The grand vision of healthcare is a mirage. For decades, the industry has been in a slow, painful march from the reactive, volume-driven world of fee-for-service to the promised land of value-based care. But a quick glance at the landscape reveals a paradox: despite ambitious goals from CMS to put all Medicare beneficiaries into accountable care relationships by 2030, the vast majority of payments still reward sick care, not health. While a significant portion of payments may be tied to quality metrics, the true, two-sided risk-based models that fundamentally change behavior remain the exception, not the rule.

So, if the vision is stuck in transition, where is the momentum? The answer lies not in the “what” of value-based care, but in the “how.” A new and powerful ecosystem of VBC enablers has emerged. These are no longer just vendors selling software; they are the architects, engineers, and financial partners building the new operating system of healthcare from the ground up. They are thriving not because the shift is complete, but precisely because it isn’t—they are the critical bridge making a painful, protracted transition profitable for providers. This article explores how these companies are accelerating the future of healthcare, even as the old system fights to survive.

Market Size and Growth

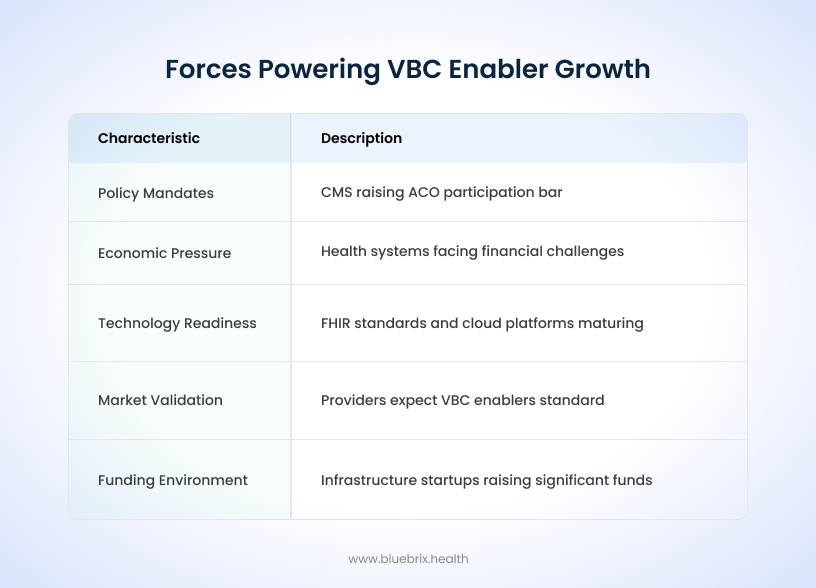

Value-based care has matured beyond its early-stage experiments. What began as a series of ACO pilots and Medicaid waivers has scaled into a mainstream payment model. Analysts now project that the VBC enabler segment will nearly triple in size over the next seven years, with growth powered by three primary forces.

Policy mandates are setting the pace. CMS has consistently raised the bar on ACO participation and risk levels, while commercial payers are creating shared-savings arrangements to reduce employer costs. States like North Carolina and Arkansas have introduced Medicaid managed care models that explicitly reward providers for addressing behavioral health and social determinants.

Economic pressure is assisting in increased adoption. Health systems facing financial challenges cannot afford the inefficiencies of duplicated tests, preventable readmissions, or unmanaged chronic conditions. Employers purchasing insurance want greater accountability for outcomes. VBC enablers give both groups the analytics, contracting tools, and coordination platforms needed to bend the cost curve.

Finally, technology readiness has reached a tipping point. Standards like FHIR are maturing, cloud platforms can ingest and normalize disparate datasets at scale, and AI-driven analytics enable predictive risk modeling that was unimaginable a decade ago.

Market validation backs this trajectory. Eighty-four percent of providers now agree that VBC enablers will be standard infrastructure, and 60% of organizations expect higher revenue from VBC in 2025.

The funding environment also signals confidence. Infrastructure startups such as Arbital Health have raised $31 million+ Series B rounds in 2025, underscoring the investor belief that this market will define healthcare’s next decade.

