A single missed modifier, a vague operative note, or a prior authorization slip can quietly eat away at your bottom line. For Ambulatory Surgery Centers (ASCs), the details often sit in the coding and billing process. In fact, ASCs lose anywhere between 5–15% of potential revenue every year because of hidden leaks in coding, billing, and contract management.

“The details are not the details. They make the design.” – Charles Eames

Think about that in real terms: for a $5 million center, that’s up to $750,000 in lost revenue — without seeing a single extra patient. And the problem isn’t just undercoding or outdated forms. Even when patient volume goes up, these inefficiencies multiply. One ASC saw losses climb to $1.2 million annually despite growth, simply because their coding processes weren’t keeping pace.

The takeaway? You can’t “grow” your way out of revenue leaks. To stay profitable in today’s competitive and regulated healthcare environment, ASCs need smarter coding strategies, the right technology, and processes built for accuracy and compliance from the start.

ASC coding: how it differs from hospitals and physician offices

If you think ASC coding is just hospital coding on a smaller scale, think again. Ambulatory Surgery Centers have their own rulebook, and it’s packed with unique requirements that don’t apply to hospitals or physician offices. These differences are more than just technical details — they’re make-or-break for reimbursement.

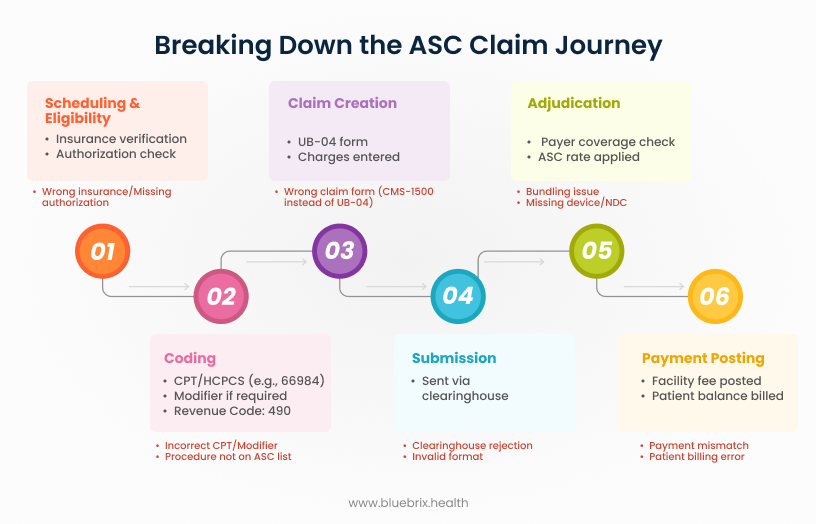

The chart below explains how ASC claim flow typically works:

