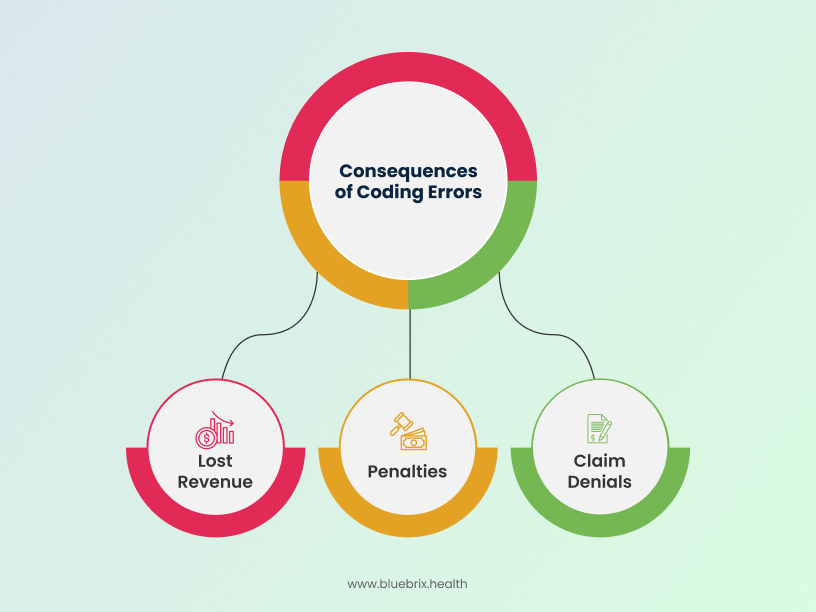

According to JAMIA, medical coding errors are estimated to cost the U.S. healthcare industry around $36 billion annually in lost revenue, denied claims, and potential penalties. A Crowe RCA benchmark analysis notes that in 2022, 11% of all claims were denied, equating to 110,000 unpaid claims for an average-sized health system. These studies definitely lead to one of the most underrated aspect of RCM which is medical coding.

While healthcare organizations prioritize patient health, the financial well-being of your practice often depends on medical coding. For private multi-specialty practices, physician groups, and Ambulatory Surgery Centers (ASCs), spanning 10 to 50 providers and managing over 1,000 visits monthly, the precision of your medical coding directly impacts your revenue stream. With nearly 20 years in the US RCM services space, blueBriX has seen how even small coding oversights can gradually lead to revenue leakage, higher denial rates, and added compliance challenges.

In this blog, we delve into the often-hidden costs of coding errors and emphasize why precision in medical coding isn’t just a best practice, but a financial imperative. More importantly, we’ll outline practical strategies to enhance accuracy and secure the revenue you’ve rightfully earned.

Common coding mistakes and their financial implications

Coding errors are more than just clerical mistakes; they are direct assaults on your practice’s profitability. Here are some of the most common missteps and their costly consequences:

- Upcoding: This occurs when a healthcare provider bills for a more complex or expensive service than what was actually performed or medically necessary. While it might seem like a way to increase revenue, it’s a fraudulent practice that can lead to severe penalties, including hefty fines, audits, and even legal action. A cardiology practice, for instance, could face serious repercussions if they consistently bill for complex procedures when simpler ones were performed.

- Undercoding: The opposite of upcoding, undercoding happens when a less complex or less expensive service is billed than what was actually provided. This is often an unintentional error due to a lack of understanding of coding guidelines or insufficient documentation. The financial implication is direct: lost revenue for services rendered. If an orthopedic surgeon performs a detailed examination but it’s coded as a basic visit, your practice is effectively giving away services.

- Unbundling: This involves billing for services separately that should be billed together under a single code. For example, when there’s a single code available that captures payment for the component parts of a procedure, which is what should be used. Using multiple CPT codes for the individual parts of the procedure, either due to misunderstanding or in an effort to increase payment, will likely lead to denials and rework.

- Modifier errors: Modifiers provide additional information about a service or procedure. Incorrectly using or omitting modifiers can lead to claim rejections or denials, as the payer doesn’t have a clear picture of the services provided. A gastroenterology practice might face denials if they don’t use the correct modifier to indicate a separate procedure performed during the same encounter.

