The ground beneath US hospitals is constantly shifting, and in 2025, one of the most significant tremors is coming from the intensified Recovery Audit Contractor (RAC) program. With over 2 decades of legacy in US healthcare RCM, blueBriX understands that navigating this landscape demands more than just reacting to denials – it requires foresight, precision, and proactive strategy.

This isn’t just about avoiding penalties; it’s about protecting your financial health, ensuring uninterrupted patient care, and maintaining your reputation. So, what exactly should your hospital be watching now, and how can you transform potential threats into opportunities for operational excellence?

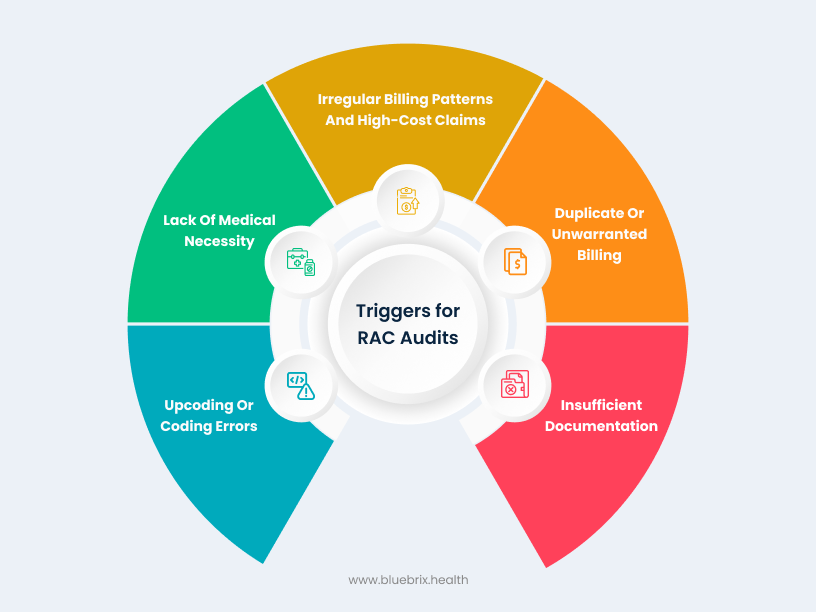

Common triggers for RAC audits

RACs don’t select claims at random – they target patterns and billing practices that suggest possible errors or non-compliance. Some common triggers and causes for RAC audits include:

- Upcoding or coding errors: Billing with codes that yield higher payment than supported (upcoding) or other incorrect coding practices can raise red flags. For instance, routinely billing high-level evaluation & management codes or improper use of certain modifiers may trigger a review.

- Lack of medical necessity: Claims for services that may not be medically necessary, or that were provided in an inappropriate setting, are prime RAC targets. An example is an inpatient hospital admission for a condition that could safely be managed outpatient – RACs often scrutinize inpatient vs. outpatient decisions and other medical necessity judgments.

- Insufficient documentation: Even if care was appropriate, incomplete or missing documentation to support the billed services can lead to an audit finding. RACs look for documentation to justify the level of service, treatments, and diagnoses billed; charts lacking key details (e.g. physician orders, progress notes, or justification for therapy intensity) are vulnerable.

- Duplicate or unwarranted billing: Submitting claims for the same service more than once (duplicates) or billing for services not actually rendered will attract RAC attention. RAC data analysis can quickly spot duplicate claim submissions or overlaps that suggest an error or fraud.

- Irregular billing patterns and high-cost claims: Medicare providers whose billing patterns deviate significantly from peers may be audited. Examples include unusually high volumes of certain procedures, excessive use of certain billing codes, or a spike in high-cost outlier claims. Services that the OIG and CMS have flagged for frequent fraud/abuse are also targets – RACs receive approved issue lists (e.g. specific DRGs, durable medical equipment, or therapy services) that focus their audits on known problem areas.

It’s worth noting that RAC audit issues can vary by provider type. For example, hospitals often face audits for inpatient medical necessity and DRG coding validation, physician practices might be reviewed for coding levels of office visits, and post-acute providers (home health, hospice, skilled nursing facilities) frequently see audits on therapy documentation or patient eligibility criteria. Being aware of the common risk areas in your practice setting can help in focusing your compliance efforts.

