It is 4:00 PM on a Friday. Your care coordination team has finally secured a skilled nursing facility (SNF) bed for a high-risk patient ready for discharge. The clinical handoff is perfect. The patient is ready. Then, the phone rings.

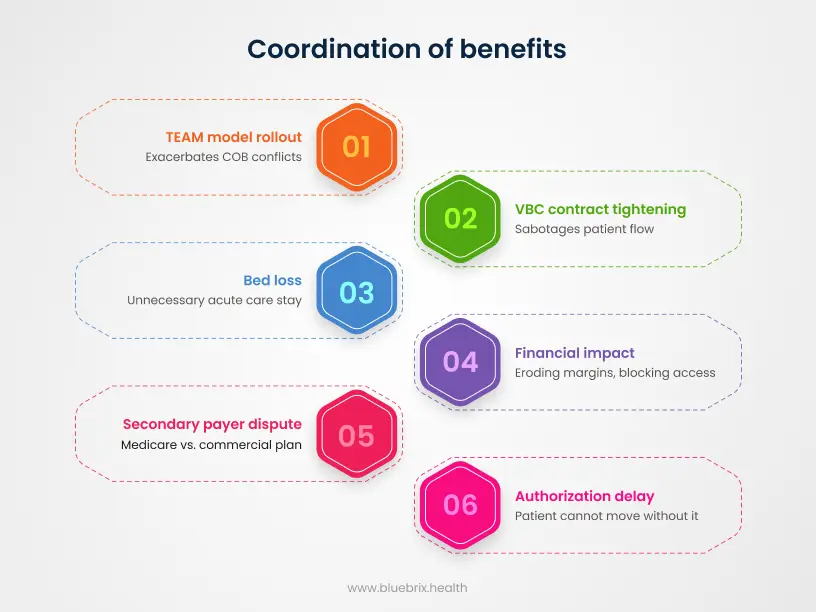

The receiving facility is refusing the transfer. Why? Not for clinical reasons, but because the payer listed, a commercial plan, claims they are secondary to Medicare. Medicare, however, shows the commercial plan as primary due to the patient’s working aged status. Until the primary payer is confirmed and authorization is granted, that patient isn’t moving.

The bed is lost. The patient spends another unnecessary weekend in an acute care bed, eroding your margins and blocking access for others. That delay creates a care gap that spikes the patient’s readmission risk. It lowers your ACO’s attribution score. It damages your length-of-stay (LOS) metrics. A single administrative COB error has now rippled through your entire value-based contract, penalizing you for a billing technicality.

For years, the Coordination of Benefits (COB) conflict was viewed as a business office problem, a tedious billing headache to be sorted out 60 days post-discharge. In 2026, that view is dangerously obsolete.

With the rollout of CMS’s Transforming Episodic Accountability Model (TEAM) and the tightening of value-based care (VBC) contracts this year, COB conflicts have mutated. They are no longer just delaying reimbursement; they are actively sabotaging patient flow, inflating denial rates, and breaking the financial backbone of care coordination.

For decision-makers navigating this complexity, the answer isn’t hiring more staff to sit on hold with payers. The solution lies in a fundamental shift: moving COB from a reactive manual chase to a proactive, agentic orchestration engine.

