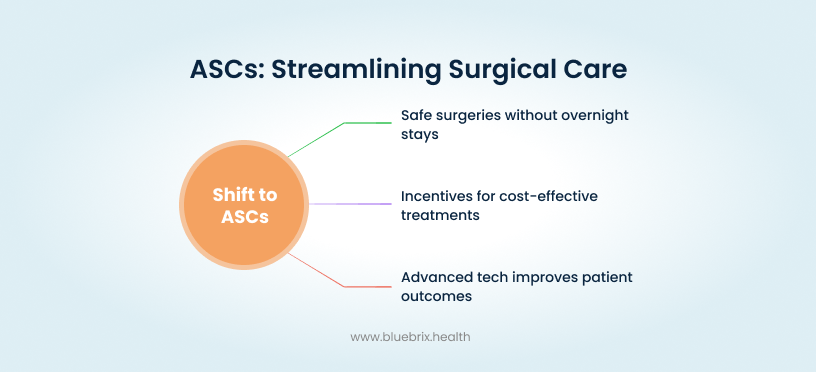

Outpatient surgery is no longer the future, it’s the present. Across the U.S., more than 60% of surgical procedures are now performed outside hospital walls, and Ambulatory Surgery Centers (ASCs) are leading that charge.

For patients, ASCs mean quicker recovery, lower costs, and greater convenience. For payers and providers, they mean efficiency and scalability. For the healthcare system at large, they represent billions in savings every year. It’s no surprise that over 80% of hospitals already co-own at least one ASC.

This guide is designed to help you understand why ASCs matter, how they operate, where the challenges lie, and what opportunities exist for growth. We’ll cover everything from reimbursement models and compliance risks to digital transformation and the role of AI.

And because no conversation about ASC performance is complete without talking about outcomes, we’ll also explore how platforms like blueBriX help centers reduce denials, optimize workflows, and scale sustainably.

So, let’s start at the beginning: What exactly is an ASC, and why are they becoming so central to healthcare delivery?

What is an ambulatory surgery center (ASC) — and why should you care?

An Ambulatory Surgery Center (ASC) is a healthcare facility designed to deliver same-day surgical care. Unlike hospitals, where patients may stay overnight, ASC patients typically go home within 24 hours.

That efficiency doesn’t mean compromise. ASCs are highly regulated, accredited, and specialized, often delivering the same quality of care as hospitals at 35–60% lower costs. They cover a wide range of procedures in orthopedics, gastroenterology, ophthalmology, cardiology, and more.

But to understand their role today, you have to look at where they came from.

A brief history of ASCs: from frustration to transformation

The story of ASCs begins in Phoenix, Arizona, in 1970. Two physicians — Drs. Wallace Reed and John Ford — were tired of delayed surgeries, overcrowded hospitals, and administrative bottlenecks. They envisioned a more patient-centered, affordable, and efficient alternative to inpatient surgery.

Their first center was modest, just a couple of operating rooms tucked away from the bustle of the hospital. Yet it quickly became a favorite among patients who appreciated being able to walk in for their surgery and return home the very same day. For many, it felt less intimidating, more personal, and refreshingly efficient compared to the long waits and overnight stays they were used to. That little experiment in Phoenix sparked a movement that would change how surgery is delivered across the U.S.

That vision became the first freestanding ASC. Over time, support from organizations like the AMA and CMS formalized standards and reimbursement models, sparking rapid growth across the U.S.

Today, there are thousands of ASCs nationwide. What started as a workaround for scheduling frustrations has evolved into a cornerstone of value-based, outpatient care. And their role keeps expanding from routine cataracts and colonoscopies to joint replacements and cardiovascular procedures, supported by robotics and minimally invasive techniques.

The ASC model has always been about more than cutting costs. Its core philosophy is efficiency, patient-centered care, and affordability.

The core philosophy behind ASCs

If you strip away the regulations, reimbursement models, and technology, ASCs are really built on three core ideas: care should be safe, care should be efficient, and care should be affordable.

That philosophy is what sets them apart.

- Efficiency matters. ASCs are designed for speed without cutting corners. The workflows are streamlined, the teams are specialized, and the entire environment is optimized for getting patients in, treated, and recovering faster.

- The patient comes first. Hospitals can feel overwhelming. ASCs flip that by creating a more personal, less stressful experience. Same-day discharge, shorter wait times, and direct surgeon-patient interactions all build trust and satisfaction.

- Costs should not be barriers. Because ASCs cut out the overhead of hospital stays, they make high-quality surgical care more affordable for patients and more sustainable for payers.

These three values are not just guiding principles. They are the reason ASCs continue to gain traction across the U.S. They have proven that surgical care can be delivered with better outcomes, higher satisfaction, and lower costs.

Which raises the next question: What exactly makes ASCs different from hospitals, and why does that difference matter for patients, payers, and providers alike?