- Overusing or improperly documenting specific modifiers: For example, overusing modifier 22 (Increased Procedural Services) without including proper documentation to explain why the procedure required more work than usual, or incorrectly appending modifier 50 (Bilateral Procedure) to a code that already includes bilateral service, are common errors.

- Lack of medical necessity: Codes must align with the patient’s diagnosis and be medically necessary. If the documentation doesn’t support the service billed, even if the code is technically correct, the claim will be denied. This is a common challenge for specialties like neurology or behavioral health, where the justification for services can be complex.

- Incomplete documentation: When a provider’s clinical notes lack the necessary detail to fully support the services billed, it can lead to undercoding or outright denials. Coders can only code what is documented, so if crucial information is missing, the claim will not accurately reflect the services provided or their medical necessity. This often leads to frequent audits and compliance risks.

- Duplicate billing: This error occurs when the same service or procedure is billed to the payer more than once for the same patient on the same date of service. This can be accidental, due to system glitches or human error, but it often triggers payer audits and can result in significant financial penalties and a damaged reputation.

- Incorrect place of service (POS) codes: The Place of Service code indicates where the service was rendered (e.g., office, hospital, ASC). Using an incorrect POS code is a common error that can lead to claim denials or incorrect reimbursement rates, as payers have specific rules for different settings.

- Lack of specificity in diagnosis coding: With the advent of ICD-10-CM, highly specific diagnosis codes are often required to justify medical necessity and services. Using a general or unspecified diagnosis code when a more detailed one is available can lead to claim denials or requests for additional information, delaying payment.

- Failing to check national correct coding initiative (NCCI) edits: The Centers for Medicare & Medicaid Services (CMS) developed NCCI edits to prevent inappropriate payments for Medicare Part B claims and ensure correct coding methods are followed. Failing to check these edits when reporting multiple codes can lead to denials.

- Improper reporting of time-based codes: Services like infusions and hydration are often time-based. Incorrectly documenting start and stop times or misinterpreting rules (e.g., how to report services spanning two days) can lead to improper billing and denials.

- Reporting unlisted codes without documentation: When a specific CPT code does not exist for a unique service, an “unlisted” code may be used. However, using these codes requires comprehensive supporting documentation to explain the service provided; without it, claims will be denied.

- Global period violation: Many surgical procedures include a “global period” during which related follow-up care is considered part of the initial procedure and cannot be billed separately. Billing for services within this global period can lead to denials and raises compliance flags.

- Bundled services: Similar to unbundling, this error occurs when services that are typically considered components of a larger procedure or service are billed separately when they should be included in a single, comprehensive code. Adherence to payer bundling rules is crucial to avoid denials.

- Code not covered or non-billable: Sometimes, a perfectly valid CPT or HCPCS code might not be covered by a patient’s specific insurance plan for a given diagnosis, or it might be considered non-billable in certain contexts. Submitting such a code without verifying coverage beforehand will result in an immediate denial.

- Lack of prior authorization for performed CPT/HCPCS: For many high-cost or specialized procedures (CPT/HCPCS codes), payers require prior authorization before the service is rendered. Performing these services without obtaining the necessary authorization beforehand will almost always lead to a claim denial, even if the service was medically necessary.

These errors don’t just result in individual claim denials; they contribute to a cumulative revenue leakage that can easily reach 10-15% of a practice’s annual earnings. For a practice generating $10 million annually, that’s $1 million to $1.5 million potentially lost—a staggering amount that could otherwise be invested in new equipment, staff training, or expanding patient services.

What is the role of certified coders in healthcare?

In the face of complex and ever-evolving coding guidelines (like ICD-10-CM, CPT, and HCPCS Level II), the expertise of certified medical coders is invaluable. They are the frontline defenders against revenue loss and compliance risks.

Certified coders possess:

- Deep understanding of coding guidelines: They are rigorously trained in the nuances of coding rules, ensuring that services are accurately translated into billable codes.

- Knowledge of payer-specific requirements: Different payers often have unique coding preferences and rules. Certified coders are adept at navigating these complexities, reducing denials due to payer-specific issues.

- Medical terminology and anatomy knowledge: This allows them to interpret clinical documentation accurately and assign the most appropriate codes, reflecting the true nature of the patient encounter.

- Compliance expertise: They stay abreast of regulatory changes (e.g., HIPAA, OIG guidelines), minimizing the risk of fraud and abuse accusations that can stem from coding errors.