The 2026 reality: why payer conflicts are accelerating

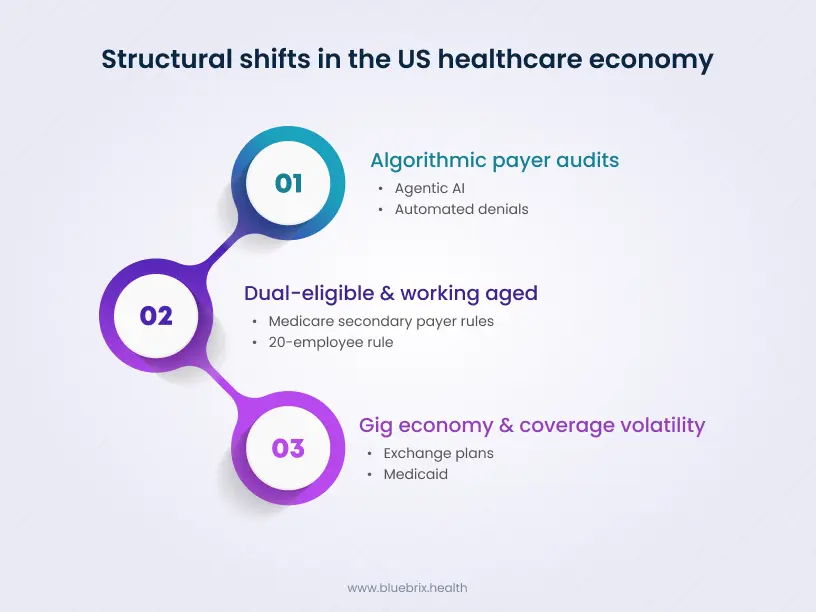

If it feels like payer conflicts are getting more frequent and harder to resolve, the data supports you. Three structural shifts in the US healthcare economy have created a perfect storm for COB failures.

1. The “dual-eligible” & “working aged” explosion

The demographic shift is undeniable. As the workforce ages, more Americans are remaining employed well past 65. This creates a massive cohort of patients who possess both Medicare and Employer Group Health Plans (EGHP). Determining who pays first under Medicare Secondary Payer (MSP) rules is nuanced. It depends on employer size (the 20-employee rule), disability status, and active employment definitions. Humans are notoriously bad at tracking these multi-variable logic trees in real-time. Algorithms, however, are built for it.

2. The gig economy and coverage volatility

The days of a patient holding the same insurance policy for a decade are over. The modern workforce is transient. Patients move between Exchange plans, Medicaid, and commercial coverage rapidly. A patient might be Medicaid-primary in January, acquire a commercial plan in March, and drop it by June. Manual verification processes which often rely on “last month’s data”, cannot keep pace with this volatility, leading to a surge in retroactive denials.

3. The rise of algorithmic payer audits

Payers have upgraded their arsenals. In 2026, payers are utilizing their own Agentic AI to scan claims for potential COB overlaps. They are finding other coverage that you missed and issuing automated denials. If the payer’s tech is smarter than your tech, you will lose that revenue cycle battle every time.

Why COB is not just a billing issue?

For the decision-maker, whether a CFO, a VP of Revenue Cycle, or a Director of Care Management, it is critical to reframe the COB problem. When COB fails, it triggers a cascade of operational failures beyond a denied claim:

- Regulatory exposure (the no surprises act): Inaccurate COB data doesn’t just delay payment; it breaks your compliance. If your Good Faith Estimate (GFE) is calculated based on the wrong primary payer, you face disputes and federal penalties. You are legally required to get the numbers right upfront.

- The human capital crisis: Your revenue cycle staff is likely already stretched thin. Forcing them to spend 40% of their day fighting manual denials is a retention killer. Automation isn’t just about efficiency; it’s about protecting your workforce from burnout and allowing them to work at the top of their license.

- Care delays: Prior authorizations are submitted to the wrong payer, leading to automatic rejections and days of delay while the administrative team scrambles to re-submit to the correct entity.

- Inflated A/R days: A COB denial is one of the slowest to resolve. It requires proving a negative (e.g., proving a patient doesn’t have other coverage), which often involves conference calls between the patient, provider, and two insurance carriers.

- Patient dissatisfaction: Nothing destroys patient trust faster than receiving a surprise bill for the full amount because their insurers couldn’t agree on who was responsible.

The solution: Intelligent orchestration and counter-agentic AI

Historically, providers tried to solve this with simple eligibility scraper tools that ping a payer website to see if a policy is active. That is no longer sufficient. Knowing a policy is active tells you nothing about primacy.