ASCs vs. Hospitals: what really sets them apart

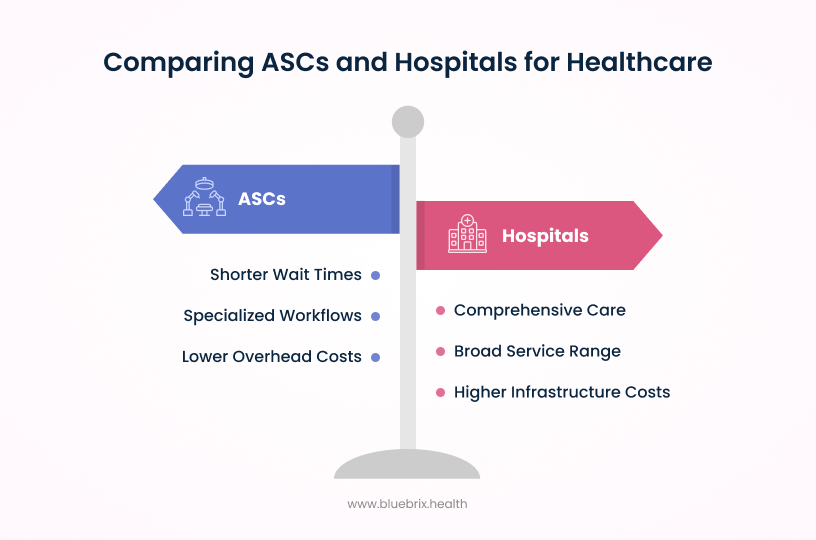

At first glance, an Ambulatory Surgery Center and a hospital may seem like they do the same thing: both perform surgeries, both follow strict safety standards, and both are staffed by licensed clinicians. But dig a little deeper and the differences are clear, and those differences are exactly why ASCs are thriving.

Take something as routine as cataract surgery. In a hospital setting, patients often describe the process as long and tiring — parking far away, waiting in crowded lobbies, and dealing with multiple layers of check-in before they even meet their surgeon. In contrast, many ASC patients say the experience feels more like visiting a specialized clinic: park close, walk in, meet your care team, and head home the same afternoon. The medical outcome may be the same, but the journey feels completely different.

That simplicity is what keeps patients coming back to ASCs and why payers and providers see them as a smarter alternative for same-day surgeries.

- Facility structure: Hospitals are designed to do it all, from emergency care to intensive care to long-term inpatient stays. ASCs, on the other hand, are purpose-built for one thing — same-day surgical care. That focus keeps operations lean and patient flow faster.

- Scale and resources: Hospitals run with massive infrastructures, ICUs, and multiple departments to handle every possible emergency. ASCs operate on a tighter scale, with specialized teams that maximize efficiency for procedures that do not require overnight stays.

- Cost dynamics: For the same procedure, Medicare and commercial payers often reimburse ASCs 35 to 60 percent less than they reimburse hospitals. This is not about paying providers less — it is about cutting out hospital overhead. Those savings flow to patients, payers, and the healthcare system as a whole.

- Patient experience: Hospitals are complex systems. Navigating them can be stressful, with long waits and crowded environments. ASCs flip that experience, offering streamlined check-ins, shorter stays, and same-day recovery at home.

- The bottom line: hospitals are built for breadth, ASCs are built for focus. Both play critical roles in the healthcare ecosystem, but when it comes to efficiency and affordability, ASCs hold the advantage.

And when we narrow the comparison to Hospital Outpatient Departments (HOPDs), the differences become even more striking.

ASCs vs. Hospital outpatient departments (HOPDs): which delivers more value?

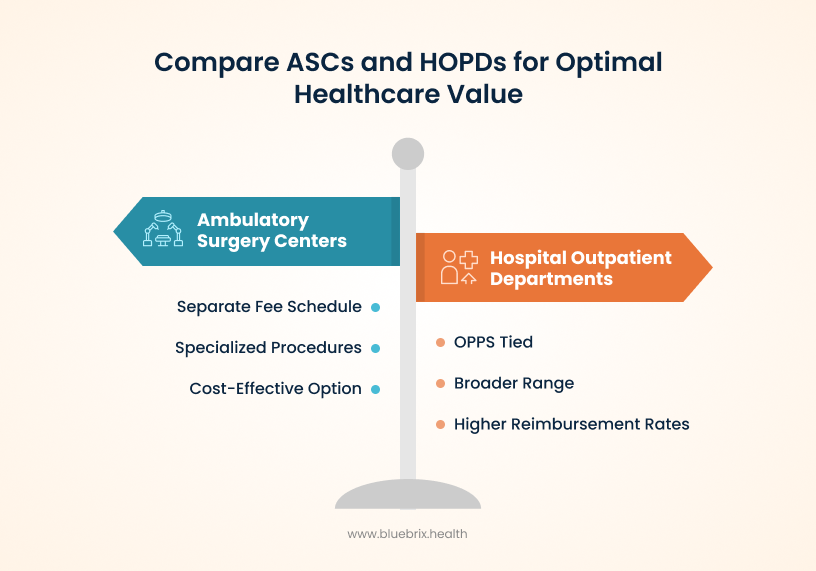

If hospitals are the “all-purpose” centers of healthcare, then Hospital Outpatient Departments sit somewhere in the middle. They are technically part of a hospital but are structured to deliver outpatient services. On paper, that might sound a lot like an ASC, but the differences become clear when you look at regulation, reimbursement, and specialization.

- Regulatory framework and payments: HOPDs are tied to their parent hospitals and operate under the Outpatient Prospective Payment System (OPPS). ASCs, however, follow a separate fee schedule set by CMS. That distinction matters because it directly impacts reimbursement rates and the types of procedures each facility can perform.

- Specialization vs. breadth: ASCs are laser-focused on a defined set of procedures. This allows them to fine-tune workflows and deliver consistent results. HOPDs, while offering a wider range of outpatient surgeries, often involve more logistical complexity and longer wait times.

- Cost comparison: For payers and patients, the financial difference is significant. Procedures done in ASCs are consistently reimbursed at lower rates compared to HOPDs, which makes ASCs the more cost-effective option without sacrificing safety or quality.

So while both ASCs and HOPDs are technically “outpatient” settings, their models are not interchangeable. ASCs win on efficiency and affordability, while HOPDs carry the weight (and costs) of being tied to larger hospital systems.