The evolving audit horizon: key shifts for hospitals

Medicare’s Recovery Audit Contractors (RACs) were established to identify and correct improper Medicare payments. While their core mission remains, the strategies and intensity of their audits are evolving dramatically, especially for 2025 and beyond.

Medicare advantage (RADV) audits intensifying

This is arguably the biggest game-changer. CMS is aggressively expanding its Risk Adjustment Data Validation (RADV) audits for Medicare Advantage (MA) plans.

- Unprecedented scope: CMS plans to audit all eligible MA contracts annually—a staggering increase from approximately 60 to over 550 plans per year.

- Accelerated backlog clearance: CMS aims to complete all outstanding RADV audits for Payment Years 2018 through 2024 by early 2026, meaning retroactive scrutiny will be intense.

- Increased sample sizes: Expect auditors to review significantly more records per plan (from 35 to potentially 200), exponentially increasing the documentation workload for both MA plans and, crucially, their provider partners.

- Massive workforce expansion: CMS is scaling its medical coder workforce from a mere 40 to an astonishing 2,000 by September 1, 2025, signaling a serious commitment to manual review and recoupment.

- Direct impact on hospitals: While audits target MA plans, the financial burden often flows down to hospitals, especially those in risk-sharing or capitated arrangements. Unsupported diagnoses can lead to direct recoupments from providers.

The AI revolution in auditing

Auditors are no longer solely reliant on manual reviews.

- Sophisticated data analysis: Medicare auditors are increasingly leveraging Artificial Intelligence (AI) and advanced data analytics tools to scrutinize vast volumes of claims data. These tools flag unusual patterns, anomalies, and potential improper billing practices with unprecedented speed and accuracy.

- Predictive capabilities: AI can identify high-risk areas, predict audit vulnerabilities, and even pinpoint specific diagnosis codes or Hierarchical Condition Categories (HCCs) that warrant deeper investigation.

- What this means for You: Errors or inconsistencies that might have slipped through the cracks in the past are now more easily detected, demanding a proactive, technology-driven defense.

OIG’s unwavering gaze

The Office of Inspector General (OIG) continues its relentless pursuit of fraud, waste, and abuse, influencing RAC focus areas.

- High-cost services under scrutiny: Expect enhanced focus on high-cost services like surgeries, specialty treatments, and long-term care, where higher reimbursements make them prime targets for potential billing errors.

- Telehealth compliance: As telehealth becomes an entrenched mode of care delivery, audits will increasingly scrutinize documentation and adherence to specific regulations for virtual visits.

- Clinical diagnostic lab tests: A new OIG Work Plan item for 2025 specifically targets Medicare payments for clinical diagnostic laboratory tests, emphasizing medical necessity and proper documentation.

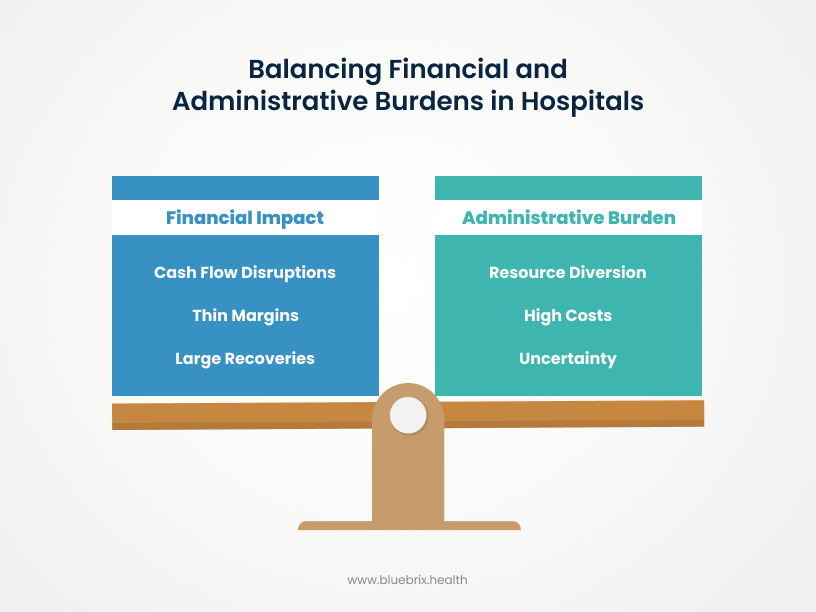

The persistent burden

Despite advancements, the fundamental challenges of RAC audits persist.