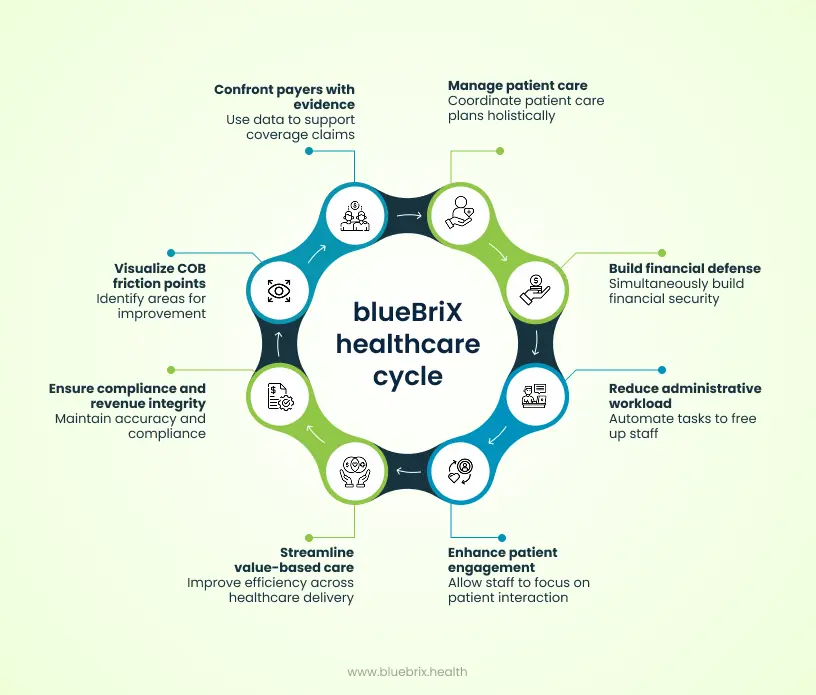

To resolve payer conflicts in 2026, organizations need Intelligent Orchestration. This is where blueBriX differentiates itself from the commodity market. We don’t just “check status”; we orchestrate a logic-driven investigation into the patient’s entire coverage profile.

The role of payer rule engines

At the heart of the blueBriX platform is a sophisticated payer rule engine. This engine digitizes the complexity of MSP statutes and commercial coordination clauses.

Instead of relying on a registration clerk to remember if the “Birthday Rule” applies to a dependent child, the system automatically evaluates the dates of birth of both parents and assigns the tentative primary payer order. It flags discrepancies immediately—before the patient walks into the exam room.

Interoperability as the enabler

Automation is useless if it sits in a silo. The blueBriX orchestration platform is designed with deep interoperability at its core. It pulls demographic data from your Integrated EHR, cross-references it with real-time payer databases, and pushes the “clean” COB hierarchy back into your Integrated RCM workflow.

This creates a “single source of truth” that travels with the patient. When the care coordinator applies for a SNF placement, the system already knows who the primary payer is. The prior auth goes to the right destination the first time.

Deploying counter-agentic defense

Payers are using AI agents to find reasons to deny your claims. blueBriX acts as your Counter-Agentic AI. We use the same level of algorithmic sophistication to find the irrefutable evidence that requires them to pay.

Compliance first

Decision-makers know that data fluidity cannot come at the cost of security. blueBriX is SOC2 Type II certified and HIPAA compliant, ensuring that while your data moves fast, it never moves unprotected.

3 dangerous misconceptions about COB automation

As you evaluate solutions, you will encounter resistance and myths. Let’s dismantle the three most common misconceptions that hold healthcare leaders back.

Myth 1: “Our EHR already does this.”

The reality: Most EHRs are excellent at clinical documentation but rudimentary at complex financial logic. They typically offer a static field for “Primary” and “Secondary,” relying on the user to manually select the order. They do not possess the dynamic workflow automation engines required to constantly re-verify and re-order payers based on changing MSP triggers. blueBriX acts as the intelligence layer that supercharges your existing EHR, rather than replacing it.