Key differences in payment, forms, and compliance

While ASCs, hospital outpatient departments (HOPDs), and physician offices all use CPT coding, their payment and documentation rules vary widely.

- ASCs must follow Medicare’s ASC Payment System with facility-specific coverage and payment restrictions.

- Hospitals bill under the Outpatient Prospective Payment System (OPPS) and are reimbursed at higher rates.

- Physician offices use the Physician Fee Schedule (PFS), which focuses more on evaluation and management services than procedures.

- ASCs use the CMS-1500 claim form with facility-specific edits, while hospitals use UB-04 (CMS-1450).

- Modifiers such as –SG (ASC facility service) are critical for ASC claims but irrelevant in most hospital settings.

- Only procedures approved on Medicare’s ASC list are billable in the ASC setting — meaning many complex cases that are valid in hospitals cannot be performed in ASCs.

- Documentation must match procedures exactly. Unlike hospitals, ASCs often lack extensive documentation infrastructure, so incomplete or vague operative notes can lead directly to denials.

In short, ASC coding is not a lighter version of hospital coding. It’s its own discipline that requires specialty knowledge, meticulous documentation, and constant vigilance to stay compliant and profitable.

So the next question is: if ASCs are designed for efficiency, what kinds of surgeries are they actually equipped to handle?

What types of surgeries and procedures are performed in ASCs?

Not every surgery needs the scale of a hospital. ASCs focus on procedures that can be safely completed in a same-day setting, where patients recover at home instead of staying overnight. That balance between safety and efficiency defines the scope of what ASCs handle.

Common procedures in ASCs include:

- Cataract removal and other ophthalmology surgeries

- Colonoscopy, endoscopy, and other GI procedures

- Pain management injections

- Minor orthopedic repairs such as knee arthroscopy

- Hernia repairs and similar low-risk surgeries

These surgeries share two things: they are less invasive, and they come with low complication risks when performed on properly selected patients.

What about hospitals?

Hospitals and their outpatient departments still handle more complex and higher-risk surgeries. These include:

- Cardiovascular or neurological surgeries

- Major orthopedic reconstructions

- Any procedure that requires intensive monitoring or specialized equipment in case of complications

The dividing line is not about prestige or capability. It is about patient safety and appropriateness of care. ASCs excel when surgeries are predictable and low-risk. Hospitals are essential when the unexpected can happen and critical care resources might be needed.

That brings us to the next important factor: how do ASCs decide which patients are a good fit, and when is it safer to send them to a hospital instead?

Patient selection: who is right for an ASC and when is a hospital the safer choice?

One of the reasons ASCs maintain such strong safety records is because they are highly selective about which patients they treat. Not everyone is an ideal candidate for same-day surgery, and that screening process is critical.

Who typically qualifies for an ASC?

ASCs are best suited for patients who are generally healthy or have well-controlled medical conditions. Most fall into ASA Class I or II — meaning they are low-risk. Before surgery, patients undergo a thorough preoperative assessment that includes medical history, lab work, and risk evaluation. This ensures the procedure can be performed safely outside a hospital.

Consider two knee replacement candidates. The first is a 55-year-old with well-managed hypertension and no other major conditions. Her pre-op assessment places her in ASA Class II, making her an excellent fit for an ASC setting where the focus is on efficiency and rapid recovery. Now compare that to a 72-year-old with obesity, moderate COPD, and poorly controlled diabetes. While the procedure itself could be performed in an ASC, the perioperative risks — airway management challenges, blood glucose instability, and the potential for pulmonary complications — make a hospital the safer choice. These are the kinds of nuanced judgments ASCs make every day: balancing the benefits of a streamlined, lower-cost environment with the reality that some patients require the resources and escalation pathways only hospitals can provide.

In short, patients with complex comorbidities or high surgical risks belong in hospitals, where critical care teams and escalation pathways are immediately available. The goal isn’t to exclude patients from ASCs — it’s to ensure every case is matched to the safest possible environment.

By matching the right procedure to the right setting, ASCs maintain safety while delivering the efficiency and affordability they are known for. Once the right patients are identified, the next question is who owns and operates ASCs, and what rules do they need to follow to stay compliant?

Who owns and operates ASCs — and what rules govern them?

Behind every Ambulatory Surgery Center is a specific ownership model, and those models shape how the facility is run, financed, and managed. On top of ownership, ASCs also operate within a strict regulatory framework to ensure patient safety and compliance.

Common ASC ownership models

- Physician-owned ASCs: Doctors hold full equity and control over management decisions. This gives them direct financial incentives to drive efficiency and quality. However, these centers must carefully follow rules like the Stark Law, which restricts self-referral and requires shares to be valued fairly.

- Joint ventures: Increasingly popular, these combine physicians with hospitals or management companies. Some are two-way partnerships, while others bring all three players together. The idea is to balance clinical expertise with operational and financial support.

- Hospital-owned ASCs: Hospitals own the facility outright. They often contract physicians for clinical roles but do not always offer equity. This model reflects the strategic push hospitals are making into outpatient care.

- Corporate chains: Larger corporations manage multiple ASCs, often with minority physician ownership. These setups can drive efficiency at scale, but sometimes at the cost of physician independence.

Licensing, certification, and accreditation

No matter who owns an ASC, every center must meet rigorous requirements before opening its doors. These include:

- Licensing: States set their own licensing rules, covering facility standards, safety protocols, and operations.

- Certification: Many ASCs pursue Medicare certification through CMS to participate in federal programs. This requires meeting strict conditions of participation.