Competitive Landscape

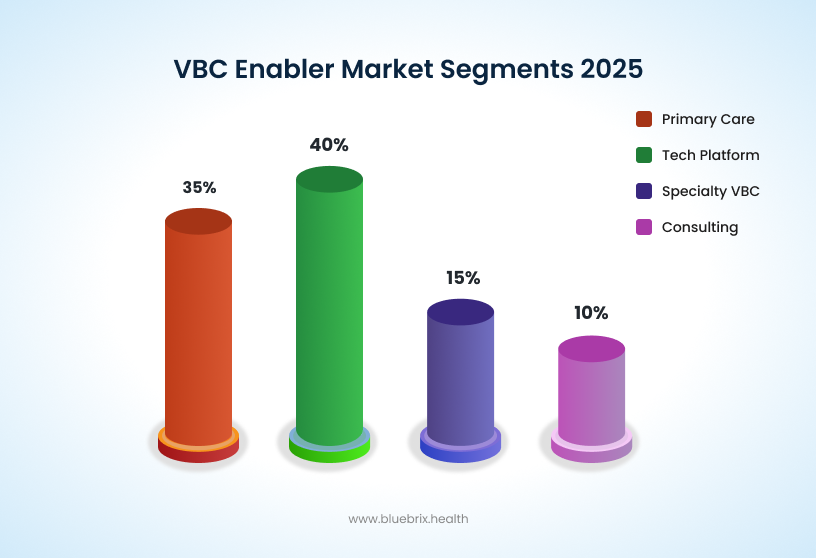

The enabler market is segmented into four categories, each with unique leaders and strategies.

Comprehensive overview of the VBC enabler market showing projected growth to $10.2B by 2031, market segment breakdown, and key performance indicators driving industry transformation

Technology-driven Enablers

Technology is no longer just a support function — it’s the engine driving value-based care. By unifying data, connecting care teams, and engaging patients in new ways, these enablers help providers shift from reactive treatment to proactive health management. The result: stronger outcomes, lower costs, and a healthcare model that is both patient-centered and financially sustainable.

Population Health Platforms

Help providers spot risks early, close care gaps, and improve outcomes across entire patient populations. They drive smarter chronic disease management and preventive care — both essential for success in value-based contracts.

Data & Interoperability Solutions

Turn fragmented data into real-time insights that matter. By breaking down silos, they give leaders visibility into costs, quality, and performance — enabling confident decisions that directly impact financial and clinical results.

Care Coordination Tools

Ensure the “right care at the right time.” These solutions streamline collaboration across providers, reduce redundancies, and improve patient flow — critical for integrated care models under value-based care.

Patient Engagement Platforms

Empower patients with seamless digital access, reminders, and personalized outreach. The result: stronger adherence, better prevention, and lower provider burden — tackling one of the biggest barriers to value-based success.

Telehealth & Remote Monitoring

Extend care beyond the clinic with real-time health tracking. This reduces avoidable visits, supports chronic care, and keeps patients healthier at home — aligning perfectly with value-based goals of prevention and cost efficiency.

Specialty Enablers

As VBC models mature and expand, there is a growing need for tailored solutions that address the unique clinical and operational needs of specific medical specialties. Specialty-specific enablers provide tools and services designed to help these specialized practices transition to and succeed in VBC models.

Examples across specialties include:

- Cardiology: Enablers help manage heart conditions and reduce readmissions through health coaching, remote patient monitoring, and digital touchpoints with cardiologists and nursing staff. They emphasize preventive care and population health strategies for cardiovascular disease.

- Nephrology: Solutions coordinate care for patients with chronic kidney disease and dialysis needs, facilitating fully capitated risk contracting and supporting care management activities with interdisciplinary clinical teams.

- Oncology: Tools support personalized cancer treatment plans and ongoing outcome monitoring, adapting to the complex and individualized nature of cancer care.

- Women’s Health: Focused on maternity, gynecological care, and preventive services that meet value-based performance standards.

- Musculoskeletal Care: These tools help coordinate orthopedic and rehabilitation services to support better patient recoveries.