- Cash flow disruption: Post-payment audits often result in recoupments for claims that are years old, creating significant and often sudden cash flow disruptions for hospitals already operating on thin margins.

- Administrative drain: Responding to audits, gathering documentation, preparing appeals, and managing the lengthy appeals process consumes immense administrative resources, diverting staff time and focus from critical patient care.

- Uncertainty: The multi-year lookback period creates prolonged financial planning uncertainty, making it difficult for hospital leaders to budget and allocate resources effectively.

Key performance indicators (KPIs) for RAC audit readiness

Monitoring key performance indicators (KPIs) is critical for hospital administrators to effectively manage RAC audits. These metrics provide a clear, actionable framework for measuring the effectiveness of audit readiness and compliance programs. By tracking these KPIs, hospitals can move beyond simply reacting to audits, enabling proactive monitoring, early identification of weaknesses, and targeted interventions. These indicators transform abstract compliance goals into concrete, measurable objectives that can be tracked over time, demonstrating improvement and justifying necessary investments in RCM and compliance infrastructure.

- Overall denial rate – Measures the percentage of claims denied by RACs (by volume and dollar amount). It helps identify systemic issues and prioritize areas for improvement. For example, if a hospital submits 10,000 claims and 1,200 are denied, the denial rate is 12%. If the total value of denied claims is $1.2 million out of $10 million billed, the dollar-based denial rate is also 12%.

- Appeal success rate – Tracks the percentage of appealed claims that result in favorable outcomes. This indicates the effectiveness of the appeals process and quality of documentation. For example, out of 500 appealed claims, 300 are overturned in favor of the hospital. The appeal success rate is 60%.

- Administrative cost per audit – Calculates total labor and resource costs for responding to audits and appeals. It reveals hidden burdens and opportunities for efficiency gains. If a hospital spends $55,000 annually on staff time, legal fees, and documentation for 500 audits. The cost per audit is $110.

- Cash flow impact – Assesses the direct financial effect of recoupments on hospital operations. This is essential for managing liquidity and preparing for financial shortfalls. For example, RAC audit could result in a recoupment of $500,000, affecting the hospital’s ability to meet payroll or purchase equipment, causing a temporary liquidity shortfall.

- Response time – Measures the average time taken to respond to RAC documentation requests. This is critical for maintaining compliance and avoiding technical denials. If the average response time to RAC documentation requests is 12 days, and the compliance window is 14 days, there’s little margin for error.

- Staff productivity metrics – Evaluates efficiency of staff handling audit-related tasks (e.g., cases per auditor). It helps optimize resource allocation and identify training needs. If each auditor processes 25 cases per week and productivity drops to 15 cases due to complex audits, it signals a workflow bottleneck.

- Overall coding accuracy – Tracks the percentage of correctly coded claims (diagnostic, procedural, modifiers). This directly influences denial rates and reflects coding quality and training effectiveness. For example, if out of 5,000 claims reviewed, 4,600 are correctly coded, the coding accuracy rate is 92%, indicating strong coding practices but room for improvement.

Tracking these KPIs not only highlights the challenges hospitals face during RAC audits—it also underscores the urgent need for a proactive, technology-driven solution. That’s where blueBriX RCM comes in, offering a strategic defense against audit risks by transforming reactive processes into resilient, data-informed operations.

blueBriX RCM: Your proactive defense against audit risks

At blueBriX RCM, we believe that true audit defense isn’t reactive—it’s woven into the very fabric of your revenue cycle. With over 2 decades of experience in the US healthcare market, we partner with hospitals to transform compliance from a burden into a competitive advantage. We empower your organization to not just survive, but thrive amidst the intensifying audit landscape.