- Accreditation: Independent bodies like AAAHC, The Joint Commission, or AAAASF audit ASCs for quality and safety standards. Accreditation not only builds trust but also strengthens payer contracting opportunities.

- Ongoing compliance: Accreditation and licensing are not one-time hurdles. ASCs must continually undergo inspections, keep staff certifications current, and implement ongoing quality improvement initiatives.

Ownership determines who manages the ASC, but licensing and accreditation determine whether it can stay open. Both are critical for building credibility and trust with patients, payers, and partners.

Next look at what keeps them financially viable: reimbursement and cost savings.

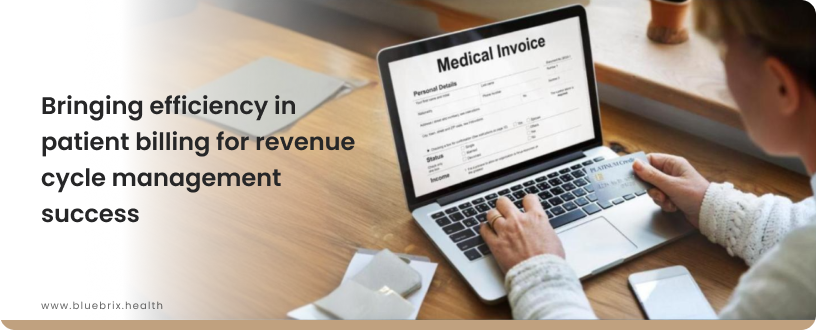

How ASCs make money: reimbursement models, savings, and challenges

Every ASC runs on two engines: clinical quality and financial sustainability. The cinical side keeps patients safe and satisfied, but the financial side determines whether the doors stay open. Unlike large hospitals with diverse revenue streams, ASCs depend heavily on how payers reimburse for procedures.

How reimbursement works in ASCs

- Medicare: Procedures in ASCs are reimbursed under the Ambulatory Surgical Center Payment System (ASC PS). On average, ASC payments are only about 58–62 percent of what hospitals receive for the same procedure under the Outpatient Prospective Payment System (OPPS). That difference is not accidental — it reflects the cost savings of the ASC model and helps Medicare save billions each year.

- Medicaid: Here the picture varies dramatically by state. Some states set clear fee schedules, while others pay significantly lower than Medicare, which can make participation unattractive for ASCs.

- Commercial payers: Private insurers often form the backbone of ASC finances. Contracts are typically negotiated as a percentage of Medicare rates but come in higher than Medicare itself. For ASCs, strong commercial contracts can mean the difference between profitability and financial strain.

Where the cost savings show up

The ASC value proposition is not just about revenue, it is about savings across the board:

- For Medicare: Billions saved annually when cases migrate out of hospitals.

- For patients: Lower copays, smaller deductibles, and fewer hidden costs tied to hospital stays.

- For employers and commercial insurers: Millions saved on routine procedures by directing patients to ASCs instead of hospital outpatient departments.

This is why payers and employers increasingly prefer ASCs for outpatient surgeries — the financial math is hard to ignore.

The challenges nobody talks about

Running lean comes with risks. ASCs face a unique set of financial headwinds:

- Negotiation leverage: Unlike hospitals, individual ASCs lack the bargaining power to push back against payer contracts. This often leaves them accepting lower-than-ideal rates.

- Contract complexity: Small clauses buried in payer agreements can erode margins if not carefully reviewed. Renewal terms, carve-outs, and exclusions all matter.

- Claims denials and underpayments: A consistent pain point. Missing documentation, coding errors, or prior authorization issues can lead to rejections that disrupt cash flow.

- Administrative burden: Payers now expect detailed data and quality reporting. Meeting these demands often requires resources many ASCs struggle to afford.

In short, ASCs create immense value for patients, payers, and the healthcare system. But staying financially healthy requires more than efficiency in the OR. It demands smart reimbursement strategies, tight revenue cycle management, and proactive navigation of evolving payment models.

That raises the next question: beyond the dollars, how do ASCs actually run day to day to keep everything moving smoothly?

How ASCs run day to day: operations and management essentials

If reimbursement is the financial backbone of an ASC, operations are the heartbeat. Every detail — from staffing models to supply chain workflows — affects patient safety, efficiency, and profitability. Running lean does not mean cutting corners; it means designing systems that deliver consistent, high-quality outcomes without waste.

Staffing models and credentialing

The right team makes or breaks an ASC. Surgeons, anesthesiologists, nurses, and admin staff must all be credentialed through a rigorous process that verifies qualifications, licensure, and training. Increasingly, digital credentialing platforms are used to track renewals and ensure compliance. For leadership, staffing is not just about filling roles — it is about creating an aligned, specialized team that thrives in a fast-paced outpatient environment.

Facility design and workflow optimization

ASC layouts are engineered for flow. A typical design moves patients in one direction: check-in → pre-op → surgery → recovery → discharge. This reduces bottlenecks, minimizes cross-traffic, and shortens wait times. Even details like where supplies are placed or how rooms are positioned make a measurable difference in turnaround speed and patient throughput.

Scheduling and patient throughput

Operating rooms are the most valuable real estate in an ASC, and efficient scheduling maximizes their use. Cases are tightly sequenced with planned turnover times. A single disruption — such as a patient not fasting properly or arriving without an escort — can ripple through the day. That is why patient preparation protocols and real-time scheduling adjustments are essential for smooth throughput.

Supply chain and inventory management

Supplies are the second-largest expense after labor, and poor inventory management can eat into margins. Leading ASCs use demand forecasting, vendor-managed inventory, and digital tracking systems to avoid both stockouts and waste from expired items. Accurate tracking also ensures full cost capture for every case.