The increasing adoption of VBC models by specialists highlights the importance of these niche enablers. They offer deep domain expertise and tailored solutions that general VBC platforms might lack, addressing the unique clinical and operational needs of specialized care.

Somatus, OneOncology, and Strive Health represent around 15% of the market. These companies extend VBC into specialty care, managing diseases like kidney disease, cancer, or advanced cardiology where outcomes and costs are tightly linked. Specialty enablement remains under-penetrated but is one of the fastest-growing segments, as payers recognize the need for value-based models beyond primary care.

Infrastructure and Emerging Players

VBC enablers are increasingly combining their technology and service offerings to provide comprehensive, unified solutions. These integrated approaches are designed to streamline the VBC journey for healthcare organizations. Many provide platforms with tools for population health management, care coordination, financial risk management, quality improvement, patient engagement, and performance analytics. They often integrate specialized clinical staff, back-office support services, and advanced technology (including AI) directly into existing infrastructures and EHRs. This blend of “people, processes, and technology” aims to empower physicians, reduce administrative burdens, and promote financial success under value-based contracts.

The success of VBC is heavily reliant on effective collaboration across the healthcare ecosystem. VBC enablers play a crucial role in fostering these partnerships:

- Accountable Care Organizations (ACOs): Large, independent medical groups and formal networks like ACOs, Management Services Organizations (MSOs), Clinically Integrated Networks (CINs), and Independent Physician Associations (IPAs) are particularly well-suited to leverage enabler support. These organizations typically possess the resources to take on greater downside risk, and enablers help them integrate data insights, provide point-of-care data, and offer clinical coaching for improving preventive care.

- Payer-Provider Alignment: A key function of enablers is to align health plans and providers, thereby removing complexity and friction from their relationships. They facilitate stronger partnerships to unlock the benefits of collaborative data exchange, which is essential for mutual success in VBC.

Agilon Health, Aledade, and Privia Health dominate this space, representing about 35% of market share. Their focus is empowering primary care physicians and ACOs to participate in complex risk contracts. They provide centralized contracting, care management resources, and performance analytics. Aledade, for instance, has helped hundreds of independent practices generate savings under Medicare Shared Savings Programs.

The various enabler types—PHM, analytics, care coordination, patient engagement, RPM—and the emphasis on “unified solutions” indicate a clear trend towards “full-stack” or comprehensive VBC enablement. However, the persistent challenge of “data silos and interoperability gaps” implies that even as enablers offer more features, the ability to seamlessly integrate with existing diverse EHRs and systems remains a critical differentiator and a barrier to widespread adoption. The success of these integrated models will depend not just on their breadth of offerings but on their “collaborative interoperability”.

Furthermore, some enablers emphasize “clinical autonomy” while simultaneously promoting “population health strategies“. This highlights a significant aspect of their value. Historically, managed care models were sometimes perceived as restricting physician autonomy. VBC enablers, by providing data, analytics, and administrative support, aim to free up physicians from routine tasks and administrative burdens, allowing them to focus on personalized, high-value care and proactive health management. This suggests that the rise of enablers is not just about improving efficiency, but about empowering clinicians to practice medicine more effectively within a value-based framework, thereby enhancing physician satisfaction and potentially reducing burnout.

A smaller, yet emerging, segment includes Arbital Health, Navina, and Pearl Health, and other younger companies building foundational tools for contract management, provider enablement, and AI-assisted workflows. Many are Series B or later, positioning themselves as acquisition targets for larger players seeking to round out offerings.