Key differences that set ASC coding apart

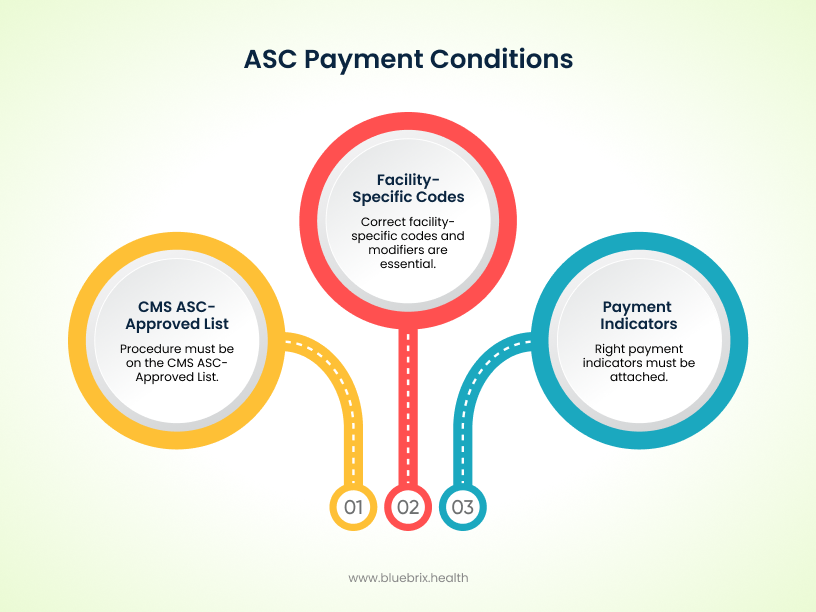

- ASC-specific rules: Hospitals rely on ICD-10-PCS for inpatient and CPT/HCPCS for outpatient coding. ASCs, on the other hand, must follow the CMS ASC-Approved Procedure list. If a procedure isn’t on that list, Medicare won’t reimburse it in the ASC setting, no matter how medically necessary it is.

- Payment indicators: Every code billed by an ASC comes with a payment indicator that decides how it gets reimbursed — whether it’s bundled, separately payable, or tied to specific devices or drugs. Miss that indicator, and you miss the payment.

- Modifiers that matter: ASCs must use facility-specific modifiers, like -SG, which identifies ASC billing. This modifier doesn’t exist in hospital or physician settings, so it’s easy for inexperienced coders to overlook. But if it’s missing? Expect underpayments or outright denials.

Real-world ASC coding examples

Here’s how these rules play out in practice:

- Shoulder arthroscopy (CPT 29826)

- Hospital/Physician office: Reimbursed when billed correctly.

- ASC: Medicare has removed this code from the ASC-approved list. If billed by an ASC, it’s automatically denied.

- Pacemaker insertion (CPT 33208)

- Hospital outpatient: Paid with correct documentation.

- ASC: For years, pacemaker insertions weren’t allowed in ASCs at all. Claims were denied regardless of medical necessity.

- Cataract surgery (CPT 66984)

- ASC: Requires the right payment indicator and HCPCS Q-codes for intraocular lenses (IOLs). Miss those, and reimbursement can be bundled or denied. Hospitals follow different rules here.

- Hernia repair

- Physician office: Surgeons can bill multiple repairs with modifiers.

- ASC: Many hernia repairs are bundled differently. Incorrect coding here = reduced or denied payment.

- SI joint injection (CPT 27096 vs. HCPCS G0260)

- Physician: CPT 27096 is standard.

- ASC: Must use G0260 for Medicare reimbursement. Otherwise, the claim gets denied.

- Anesthesia services – modifier SG

- ASC: Facility fees for Medicare claims require the SG modifier. Without it, expect underpayment or rejection.

- Biopsy procedures

- ASC: Some biopsies need unique HCPCS codes or are excluded under payer contracts. Using the physician’s CPT code often leads straight to denial.

Hospitals and physician offices may have more flexibility, but ASCs operate in a narrower, stricter reimbursement environment. That’s why coding precision isn’t just a compliance issue — it’s a matter of financial survival.

The pain points that bleed ASC revenue

Even the most well-run Ambulatory Surgery Centers lose money because of hidden pitfalls in coding and billing. These aren’t always obvious — but they add up fast. Let’s break down the most common pain points that silently drain ASC revenue.

Multispecialty mayhem: Orthopedics, GI, and pain management

ASCs often handle multiple specialties, each with its own coding rules. That’s where things get tricky.

- Orthopedics: Imagine a case involving meniscus repair, ACL reconstruction, and cartilage restoration. Some of these procedures get bundled together by NCCI edits. With the right modifiers, you can bill separately — but if the coder misses something like the -59 modifier, your ASC loses thousands.

- Gastroenterology (GI): Coding polypectomies isn’t as straightforward as “polyp removal.” It depends on the size and the technique (piecemeal, EMR, etc.). Miss that detail, and you’re leaving money on the table every single time.

The bundling blunder: modifier misuse & NCCI edits

Modifiers can be your ASC’s best friend — or worst enemy. Missing one means payers bundle multiple services into a single payment, slashing revenue.