Physician alignment and incentives

Physician engagement is critical for ASC success. models vary:

- Ownership: Physicians who hold equity stakes are financially motivated to drive volume and efficiency.

- Co-management agreements: Physicians receive fixed fees plus bonuses tied to metrics like on-time starts or patient satisfaction.

- Value-based incentives: Increasingly, physicians are rewarded for outcomes — lower complication rates, fewer readmissions, and improved patient experiences.

In short, operations at ASCs are about orchestration. From the OR schedule to supply cabinets, every moving part must work in harmony to achieve efficiency without compromising care.

But even with flawless operations, financial stability depends on one critical element: billing, coding, and revenue cycle management.

Billing, coding, and RCM: how ASCs keep the revenue flowing

Efficient operations mean little if the revenue cycle breaks down. For Ambulatory Surgery Centers, billing and coding are not just back-office tasks. They are directly tied to financial health, compliance, and the ability to reinvest in growth.

The basics of ASC billing and coding

ASC billing requires precision because payers scrutinize every detail.

- CPT and HCPCS codes capture the procedures, supplies, implants, and drugs used in surgery.

- ICD-10-CM codes document the patient’s diagnosis and justify the medical necessity of the procedure.

- Modifiers add critical context. A bilateral procedure, for example, is marked differently than an unplanned return to the OR. Using the wrong modifier can mean the difference between full payment and outright denial.

But the real complexity starts when you move beyond the fundamentals. Every specialty and every surgical setting introduces its own rules, payment quirks, and compliance nuances that can dramatically impact an ASC’s bottom line.

That complexity becomes especially clear when we look at how coding plays out in the real world — across different specialties and surgical settings.

Unique coding challenges for ASCs: procedure-specific CPTs and setting differences

Ambulatory Surgery Centers face a distinct set of coding challenges, particularly for procedure-specific CPT codes in high-volume specialties like orthopedics, gastroenterology (GI), and ophthalmology. These challenges are compounded by differences in how ASCs, hospital outpatient departments (HOPDs), and physician offices code and bill for the same procedures.

Why is coding tougher in ASCs?

ASCs must:

- Work with a narrower, stricter rulebook for coding and billing

- Apply CPT codes and precise modifiers that can make or break payment outcomes

- Stay updated with frequent rule changes, payer-specific quirks, and Medicare’s ASC-approved procedure list

- Ensure documentation exactly matches procedures performed, vague notes or missing details can halt or reduce payment

These nuances set the stage for the real coding challenges ASCs face every day — the ones that differ by specialty and procedure type.

Procedure-specific coding pitfalls

Orthopedics

- Bundling errors: When multiple procedures are performed in the same joint compartment, ASCs may only bill for the more complex procedure, unlike a physician claim, which sometimes allows both.

- Hardware/implant rules: Codes like 20680 (removal of implant) should be billed once per fracture, even if multiple implants or incisions are involved.

- Graft harvesting: Certain combinations for instance, 20924 with 29888 are payable only when the graft source is from a distant site.

Gastroenterology (GI)

- Screening vs. diagnostic confusion: If any symptoms are listed, the case must be coded as diagnostic, not screening even if the physician indicates “screening.” Mislabeling here frequently triggers denials or reduced payments.

- Payer variation: Commercial and Medicare payers differ on what qualifies as a screening versus diagnostic colonoscopy, directly affecting reimbursement and patient cost-sharing.

Ophthalmology

- Codes for implants, such as V2787 (astigmatism-correcting lens), must match the documented procedure precisely. Coverage differs widely across payers, and a mismatch between documentation and code can invalidate payment.

- Frequent CMS and payer edits to the ASC covered procedures list add an extra layer of vigilance.

Together, these examples highlight why ASC coding requires more than accuracy — it demands context, payer awareness, and a deep understanding of how each surgical specialty interacts with reimbursement models. And those reimbursement models are driven largely by two key mechanisms: bundled payments and global periods.

Bundled payments and global periods

Bundled payments and global periods define how ASC reimbursement is structured — determining which services are included in the payment and which can be billed separately.

Bundled payments in ASC coding

Under Medicare’s ASC Payment System, most procedures are reimbursed through prospectively determined payment groups that bundle all related services into one payment. This typically includes the surgical procedure itself, anesthesia, implants, drugs, and supplies.

In commercial contracts and value-based models, bundles may cover a broader episode of care beyond the day of surgery, rewarding efficiency and quality coordination.

For coders, that means:

- Knowing exactly which CPT and HCPCS codes are bundled and which can be billed separately.

- Using modifiers correctly to indicate discontinued or distinct procedures.

- Avoiding double billing for services like pre-op labs, supplies, or implants already included in the bundled payment.

A single coding misstep like unbundling a covered service or missing a modifier can trigger denials, audits, or underpayment.

But bundled payments are only half the picture. Coders also need to understand how postoperative timelines affect reimbursement — and that’s where global periods come in.

Global periods in ASC reimbursement

Global periods define the postoperative window bundled into the payment, during which related services are not separately reimbursed.

For ASCs, that period usually applies only to the same day as the surgery. If a patient returns to the ASC for a related issue that day, modifier –78 must be appended to the claim. Procedures performed after that same-day window are billable independently, provided documentation supports medical necessity.

Unlike physicians, who typically have 10- or 90-day global periods under the Physician Fee Schedule, ASCs only bill for the facility, so their global period ends when the patient leaves the center.

In short, bundled payments and global periods make ASC coding both strategic and unforgiving. Coders must align every service, modifier, and documentation detail with payer-specific rules to avoid lost revenue.