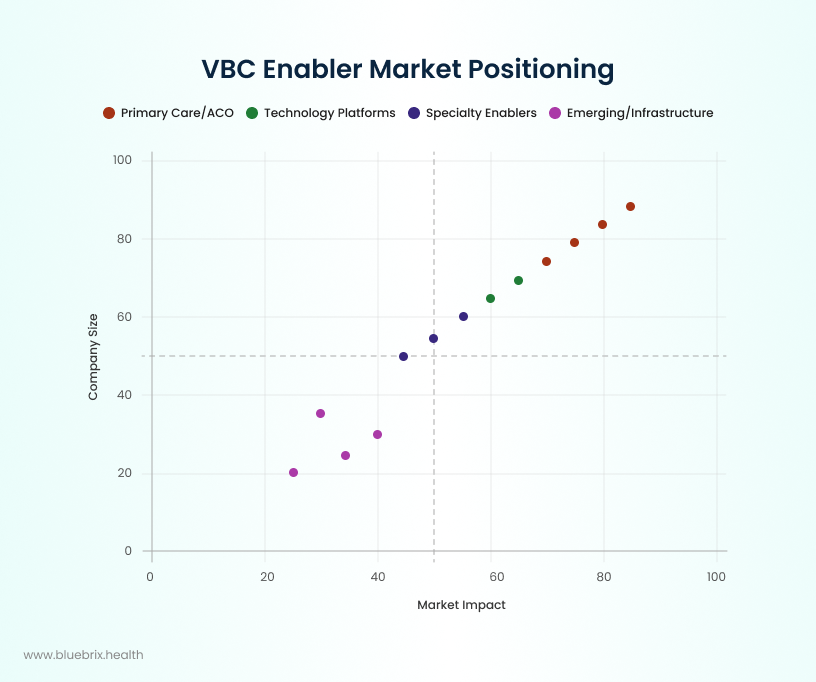

Competitive positioning of leading VBC enabler companies mapped by market impact and company scale, showing the concentration of established players and emerging opportunities

The competitive landscape reflects a dual dynamic: consolidation at the top, as large enablers scale nationally, and fragmentation at the edges, as startups address niche specialties or infrastructure gaps.