Myth 2: “Automation is too expensive and complex for our size.”

The reality: This was true in the era of on-premise servers and custom code. Today, the blueBriX Low-Code / No-Code architecture changes the equation. But more importantly, it future-proofs your organization.

Healthcare mandates change constantly (like the TEAM model or new VBC protocols). Hard-coded legacy systems take 18 months to update. Because blueBriX is Low-Code, when CMS changes the rules in 2027, you can update your logic in hours, not months.

You aren’t just buying a solution for 2026; you are buying the agility to survive the next decade of regulation. Whether you are a mid-sized ACO or a large health system, the platform scales with your complexity.

Myth 3: “COB is a back-end function; front-end staff shouldn’t worry about it.”

The reality: By the time a claim hits the back end, it’s too late. The cost to rework a denial is roughly 4-5x the cost of getting it right at registration. Automation moves the COB resolution to the “front of the house” without burdening staff. The system does the heavy lifting in the background, presenting the registration team with a simple “green light” or a specific question to ask the patient.

The blueBriX difference: Care coordination as a financial engine

Why are leading healthcare organizations turning to blueBriX? Because we understand that care coordination and revenue cycle management are inextricably linked.

Our platform treats the patient journey as a holistic data stream. When you use blueBriX to manage a patient’s care plan, you are simultaneously building the financial defense for that care.

Real-world impact: The numbers don’t lie

We don’t just talk about efficiency; we deliver it. In our work with partners like Aligned Modern Health, we deployed digital health solutions that resulted in a 25% reduction in administrative workload. By automating the busy work of coordination, including the verification of coverage nuances, staff were freed to focus on patient engagement.

Similarly, our partnership with Arkos Health demonstrated the power of a unified platform. Supporting over 750 HCPs and a patient population of 350,000+, the integration of blueBriX helped streamline value-based care delivery across five states. When you operate at that scale, manual COB is impossible. Automation is the only way to ensure compliance and revenue integrity.

Custom reporting & data integrity

In a conflict, he who has the best data wins. blueBriX provides custom reporting dashboards that allow you to visualize your COB friction points.

- Which commercial payers are most frequently denying MSP claims?

- What percentage of your “dual” population has an unresolved COB status?

Our data visualization tools turn these abstract questions into actionable intelligence, allowing you to confront payers with irrefutable evidence of coverage order.