This tight reimbursement framework means every coding decision has to align with payer rules and documentation detail. Even small mistakes can ripple downstream — which brings us to the most common coding errors that disrupt the revenue flow.

Common coding errors in ASCs

Even the most efficient ASCs lose money to preventable coding mistakes. The most common issues involve unlisted codes, modifier misuse, and device-intensive procedures.

Unlisted codes

Unlisted CPT codes are used when no specific code exists for a procedure. They should never be used as a “close enough” substitute. Because of their ambiguity, payers typically flag them for manual review and demand detailed documentation.

CMS and many commercial payers may deny unlisted codes outright in ASC settings because safety and appropriateness cannot be verified. Using them incorrectly often results in non-covered services and potential financial responsibility for patients.

Coders should always confirm whether a new or updated CPT code exists before defaulting to an unlisted one, and when unavoidable, ensure documentation fully supports the service performed.

Modifier errors

Modifiers are essential for payment accuracy — and one of the most common sources of ASC denials.

- Modifier 59 (distinct procedural service) is frequently misused to bypass bundling edits and can trigger post-payment audits.

- Modifiers 73 and 74 are specific to discontinued procedures — 73 applies when a procedure is stopped before anesthesia, 74 after anesthesia or incision. Confusing them leads to inaccurate billing.

- Laterality modifiers (e.g., for eyes, limbs) are often missed, resulting in partial or denied payments.

A single missing or incorrect modifier can derail an otherwise valid claim and delay reimbursement.

Device-intensive procedure coding

Device-intensive procedures, those involving high-cost implants require exact documentation and coding.

Common mistakes include:

- Failing to document the implant in the operative note.

- Reporting a device code when no implant was actually used.

- Using the wrong HCPCS level (C-code vs. L-code) depending on payer requirements.

CMS adjusts payment rates for qualifying device-intensive procedures based on device cost. Missing or incorrect device coding can therefore lead to substantial underpayment or audit exposure.

ASC coding errors — from unlisted codes to modifier and device missteps — are more than clerical mistakes; they’re direct threats to revenue integrity. The solution lies in consistent documentation review, targeted coder training, and proactive auditing.

When ASC coding accuracy aligns with payer expectations and clinical documentation, centers not only reduce denials but strengthen financial predictability and compliance readiness.

Ultimately, these coding errors don’t just affect claim accuracy — they’re the starting point of a much larger issue: denials and recoupments. Understanding their true cost is essential to protecting ASC margins.

The hidden cost of denials

A denied claim doesn’t just delay revenue — it drains resources. Each one requires review, correction, resubmission, and tracking. Studies estimate that more than 60% of ASC denials are preventable, and yet many centers write them off rather than reworking them due to staffing or time constraints.

Over time, these missed opportunities create a secondary loss: recoupments. Payers increasingly audit paid claims for overbilling, upcoding, or incorrect bundling. When they find errors, they claw back funds — sometimes years later. These retroactive recoveries are harder to contest because they’re framed as “compliance corrections,” not denials.

And while denials can be managed in real time, recoupments often surface long after the fact turning what looked like stable revenue into a financial setback.

Recoupments: the silent revenue drain

Unlike denials, recoupments arrive after payment — often months later. They stem from retrospective audits where payers identify:

- Duplicate billing or unbundled claims.

- Incorrect reporting of device-intensive procedures.

- Misused modifiers that overstated complexity.

- Overpayments tied to incorrect ASC payment group assignments.

The sting isn’t just financial. Recoupments flag facilities for deeper payer scrutiny, potentially delaying future payments or triggering pre-payment review. That’s why denial and recoupment prevention must be built into the revenue cycle — not treated as an afterthought once payments start lagging.

Strengthening the revenue defense line

ASCs that consistently outperform peers treat denial prevention as a strategic revenue safeguard, not an afterthought. The key pillars include:

- Front-end verification: Automate insurance eligibility and prior authorization before scheduling.

- Tight documentation control: Require surgeons to complete operative notes within 24 hours of procedure completion.

- Coding audit cycles: Conduct routine pre-bill audits to catch modifier or bundling errors before claim submission.

- Denial analytics: Track denial categories and payer patterns to identify systemic process gaps.

- Technology integration: Use RCM systems with AI-based validation to flag missing fields, mismatched codes, or non-covered services before submission.

The most successful ASCs approach billing like clinical quality — measure, monitor, and continually improve. Every clean claim represents not just revenue earned, but compliance maintained.

And that’s where the real transformation begins — when ASCs move from manual oversight to technology-enabled precision.

Best practices for compliance and automation

To minimize denials and protect cash flow, leading ASCs are embracing automation and proactive compliance:

- Automated eligibility checks confirm coverage before a patient is ever scheduled.

- AI-driven coding tools validate code combinations and flag potential denials before submission.

- EHR and RCM integration creates a seamless flow of clinical and billing data, reducing manual errors.

- Real-time denial monitoring helps staff spot trends early and resolve issues before they snowball.

- Continuous staff training ensures teams stay up to date on payer rules and coding changes.

The revenue cycle is where the clinical side of ASCs meets the business side. Getting it right means fewer denials, faster reimbursements, and a healthier bottom line.

For a deeper dive into preventing revenue leaks, check out our related blog: Overcoming ASC coding challenges: the strategic blueprint to fix the leak

Of course, no discussion of ASC success is complete without looking at quality and compliance. After all, financial performance only matters if patient safety and regulatory standards are met.