- Example: During a colonoscopy, the doctor performs a polypectomy, biopsy, and mucosal resection. By default, NCCI rules bundle polypectomy and biopsy. Unless the coder uses a modifier (-59 or -X{EPSU}) to show they’re distinct procedures, it all gets paid as one — the lowest one.

Commercial payers have their own bundling rules, too, which don’t always match Medicare. If coders aren’t up to date on each payer’s quirks, denials are inevitable.

The implant trap: lost revenue on devices ancillaries

High-cost items like screws, anchors, and surgical kits can either bring in revenue — or quietly drain it away.

- Example: A hip arthroscopy involves multiple anchor implants. If the coder uses a generic HCPCS code instead of the device-specific one from CMS’s pass-through list, the reimbursement for the implants is denied. That’s thousands of dollars lost on a single case.

Without proper device registries and audits, these misses often slip through unnoticed until it’s too late to appeal.

The prior auth predicament: when front-end errors sink the back-end

Prior authorizations can make or break reimbursement. Missing one approval can trigger a chain reaction of denials.

- Example: A cervical spine surgery may require separate authorizations for the procedure, the implant, and post-op therapy. If even one is missed, the claim gets denied. Retroactive appeals are slow, costly, and often unsuccessful.

Automated prior auth platforms with built-in alerts help prevent this — by making sure all approvals are in place before the first incision.

Lost in translation: vague surgeon notes

Coders can only work with what’s written. When operative notes are vague, coders default to generic (and lower-paying) codes to stay compliant.

- Example: A surgeon notes “minor neurolysis performed” without specifics. The coder assigns CPT 64721 (generic neurolysis). But if the note had said “subcutaneous ulnar nerve transposition,” the right code would have been CPT 64718 — worth significantly more.

Clear, standardized templates and closer coder-surgeon collaboration can close this gap and protect revenue.

Riding the regulatory whiplash

ASC coding rules change constantly. If your workflows aren’t updated, you’re coding blind.

- Example: CMS adds new musculoskeletal procedures to the ASC-approved list mid-year. But your billing system is still running on last quarter’s tables. Result? A spike in denials that stalls cash flow.

Centers that stay current with real-time updates and ongoing coder training are far less likely to feel this “whiplash.”

Compliance under the microscope: CMS conditions for coverage

CMS doesn’t just want the right code — they want complete documentation. Missing forms or details can trigger audits and claim holds.

- Example: A cataract ASC submits claims without complete consent forms and lens model documentation. That small oversight leads to retroactive recoupments after a Medicare RAC audit.

Long-term compliance is maintained by embedding configurable checks and regulatory updates directly into coding and billing workflows. Audit logs capture every action, while automated alerts and customizable templates adapt processes to new CMS, HIPAA, or payer requirements. Continuous monitoring ensures ASCs remain audit-ready over time, not just claim-accurate in the moment. Compliance tools that flag these issues before submission keep ASCs audit-ready and protect margins.

Data fragmentation & EHR gaps

Generic or hospital-focused EHRs often don’t match the way ASCs work. This leads to missing codes, delays, and incomplete claims.

- Example: A multi-specialty ASC using a hospital-based EHR runs into delays when anesthesia codes for GI cases don’t flow correctly into the billing system. The result? Incomplete claims and slow reimbursements.

ASC-specific EHRs, especially those built with anesthesia and implant workflows in mind, close these gaps and get revenue flowing faster.

These pain points might seem small in isolation, but together, they create a steady leak that can sink an ASC’s financial stability.