Barriers and Success Factors

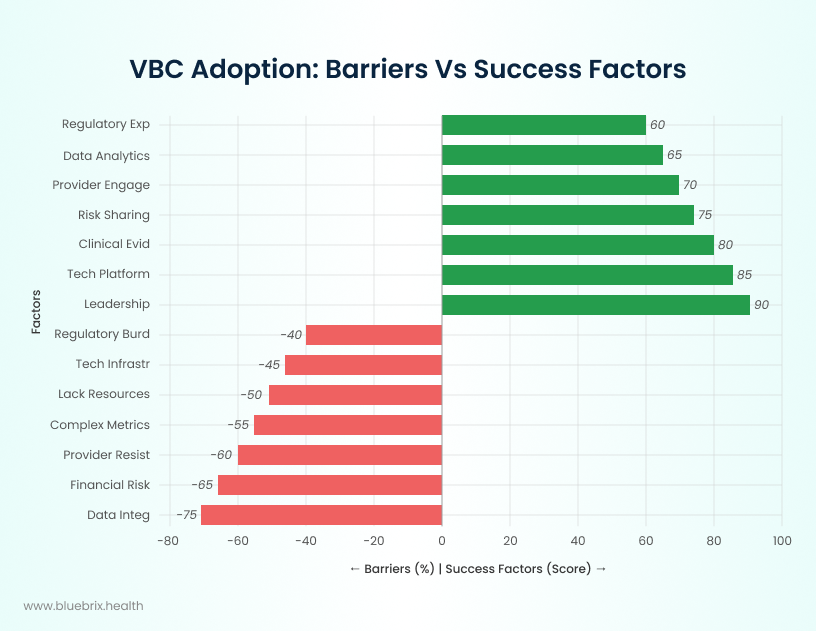

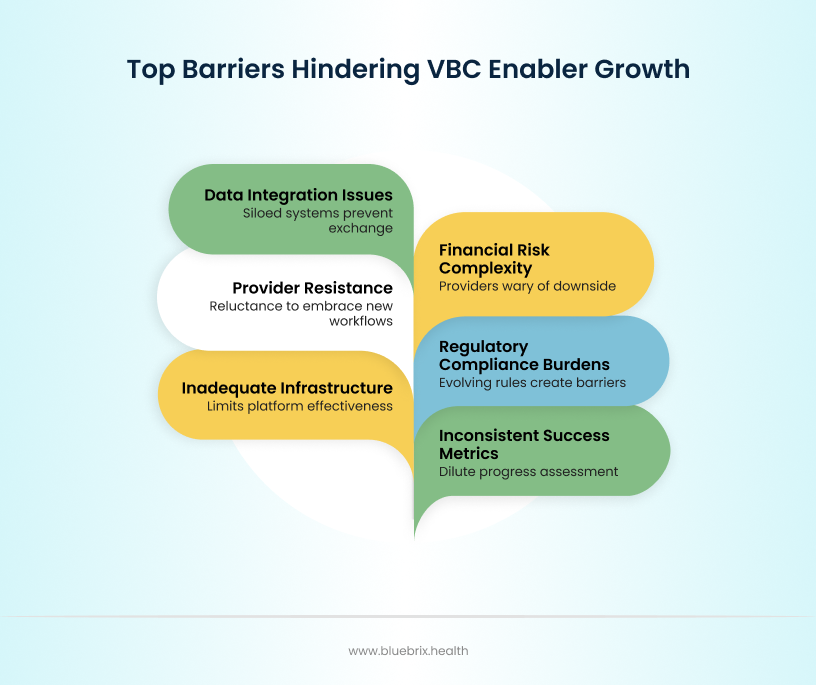

Top Barriers to VBC Enabler Growth

Even with momentum, integration of VBC enablers faces hurdles. It is shaped by a combination of significant barriers and essential success factors. Overcoming these barriers and leveraging the success enablers is critical for VBC enablers—including technology platforms—to drive adoption in the US healthcare landscape.

- Data integration and interoperability, cited by 75% of organizations, remain the Achilles’ heel. Health systems still run dozens of siloed IT platforms, many incapable of seamless exchange. Despite billions invested in EHR adoption, providers report they are less likely to integrate data from outside sources than they are to send, receive, and find such data. Only 30% of healthcare resources are utilized efficiently due to fragmented data systems, while interoperability challenges continue preventing the holistic patient view essential for successful VBC arrangements.

- Financial risk management complexity, reported by 65%, makes providers wary of downside exposure. The transition from predictable fee-for-service revenue to risk-based arrangements creates financial uncertainty that particularly impacts smaller practices. High upfront costs for technology, infrastructure, and care management systems strain budgets, while only 20% of organizations have over half their revenue from fully capitated contracts. Many providers lack sufficient cash reserves and actuarial expertise to manage two-sided risk arrangements effectively.

- Provider resistance to change, highlighted by 80% of respondents, demonstrates the cultural challenge of moving away from fee-for-service. Healthcare professionals exhibit reluctance to embrace new workflows, with end-user unfamiliarity with technology affecting adoption rates. Time constraints during patient consultations make providers hesitant to learn new systems that might slow their workflows. The loss of clinical autonomy and concerns about negative impacts on doctor-patient relationships create additional resistance, particularly when systems require extensive additional training.

- Regulatory complexity and compliance burdens, cited by 69% of organizations, create implementation barriers. Ever-evolving VBC program requirements make long-term planning difficult, with many innovative programs lasting only 3-5 years before rule changes. Complex quality metrics across different payers create administrative burden, while varying state insurance laws require different risk-bearing entity licenses for advanced arrangements. HIPAA, privacy, and security requirements add validation steps that must be built into systems rather than bolted on.

- Inadequate technology infrastructure, affecting 63% of healthcare organizations, limits enablement platform effectiveness. Many healthcare systems lack the necessary IT infrastructure and data collection processes to support VBC. Legacy clinical systems and fragmented workflows across EHR, portals, and billing systems create operational inefficiencies. Software bugs and technical issues impact 52% of users, while insufficient funding for technology upgrades remains a persistent barrier spanning decades.

- Inconsistent success metrics and outcome measurement challenges, identified by industry summits, dilute progress assessment. The complexity of measuring success across diverse populations and varying contract structures makes performance evaluation difficult. Limited quality measures exist for many specialties, including clinical quality and patient-reported experience outcomes. Time lags in registry-based quality measures prevent direct linking of patients in registries to those in payment models.