Quality, safety, and compliance: the standards that keep ASCs running

For Ambulatory Surgery Centers, financial performance and operational efficiency mean little without one non-negotiable foundation: patient safety. Every ASC operates under a strict web of regulations, accreditation requirements, and clinical quality benchmarks designed to protect patients and maintain trust. Patients, payers, and regulators all want the same thing: proof that the facility is safe, compliant, and delivering quality care every single day.

The rules that shape ASCs

Every ASC operates under layers of oversight.

- At the federal level, CMS Conditions for Coverage set the baseline for governance, patient rights, emergency preparedness, and quality improvement.

- States add another layer through licensing requirements, inspections, and ongoing monitoring.

- Accreditation bodies like AAAHC, The Joint Commission, and AAAASF hold ASCs to nationally recognized standards, making it easier to win payer contracts and patient confidence.

- Then there is data security. HIPAA requires ASCs to protect patient information with the same rigor they bring to clinical safety, which means encryption, access controls, and ongoing risk assessments.

How ASCs prove they deliver quality

The best ASCs do not just follow rules, they show results.

- Infection control protocols keep complication rates low and align with national safety guidelines.

- Quality reporting under CMS’s ASCQR Program tracks measures like surgical site infections, patient falls, and transfers to hospitals.

- Benchmarking performance against national averages highlights where improvements are needed and where ASCs are excelling.

- Patient experience surveys capture what patients think, not just what clinical data says, and provide real accountability for the care experience.

The results speak for themselves. Studies show ASCs often equal or outperform Hospital Outpatient Departments when it comes to safety and outcomes. That edge comes from selecting the right patients and focusing resources on what matters most: safe, efficient surgical care.

Risk management that goes beyond compliance

Compliance is the minimum. Smart ASCs build risk management programs that anticipate problems before they occur. This covers everything from malpractice protection to emergency preparedness and staff training. The goal is not just to pass audits, but to create a culture where safety and accountability are second nature.

When an ASC gets compliance and safety right, it builds credibility with payers, loyalty with patients, and resilience against regulatory shifts. In other words, quality is not just a checkbox — it is a growth strategy.

That sets the stage for the next big question: how can ASCs move from simply meeting standards to actively transforming their operations with technology?

Challenges facing ASCs: the roadblocks to growth

Ambulatory Surgery Centers may represent the future of outpatient care, but the path forward is not without friction. Even the most efficient centers deal with headwinds that can slow growth, cut into margins, or stretch clinical teams to the breaking point.

Regulatory burden and reporting fatigue

ASCs operate under layers of oversight, from CMS rules to state licensing and payer-driven reporting programs. While necessary, the sheer volume of requirements can overwhelm staff. Programs like the ASC Quality Reporting (ASCQR) initiative demand constant data submission to avoid penalties. The result is reporting fatigue, with clinical teams pulled away from patient care to chase compliance deadlines.

Staffing shortages and burnout

Nurses, surgical techs, and anesthesiologists are in high demand, and hospitals often outcompete ASCs with higher pay and richer benefits. That leaves many centers understaffed, which drives up workloads and creates a cycle of burnout and turnover. Short staffing does not just affect morale — it impacts patient safety, scheduling, and overall throughput.

Rising supply chain costs and resource constraints

Medical supplies are the second-largest expense for ASCs, and recent disruptions have made them harder to manage. From global manufacturing delays to vendor consolidations, supply costs are climbing. Many ASCs still rely on manual inventory systems, which lead to overstocking, waste from expired items, and unnecessary spending. Without smarter supply chain strategies, margins will continue to shrink.

Competition with hospitals

Hospitals have deep pockets, established referral networks, and the ability to scale outpatient services quickly. Some hospitals even acquire or partner with ASCs to capture outpatient revenue. For independent centers, competing against these large systems can feel like an uphill battle, especially when hospitals can bundle services and offer broader care pathways.

Navigating value-based care and bundled payments

The shift from fee-for-service to value-based care is both a challenge and an opportunity. Bundled payment models require ASCs to manage the entire episode of care within a fixed budget. While ASCs excel at efficiency, not every center has the integrated IT systems or financial modeling to manage risk across multiple care settings. Smaller facilities often feel the strain the most.

The reality is clear: ASCs are a high-value alternative to hospitals, but they are not immune to external pressures. Those that succeed will be the ones that address these challenges head-on while positioning themselves for the opportunities ahead.

And those opportunities are significant. From higher-acuity procedures to payer partnerships, the next decade offers ASCs the chance to expand their footprint and redefine outpatient surgery.

Opportunities and the future of ambulatory surgery centers

Despite the hurdles, the outlook for ASCs is strong. Demand for lower-cost, high-quality surgical care is only increasing, and technology is expanding what is possible in outpatient settings. For ASCs that adapt, the next decade represents a period of accelerated growth and influence in the U.S. healthcare landscape.

Expansion into higher-acuity procedures

The ASC model is no longer limited to “routine” outpatient surgeries. Advances in minimally invasive techniques, robotics, and anesthesia safety are making it possible to perform more complex procedures outside of hospitals. Joint replacements, spine surgeries, and even certain cardiac interventions are shifting into ASCs. This migration creates new revenue streams, but it also requires investment in advanced equipment, specialized staff, and redesigned facilities to handle higher-risk cases.

Integration into broader healthcare ecosystems

ASCs are moving away from being standalone centers. Increasingly, they are integrated into larger healthcare networks through partnerships with hospitals, physician groups, or technology platforms. Integration allows for shared access to patient records, unified billing systems, and better care coordination. For patients, it means smoother transitions between providers. For ASCs, it means greater operational stability and stronger negotiating positions with payers.