For instance, a busy dermatology practice dealing with a wide range of procedures from biopsies to excisions benefits immensely from certified coders who can correctly distinguish between similar procedures and apply the precise codes and modifiers, thus preventing denials and ensuring full reimbursement.

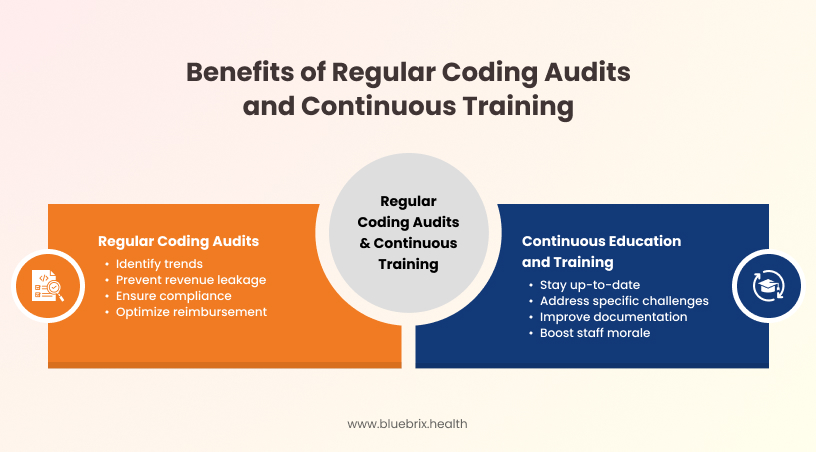

What are the benefits of regular coding audits and continuous training?

Even with certified coders, continuous vigilance is key. The healthcare landscape is constantly shifting, with new codes, updated guidelines, and evolving payer policies. This necessitates a proactive approach to coding accuracy through:

Regular coding audits:

- Identify trends: Audits help pinpoint recurring coding errors, indicating areas where further training or process improvements are needed.

- Prevent revenue leakage: By catching errors early, audits prevent denials and underpayments before they become significant losses.

- Ensure compliance: Regular reviews and training ensure that coding practices adhere to current regulations and guidelines, minimizing compliance risks.

- Optimize reimbursement: Audits ensure that services are coded to the highest level of specificity and accuracy, maximizing legitimate reimbursement.

Continuous education and raining:

- Stay up-to-date: Regular training sessions keep coders informed about the latest coding changes, payer updates, and industry best practices.

- Address specific challenges: Training can be tailored to address common errors identified in audits or specific challenges faced by a particular specialty.

- Improve documentation: Coders can educate providers on the importance of thorough and precise clinical documentation, which is the foundation of accurate coding.

- Boost staff morale: Investing in professional development shows your commitment to your team, reducing burnout and attrition in internal billing or coding teams.

For a large physician group with diverse specialties, conducting quarterly coding audits and providing monthly educational refreshers can significantly reduce their >10% claim denial rate, a common pain point.

How does technology aid in reducing coding errors?

While human expertise is irreplaceable, technology plays a vital role in enhancing coding accuracy and efficiency. Modern RCM platforms and coding software can:

- Automate code assignment (with Human Oversight): AI-powered coding tools can suggest codes based on clinical documentation, accelerating the coding process and reducing manual errors. However, human coders must always review and validate these suggestions.

- Provide real-time claim scrubber functionality: Integrated systems can flag potential coding errors, missing information, or inconsistencies before claims are submitted to payers, acting as a critical preventative measure.

- Offer comprehensive code libraries and updates: Software keeps coding libraries current, ensuring coders always have access to the latest ICD-10-CM, CPT, and HCPCS codes and guidelines.

- Enable robust reporting and analytics: Technology provides dashboards and reports that track denial rates, clean claim rates, and coding error patterns, offering actionable insights that were previously hindered by reporting gaps.

- Facilitate integration: Modern RCM solutions like blueBriX, seamlessly integrate with common EHR/practice management systems like Athenahealth, eClinicalWorks (eCW), NextGen, Kareo, AdvancedMD, and DrChrono, streamlining data flow and reducing manual data entry errors.

Automated coding tools can cut administrative overhead by 20% while outsourcing can lead to savings of up to 70% in staffing costs. For a busy urgent care center with high patient volume, leveraging technology for claim scrubbing and automated code suggestions can dramatically improve their clean claim rate, ensuring faster reimbursement and reducing administrative burden.