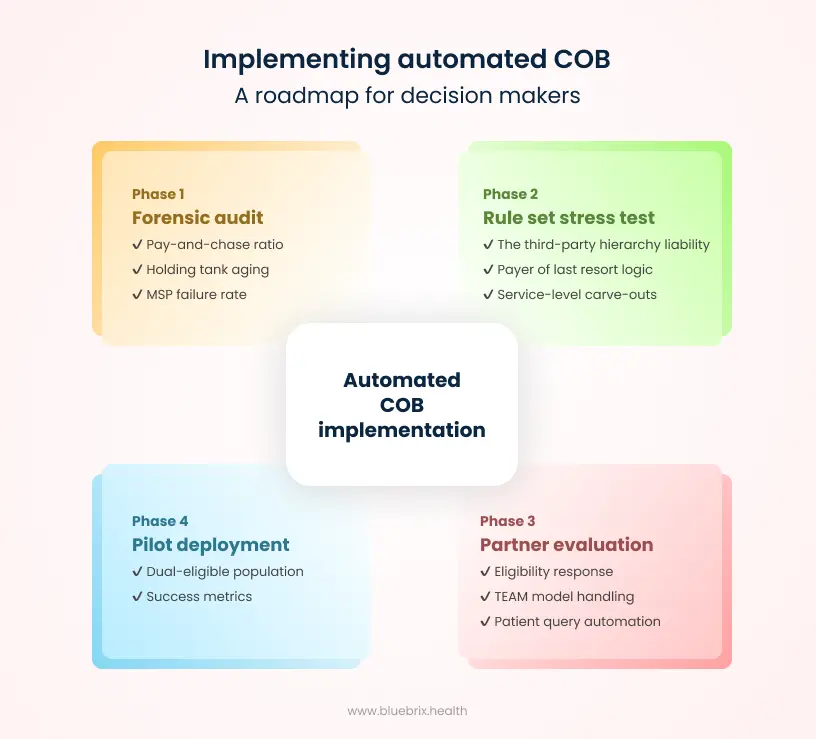

A roadmap for decision makers: Implementing automated COB

If you are ready to resolve payer conflicts, you do not need another high-level strategy meeting. You need a forensic audit of your current leakage and a tactical deployment plan. Here is your execution framework for Q1 2026.

Phase 1: The forensic audit (beyond standard reporting)

Most organizations track denial rate. That is too broad to be useful for COB. You need to isolate the friction points. Ask your analytics team to pull these three specific datasets:

- The pay-and-chase ratio: Calculate the percentage of claims where you received a payment, had it recouped due to retro-termination/COB, and then had to re-bill. If this is above 5%, your current eligibility vendor is giving you false positives (telling you active coverage exists without checking primacy)

- The holding tank aging: Look at unbilled encounters currently sat in Registration Review or Financial Clearance work queues due to missing insurance info. This is your hidden A/R. Calculate the average age of these holds. Manual COB usually creates a 14-21 day drag here; automation should cut it to under 24 hours

- The MSP failure rate: Specifically filter for patients over age 65 who were denied by Medicare for MSP (Medicare Secondary Payer) reasons. This reveals exactly where your registration staff is failing to ask the working aged questions (employer size, spouse employment).

Phase 2: Stress-test your rule sets

Generic automation fails because it treats all coverage equally. You must document the specific logic collisions that drive your denials before you configure a system.

- The third-party liability hierarchy (TPL): How does your workflow handle Third-Party Liability? If a patient presents with an injury, your system must automatically trigger logic to check for Auto or Workers’ Comp coverage before billing the commercial health plan.

- Payer of last resort logic: Beyond just Medicare, are you correctly identifying Medicaid’s place in the chain? Ensure your rules strictly enforce “Payer of Last Resort” statutes so you never bill a state program primary when a private plan exists.

- Service-level carve-outs: Does your facility offer services (like Behavioral Health or Physical Therapy) that are often “carved out” to a secondary vendor? Your logic engine must be smart enough to know that the payer for the doctor’s visit might differ from the payer for the specific therapy.

Phase 3: The agentic litmus test for partners

When evaluating orchestration platforms versus standard clearinghouses, stop asking “Do you check eligibility?” Everyone does. In 2026, that is a commodity. The real question is: Can you survive a payer audit?

Ask these killer questions:

- “Do you return a raw ‘Active/Inactive’ response, or a computed ‘Primary/Secondary’ flag?” (You need the latter. If the system cannot calculate primacy based on service-level carve-outs, it is just noise).

- “Does your COB engine protect our Good Faith Estimates (GFE)?” (Under the No Surprises Act, if your COB tool identifies the wrong primary payer, your cost estimate is legally indefensible. Your partner must protect you from this regulatory risk).

- “Show me how your rule engine handles the ‘2026 TEAM Model’ episodes.” (If they don’t know what the Transforming Episodic Accountability Model is, they aren’t ready for 2026).

- “Do you deploy ‘Counter-agentic AI’?” (Payers are using “Agentic AI” to scan for overlaps. You need a partner that proactively “stress tests” your claims against that same logic before submission).

Phase 4: The pilot deployment

Do not attempt a big bang rollout across all payers. It will fail. Instead, pick your high-friction / high-volume segment for a 90-day pilot.

- Recommendation: Start with your dual-eligible (Medicare/Commercial) population. It is rule-heavy, high-value, and the logic is standardized.

- Success Metric: Aim for a 90% reduction in MSP-related denials and a 50% reduction in registration staff touches for this cohort.