Partnerships with payers and health systems

Strategic partnerships are a powerful growth lever. Payers prefer ASCs because of their lower costs, and hospitals see them as a way to expand outpatient capacity without building new facilities. By aligning with both groups, ASCs can secure better reimbursement rates, leverage group purchasing power, and expand their patient base. These partnerships are now becoming essential for long-term sustainability.

The TEAM model and what it means for ASCs

Beginning in 2026, CMS will roll out the Transforming Episode Accountability Model (TEAM). While it primarily targets hospitals by holding them accountable for 30-day episodes of surgical care, it will create ripple effects for ASCs. Hospitals under TEAM will need closer collaboration with outpatient partners to manage costs and outcomes. That means ASCs could be drawn into new partnerships or even risk-sharing agreements. For independent centers, this represents both a challenge and an opportunity — adapt and integrate, or risk being left out of hospital-led networks.

The role of ASCs in value-based care

ASCs are naturally positioned to succeed in value-based models. Their efficiency, focus on outcomes, and cost-effectiveness align perfectly with reimbursement tied to quality rather than volume. By reducing readmissions, avoiding complications, and keeping patient satisfaction high, ASCs can thrive under bundled payments and shared savings programs. The challenge is building the infrastructure, data, analytics, and IT systems to measure and report those outcomes consistently.

Predictions for the next 5 to 10 years

Industry projections estimate ASC case volumes will grow by more than 20 percent in the next decade. Orthopedics, spine, gastroenterology, cardiology, and ophthalmology will drive much of that growth. Demographic shifts, like an aging population, combined with payer pressure to reduce costs, will accelerate the move to outpatient surgery. We can also expect more private equity investment, consolidation of smaller centers, and the rise of larger, tech-enabled ASC networks.

The bottom line: ASCs are becoming a central pillar of U.S. healthcare delivery. The next wave of winners will be the centers that invest in innovation, forge strategic partnerships, and embrace value-based care models.

So where does blueBriX fit into this future? It is time to look at how the right technology partner can help ASCs turn these opportunities into real growth.

How blueBriX enables ASC excellence

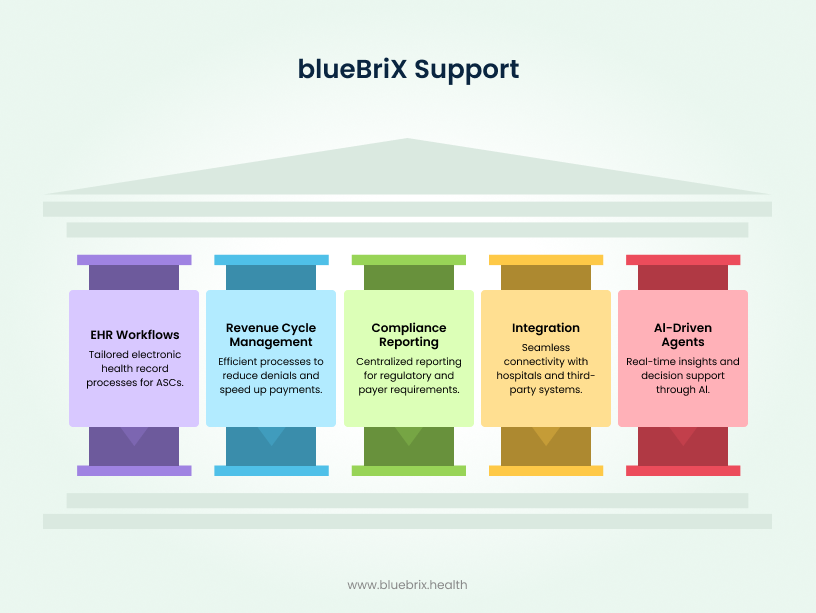

The challenges facing ASCs are real, but so are the opportunities. To compete, centers need more than incremental improvements. They need a technology partner that unifies data, automates workflows, and strengthens financial performance without adding administrative burden. That is where blueBriX comes in.

Unified EHR workflows for ASCs

Fragmented systems slow down care and create risk. The blueBriX platform consolidates clinical and administrative data into one unified hub. From surgical documentation to scheduling, everything flows through a single system. This eliminates data silos, reduces errors, and gives clinicians a complete view of the patient journey. Customizable workflows and multilingual support ensure the platform adapts to each ASC’s unique needs.

Streamlined revenue cycle and faster reimbursements

Revenue cycle management is one of the biggest pressure points for ASCs. blueBriX automates eligibility verification, prior authorizations, and coding validation to prevent denials before they happen. AI-powered auto-coding and predictive analytics improve clean claim rates, while real-time dashboards give administrators full visibility into revenue performance. The result is faster, more predictable reimbursements and fewer revenue leaks.

Centralized compliance and payer reporting

Meeting compliance requirements and payer demands is often overwhelming. blueBriX simplifies this process with built-in compliance tracking, automated reporting, and configurable rules that keep ASCs audit ready. The system also supports quality reporting programs, helping centers close care gaps and demonstrate value to both payers and regulators.

Seamless integration with hospitals and third-party systems

Most ASCs cannot afford to be isolated. The blueBriX platform is designed with an open API architecture, which means it connects easily with hospital systems, labs, e-prescribing platforms, and even enterprise software like Salesforce. This interoperability ensures continuity of care across different providers and eliminates manual data entry.

AI-driven agents for clinical decision support

blueBriX takes efficiency a step further with specialized AI agents. These agents analyze full patient charts, provide risk stratification, and assist in clinical decision-making. They can also automate repetitive tasks such as patient navigation, billing checks, and compliance audits. For clinicians, this means more time with patients and fewer administrative distractions.