Precision documentation & coding

We embed meticulous accuracy into your entire RCM.

HCC coding expertise: Specializing in Hierarchical Condition Category (HCC) coding to ensure accurate risk adjustment.

Clinical documentation improvement (CDI): Ensuring every service is fully supported by comprehensive, compliant medical records.

Proactive claim scrubbing: Leveraging advanced tools to identify and correct errors before claims are submitted, significantly improving first-pass clean claim rates (blueBriX boasts 98% clean claim rate).

Proactive internal audits

We help you identify and mitigate risks before external auditors do.

- Continuous monitoring: Implementing robust internal audit programs that regularly assess high-risk areas like medical necessity, DRG validation, and coding accuracy.

- Data-driven risk assessment: Utilizing analytics to pinpoint billing trends and outliers that might trigger an audit, allowing for targeted training and process improvements.

Empowered workforce

We equip your teams with the knowledge and tools they need.

- Ongoing education: Continuous training for your coding, billing, and clinical staff on the latest Medicare rules, compliance guidelines, and common audit pitfalls.

- Interdepartmental collaboration: Fostering seamless communication between clinical and administrative teams to ensure documentation directly supports billed services.

Cutting-edge technology integration

We bring the power of AI and automation to your RCM.

- AI-powered claim validation: using intelligent systems to review medical records, suggest appropriate codes, and flag inconsistencies, augmenting human expertise.

- Automated denial management: Streamlining the identification, analysis, and appeal of denials, leveraging AI to suggest solutions and accelerate resolution.

- Predictive analytics: Forecasting payment patterns and identifying high-risk claims, enabling your team to address potential issues proactively.

Strategic appeals management

When audits do occur, we ensure you’re prepared for a robust defense.

- Efficient process management: Establishing clear, prompt protocols for responding to audit requests and navigating the multi-level Medicare appeals process.

- Comprehensive data reporting: Providing transparent, customized weekly and monthly reports on key performance indicators like denial rates, appeal success rates, and revenue recovery, empowering data-powered business decisions.

Why hospitals can't afford to wait

The stakes are higher than ever. With median hospital operating margins hovering around 4.4% (Becker’s Hospital Review, 2024) and hundreds of rural hospitals at risk of closure, unexpected recoupments can be devastating. Hospitals spend hundreds of thousands, if not millions, annually on audit appeals and denials. While appeal success rates can be high (some historical data suggests up to 75% for certain cases), navigating the appeals process is an arduous, time-consuming endeavor.

Financial impact:

- Cash flow disruptions: RACs target claims up to three years old, forcing hospitals to repay funds already spent.

- Thin margins: With a median operating margin of just 4.4% (as of Oct 2024), hospitals have little buffer for unexpected costs.

- Large recoveries: Over $2 billion was recovered in FY 2021 alone, with a sharp rise in overpayments since 2010.

- Rural hospital risk: Over 700 rural hospitals face closure, with RAC recoupments potentially pushing many into insolvency.

Administrative burden:

- High costs: Hospitals spend hundreds of thousands to millions annually on RAC-related appeals and audits.

- Resource diversion: Staff time is redirected from patient care to managing audits and appeals.

- Uncertainty: The three-year lookback period complicates long-term financial planning.

Appeals and accuracy issues:

- Appeal success: Hospitals often succeed in overturning denials (e.g., 56% at MAC level in 2019).

- Discrepancy in accuracy: RACs report high accuracy (94.6%–99.6%), but appeal outcomes suggest actual accuracy may be closer to 44%.

- Incentive misalignment: RACs earn commissions on denials, encouraging aggressive claim rejections.

The true burden of RAC audits lies not just in financial recoupments but in the hidden costs of administrative strain and resource diversion. A proactive audit management strategy is essential to mitigate these impacts. This isn’t a problem that will solve itself; it’s an escalating challenge that demands immediate, strategic action.