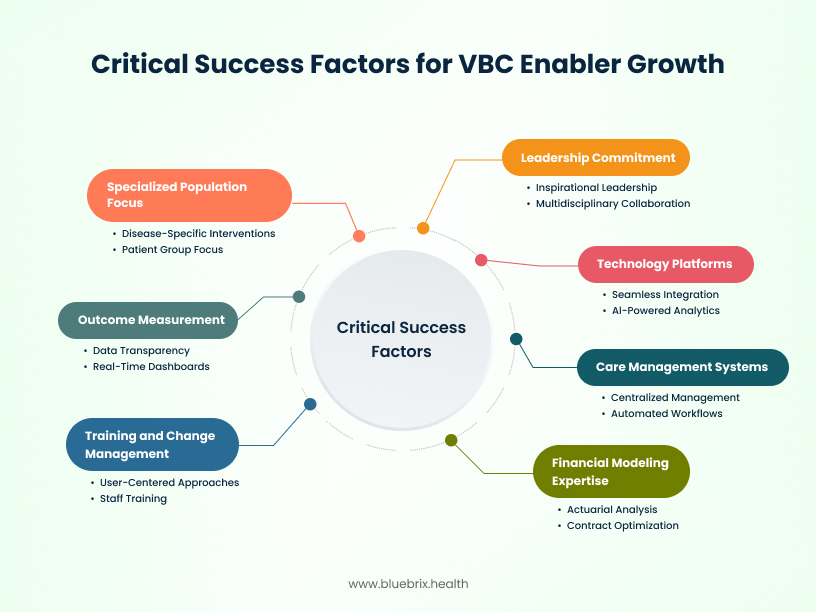

Critical Success Factors Driving VBC Enabler Growth

On the flip side, successful adopters share common strengths.

- Leadership commitment, cited by 90%, provides the top-down mandate to push through inertia. Inspirational medical leadership and multidisciplinary collaboration enhance VBC implementation by fostering continuous improvement cultures. Organizations with committed leadership support achieve better outcomes in care coordination, quality measurement, and population health management. Clear contractual agreements between partners and strategic partnerships with hospitals, insurers, and primary care providers overcome operational barriers.

- Proven technology platforms, seen as essential by 85%, reduce implementation risk and build trust. Advanced technology platforms with seamless integration capabilities, utilized by leading organizations, create competitive advantages. Platforms offering comprehensive data aggregation from multiple sources (EHRs, payers, HIEs) enable the unified patient view essential for VBC success. AI-powered analytics and machine learning capabilities, expected to reduce physician burnout through clinical documentation by 69%, provide predictive insights that support proactive interventions. Organizations investing in data analytics and AI report 31.2% allocation of VBC transformation resources to these capabilities.

- Robust care management and coordination systems, implemented by successful enablers, scale patient management effectively. Comprehensive tools facilitating centralized and decentralized management of patients, social determinants of health data, and behavioral health needs enable care teams to manage larger populations. Organizations using advanced care management platforms report 5-10 fold increases in care manager productivity, while automated workflows reduce administrative burden and enable focus on direct patient care.

- Risk stratification and financial modeling expertise, provided by mature enablers, reduce provider financial anxiety. Sophisticated actuarial analysis, contract modeling, and performance forecasting help providers understand their financial exposure and optimize risk-based participation. Platforms offering risk assessment tools, financial forecasting, and contract optimization capabilities enable informed decision-making about risk tolerance. Stop-loss provisions and shared risk pooling reduce volatility for individual providers.

- Comprehensive training and change management support, emphasized by successful implementations, overcome adoption barriers. User-centered approaches addressing literacy needs, skills, and capabilities must be incorporated into platform design. Organizations providing extensive staff training and development allocate 22.6% of their VBC resources to these activities. Trust in systems, achieved through accurate messaging and credible recommendation sources, becomes a key facilitator reported by users.

- Outcome measurement and transparency capabilities, enabled by advanced platforms, drive continuous improvement. Data transparency and benchmarking with peer organizations enhance VBC implementation success. Real-time performance dashboards and automated compliance tracking provide continuous visibility into contract performance. Organizations with unified platforms integrating clinical, financial, and operational data are more likely to succeed in VBC models.

