalable to manage increasing volumes without resource strain

Note: Primary care practices, surgical specialties, and general medical groups will find limited value in Netsmart’s behavioral health and post-acute focus. Providers outside these sectors should pursue RCM services aligned with their clinical specialty and payer mix.

7. Change Healthcare

Change Healthcare (now part of Optum) provides revenue cycle management services with a strong emphasis on clearinghouse operations and claims processing efficiency. Their services handle the core billing workflow from patient intake through payment posting, with particular strength in payer connectivity and claims volume management.

Service scope

- Patient intake and eligibility verification

- Claims submission and scrubbing via integrated clearinghouse

- Payment posting and remittance processing

- Denial management and appeals support

- Provider enrollment and credentialing

- Revenue cycle analytics and reporting

Core strengths

- Extensive payer network connectivity for faster claim processing and reimbursements

- Automation tools reducing manual billing errors and improving accuracy

- Real-time visibility into claims status and payments for better cash flow management

- Scalable platform handling high claim volumes across growing practices

Best suited for

- Large health systems: Organizations needing high-volume claims processing and payer connectivity

- Providers using optum ecosystem: Integrated workflows for existing platform users

- Claims-focused operations: Practices prioritizing clearinghouse efficiency over full billing outsourcing

Note: Practices seeking comprehensive, hands-on billing management with dedicated account teams may find Change Healthcare’s clearinghouse-focused approach insufficient. Smaller practices needing close billing support and personalized service should consider full-service RCM providers. Organizations outside the Optum ecosystem may experience integration limitations.

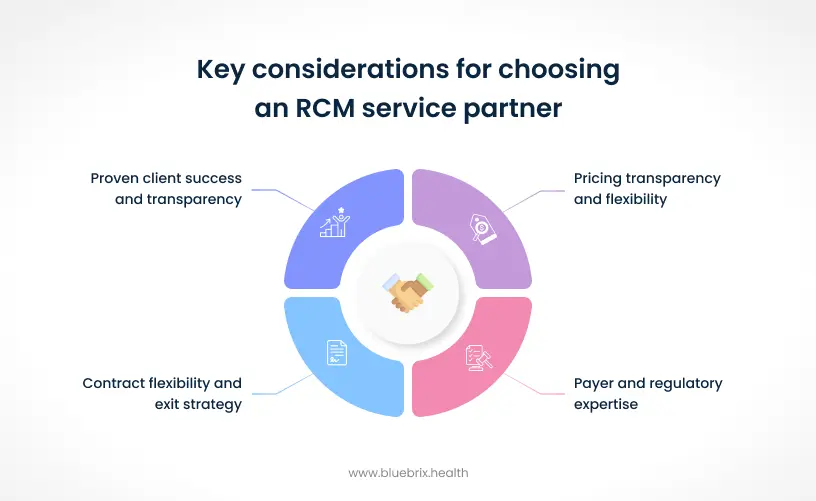

Now that you’ve seen what each RCM service excels at, the next step is evaluating how well they’ll actually work for your practice. The right partner isn’t just about capabilities—it’s about transparency, flexibility, and proven results with organizations like yours. Here are the critical factors that separate a good vendor from the right long-term partner.

Critical factors you should consider before choosing your RCM service partner

Beyond the core services and technology integration commonly highlighted in vendor overviews, prospects should evaluate these critical areas to ensure they select an RCM partner that truly aligns with their organization’s goals and operational realities.

Pricing transparency and flexibility

Understanding the pricing model beyond simple cost is vital. Vendors should offer:

- Clear pricing structures with no hidden fees for onboarding, software use, or exit

- Flexible fee models tailored to practice size and complexity—percentage of collections, flat fees, or hybrid approaches

- Assurances on cost-to-collect reductions (30%-50% savings are common goals) to justify outsourcing investments

Transparent pricing coupled with a strong ROI narrative eases budget approvals and clarifies value delivered.

Payer and regulatory expertise

A nuanced understanding of payers and regulations is a competitive differentiator. Prospects should verify:

- Experience and success handling claims with their top payers, including state Medicaid and Medicare contractors

- Up-to-date compliance with HIPAA, CMS regulations, and state-specific billing mandates

- Capability to proactively manage evolving regulatory environments, reducing audit risks and penalties

Contract flexibility and exit strategy

Long-term partnerships must be sustainable and flexible. Vendors should provide:

- Reasonable contract lengths with options for month-to-month terms upon renewal

- Clear exit clauses ensuring data ownership and accessible transition support

- No excessive early termination penalties maintaining client autonomy

Proven client success and transparency

Evaluating client success stories and validated performance metrics helps mitigate risk. Look for:

- Detailed case studies from similar-sized and specialty-matched providers

- Willingness from vendors to provide references and facilitate direct client conversations

Making the right RCM decision for your organization

Choosing an RCM partner isn’t about finding the longest capabilities list. It’s about finding the service that understands your specific challenges—whether that’s navigating behavioral health payer complexities, managing multi-specialty billing, or simply getting aged receivables under control.

The seven services outlined here each bring distinct expertise. Large health systems will find different strengths than independent practices struggling with denials. Post-acute care providers face billing intricacies that primary care offices never encounter. Your specialty, scale, and current pain points should drive your decision—not vendor marketing.

What matters most is alignment.

Does the RCM partner have demonstrated success with organizations like yours? Can they handle your top payers? Will they provide transparent reporting? Can they scale with you as volumes grow?

These aren’t questions you answer by reading websites. They require honest conversations and a clear assessment of where your revenue cycle is breaking down today.

Before committing to any partnership, understand where your revenue is slipping.

Many organizations don’t realize they’re losing 15-20% of potential collections due to preventable issues. Others discover their biggest challenge isn’t what they initially thought.

At blueBriX, we’ve spent over two decades working with practices of every size and complexity—from solo practitioners managing their first billing cycle to enterprise-level organizations. We start every conversation with a complimentary gap analysis—examining your current processes and identifying where revenue leakage is occurring.

Start with what can be optimized in the current processes. Sit with our RCM experts for valuable insights.