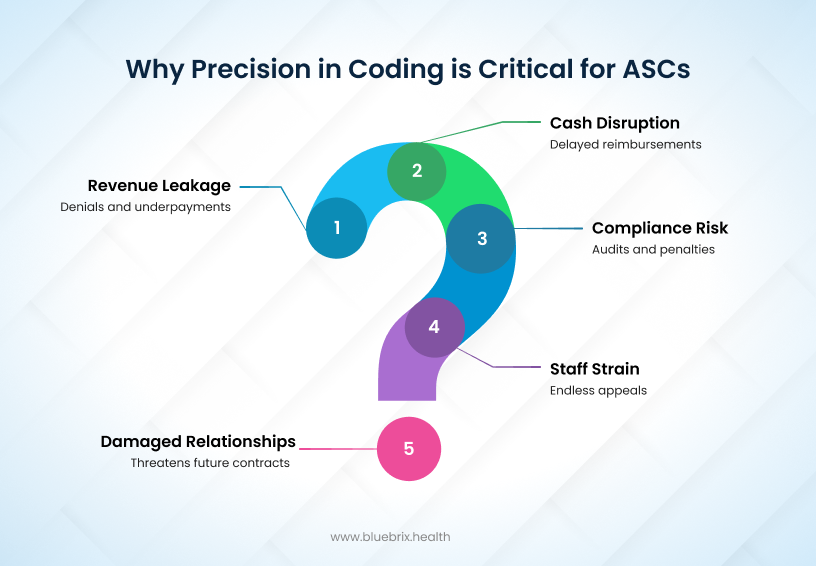

The business impact of getting ASC coding wrong

For Ambulatory Surgery Centers, they carry a serious financial and operational price tag. One small oversight can snowball into hundreds of thousands of dollars lost, staff burnout, and strained payer relationships.

Every coding error has a dollar sign attached. For a mid-sized ASC making around $12 million annually, even a 1% error rate translates to $120,000 lost through denials, underpayments, or delayed reimbursements.

Industry benchmarks tell us that ASCs lose 7–9% of annual revenue on average due to coding issues. For some, that’s hundreds of thousands gone each year. For larger ASCs, the losses can climb into the millions.

Operational disruption

The impact isn’t just financial. Coding errors ripple across the entire operation:

- Longer A/R days: Claims bounce back, clogging up your revenue cycle with resubmissions.

- Staff burnout: Teams get stuck chasing denials and fixing errors instead of focusing on higher-value work.

- Audit exposure: Repeated mistakes draw payer scrutiny, which can lead to recoupments and penalties.

What starts as a coding slip-up can quickly turn into an operational headache that affects everyone in the ASC.

Benchmarks that matter

Industry data paints a clear picture:

- 7–9% of ASC revenue is lost annually to coding errors and denials.

- Mid-sized facilities regularly lose six figures each year.

- Larger ASCs often bleed millions.

- Consistent investment in coding accuracy can cut losses by half and stabilize cash flow.

That’s why coding accuracy isn’t just a compliance checkbox anymore — it’s a financial lifeline for every ASC. Each error compounds into dollars lost, staff drained, and compliance risk heightened. The only way forward is to be proactive: invest in skilled coders, smarter technology, and continuous auditing.

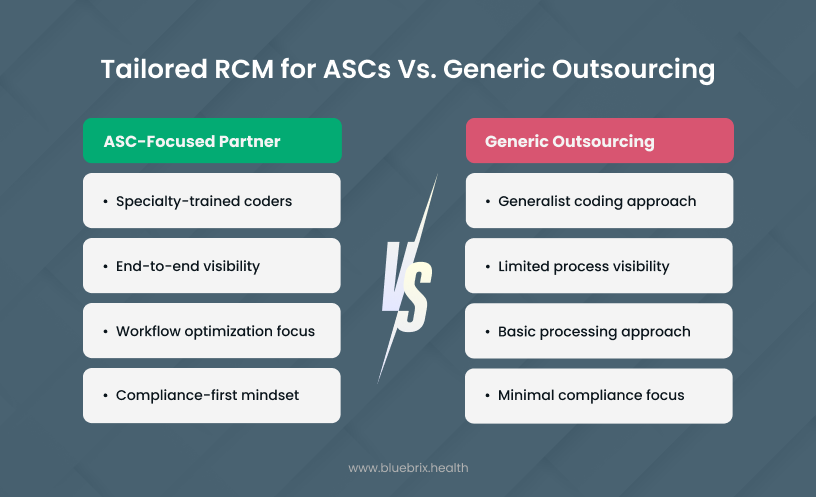

The strategic blueprint to fix the leak

Stopping revenue leaks in ASC coding takes more than quick fixes. It requires a holistic strategy that blends skilled people, smart technology, and customized workflows. That’s where partnering with a specialized RCM service provider like blueBriX makes the difference.