- Specialized population focus and targeted interventions, adopted by successful enablers, demonstrate measurable results. Organizations focusing on specific disease areas or patient groups, such as aging populations, chronic conditions, or rural residents, can develop customized interventions that lead to better outcomes. Humana reported 30% fewer inpatient admissions in 2022 among its VBC patient population compared to traditional Medicare, while specialized interventions reduce unnecessary visits and treatments.

Together, these factors define the line between organizations that thrive under VBC and those that struggle.

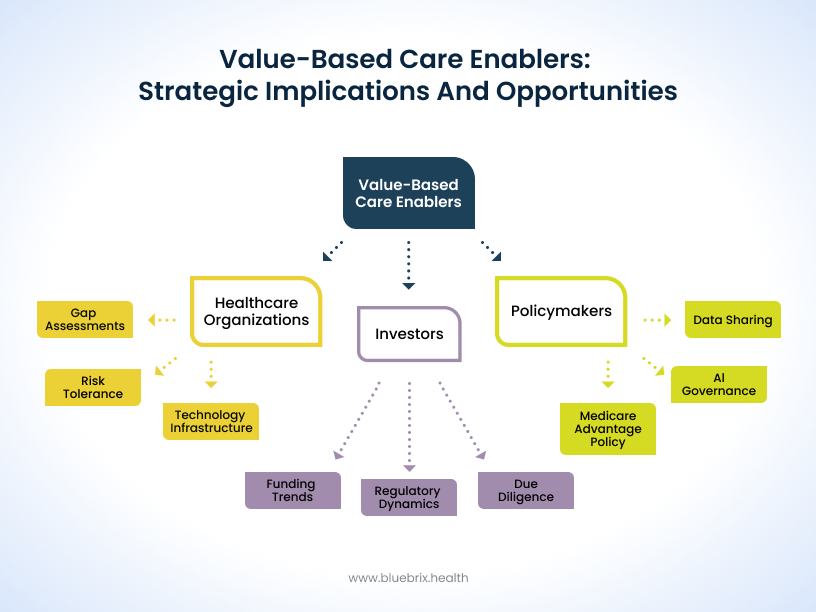

Strategic Implications

For Healthcare Organizations

The message is urgent: VBC enablers are no longer optional. Health systems, hospitals, and physician groups must evaluate partnerships now or risk losing market share to competitors who can deliver superior outcomes under value-based contracts. Organizations without enablement support face a 63% higher likelihood of failing to meet VBC contract requirements, while those with comprehensive platforms report 25-40% improvements in quality metrics and patient satisfaction scores.

Leaders should begin with gap assessments: which functions can be built in-house versus which require external enabler support. Internal development of VBC capabilities typically requires 18-24 months and $2-5 million in upfront investment, while platform partnerships can achieve go-live in 3-6 months with shared risk models. Organizations with fewer than 50,000 attributed lives particularly benefit from enabler partnerships, as the fixed costs of care management infrastructure create economies of scale challenges.

Risk tolerance assessment becomes critical. Organizations comfortable with upside-only arrangements can start with shared savings programs, while those ready for two-sided risk should seek enablers offering comprehensive financial modeling and stop-loss protection. The 87% of organizations citing financial risk complexity as a barrier must recognize that enabler partnerships provide the actuarial expertise and risk pooling necessary to participate confidently in advanced arrangements.

Technology infrastructure evaluation should focus on interoperability capabilities – platforms that can unify clinical, financial, and operational data streams. Organizations should prioritize enablers offering AI-powered analytics, as these capabilities are projected to reduce physician administrative burden while improving clinical decision-making.

For Investors

This is a prime investment window. With CAGR above 15% and a proven ROI model, the VBC enabler category is one of healthcare’s most compelling B2B opportunities. The value-based healthcare services market is projected to reach $1.2 trillion by 2029, driven by regulatory mandates and demonstrable cost savings of 10-20% in mature VBC arrangements.

Funding trends show appetite for mid-stage rounds but exits may accelerate as incumbents pursue acquisitions to consolidate market share. Traditional healthcare IT companies are acquiring enablement platforms at premium valuations, with strategic acquirers paying 6-8x revenue multiples for platforms with proven VBC track records. Pure-play VBC enablers with comprehensive platform capabilities command the highest valuations, particularly those demonstrating network effects and recurring revenue models.

Investors who understand regulatory dynamics and specialty expansion stand to benefit. CMS’s commitment to moving all Medicare beneficiaries into VBC arrangements by 2030 creates a $500+ billion addressable market, while Medicaid expansion and commercial payer adoption expand opportunities further. Specialty-focused enablers, particularly in oncology, cardiology, and behavioral health, offer differentiated value propositions with higher margins.

Due diligence should focus on platform comprehensiveness, client retention rates, and outcome demonstration. Successful platforms integrate clinical workflows, financial management, and risk optimization in unified solutions, while maintaining client retention rates above 90% and demonstrating measurable improvements in quality metrics and cost management. Platforms with AI capabilities and predictive analytics command premium valuations due to their scalability advantages.

For Policymakers

Regulators must keep pace with industry transformation. Governance frameworks for data sharing, AI transparency, and consumer protections will shape how sustainable this market becomes. The Department of Health and Human Services has identified interoperability as critical for VBC success, but current regulations create compliance complexity that affects 69% of organizations.

Without oversight, there is risk of consolidation leading to limited competition or inequitable access. Market consolidation could create dominant platforms that exploit network effects to extract excessive rents from providers. Policymakers should monitor market concentration while ensuring that smaller, rural, and safety-net providers maintain access to enablement services necessary for VBC participation.

But with supportive policies, enablers could deliver population-level gains in both health and affordability. Standardized quality metrics across payers would reduce administrative complexity affecting 69% of organizations, while simplified risk-bearing entity licensing could accelerate advanced VBC adoption. Federal support for data sharing infrastructure and interoperability standards would address the 75% of organizations citing integration challenges.

AI governance and algorithmic transparency requirements must balance innovation with consumer protection. As AI-powered care management becomes standard, regulators need frameworks ensuring algorithm fairness, clinical safety, and patient privacy. Clear guidelines would provide certainty for platform developers while protecting vulnerable populations from algorithmic bias.

Medicare Advantage and Medicaid policy evolution will significantly impact market dynamics. Expanding MA enrollment and state Medicaid 1115 waivers create opportunities for innovative VBC arrangements, but policy uncertainty affects long-term planning. Consistent, multi-year program commitments would enable platforms and providers to make necessary infrastructure investments.

This strategic framework recognizes that VBC enabler success requires coordinated action across healthcare organizations, investors, and policymakers to overcome identified barriers while capitalizing on the significant opportunities in this rapidly evolving market.

The Bottom Line

Value-based care enablers have become the connective tissue of healthcare’s shift from volume to value. With 28.5% of payments already tied to shared-risk arrangements and CMS targeting universal adoption by 2030, their role is no longer experimental—it is foundational.

But the story is incomplete without addressing two critical elements. First, patient experience and health literacy remain underutilized levers. Engagement platforms must go beyond reminders and portals to truly empower patients as partners in care. Evidence shows that improving communication and literacy can drive adherence gains of up to 30%, directly impacting outcomes and contract success. Second, while much of the market narrative is U.S.-centric, global adoption is accelerating. The NHS in the UK, Middle Eastern health systems, and Asian markets are piloting value-based models, signaling that enabler-driven transformation is becoming a worldwide phenomenon.

What’s Next for VBC Enablers

The next decade will be shaped by platforms that go beyond current expectations:

- AI-Driven Precision – Predictive analytics that not only stratify risk but personalize interventions down to the individual level.

- Seamless Interoperability – True “plug-and-play” integration across fragmented EHRs and systems, breaking the last barriers to unified care.

- Scalable, Low-Code Platforms – Faster deployment cycles, enabling organizations to transition from concept to go-live in weeks rather than years.

- Patient-Centric Innovation – Solutions that gamify engagement, measure experience outcomes, and build trust at every interaction.

- Specialty Expansion – Oncology, cardiology, behavioral health, and women’s health will remain growth frontiers where specialized enablement has outsized impact.