Precise coding & error reduction

At blueBriX, coding accuracy starts with people — our certified ASC-trained coders who know how to navigate the tricky rules of specialties like orthopedics, GI, and ophthalmology. These are the areas most prone to modifier misuse and bundling issues, and our team makes sure claims are coded correctly the first time.

To keep quality airtight, we run regular coding audits and pre-bill claim reviews. This proactive check flags high-risk patterns — like improper use of modifiers (-59, -74) or implant coding errors — before they ever hit the payer.

On top of that, we use AI-powered auto-coding and scrubbing technology to scan for documentation gaps and mismatches between operative notes and CPT/ICD codes. This means fewer denials, less rework, and cleaner claims across the board. Our AI platform employs natural language processing (NLP) and machine learning algorithms to convert clinical documentation directly into compliant CPT and ICD-10 codes, cross-reference against the latest payer policies, and proactively flag potential coding errors, missing documentation, or compliance risks before claim submission.

The system performs real-time eligibility checks, auto-detects modifier misuse, and identifies reimbursement opportunities that might otherwise go unnoticed. Advanced analytics dashboards monitor denial trends, enabling continuous feedback and refinement of both coding protocols and provider documentation. This multi-layered technology stack ensures audit-ready, accurate claims from the outset, aligning revenue cycle operations with current regulatory and payer demands.

Payer rule intelligence & workflow integration

Every payer has quirks — Medicare isn’t the same as commercial, and anesthesia or implant billing rules can vary dramatically. With customizable billing rules, blueBriX makes sure each claim meets the exact requirements of that payer and procedure type.

We’re also integration-agnostic. That means we can plug into whatever EHR or billing system your ASC already uses. The result: smoother workflows, no double data entry, and fewer chances for human error.

Documentation improvement & surgeon alignment

We don’t just code and bill — we help you fix problems at the source. Our team works directly with ASC surgeons and clinical staff to improve operative note templates and documentation practices.

Why? Because vague notes are one of the top reasons claims get downcoded or denied. By standardizing templates and training staff, we make sure every case is supported with complete, payer-ready documentation.

We also provide training and resource guides that keep your team current with evolving payer rules, coding guidelines, and compliance checklists — tailored specifically for ASC challenges.

Denials management, analytics, and revenue visibility

Denials are inevitable — but they don’t have to be permanent. With end-to-end denial management, blueBriX handles claim follow-ups, prioritizes appeals for high-value cases (like implants), and speeds up collections even in complex or out-of-network situations.

We also give ASC leaders real-time visibility into their revenue cycle. Dashboards highlight claim status, denial reasons, A/R trends, and surgeon-level performance. This helps you spot recurring leaks quickly — and fix them before they snowball.

Documented results

Our clients see the difference in black and white:

- Denial rates drop dramatically within months.

- A/R days shorten, keeping cash flow steady.

- The gap between gross charges and collected revenue narrows.

Real-world use case: orthopedic ASC turnaround

A mid-sized orthopedic ASC performing high volumes of arthroscopic and implant-based procedures was facing denial rates exceeding 18% and nearly $1 million in annual lost revenue due to modifier errors and implant coding misses. By adopting blueBriX’s ASC-focused RCM services, the center can integrate AI-powered auto-coding, real-time implant registries, and surgeon documentation templates. Within six months, denial rates will drop below 8%, implant-related revenue leakage will be eliminated, and A/R days will be reduced by 32%. The ASC will not only stabilize cash flow but also recover nearly $750,000 in previously lost revenue during the first year of implementation.

In short, blueBriX tackles ASC coding pain points with the right blend of skilled coders, technology-enabled claim scrubbing, payer-specific customization, surgeon training, and transparent analytics. That’s how we turn hidden leaks into sustainable financial performance for your ASC.