Your coders are switching between two completely different rulebooks every day. Medicare’s MS-DRG system pays based on one set of severity criteria, while your Medicaid and commercial contracts use APR-DRG with entirely different logic. That pneumonia case with diabetes? It might qualify as a CC in MS-DRG but not move the needle in APR-DRG. Your team codes it wrong, and you’re either leaving $3,000 on the table or setting yourself up for a takedown when auditors arrive.

This guide breaks down the key differences between MS-DRG and APR-DRG and explores what it takes to handle both systems without losing your mind or your revenue. The goal is simple: accurate coding that maximizes appropriate reimbursement while keeping you compliant. Understanding these differences isn’t just about avoiding mistakes—it’s about ensuring your hospital gets fairly paid for the care you provide.

The Mixed-Payer Facility: A Unique Coding Challenge

A mixed-payer healthcare facility serves patients covered by a variety of insurance types: Medicare, Medicaid, private plans, and self-pay. This payer mix shapes the facility’s finances and operations, as each payer comes with its own rules for coverage, reimbursement, and billing. In other words, a mixed-payer environment means coding professionals must navigate a landscape where “one size fits all” simply does not apply.

Because each payer program (like Medicare’s MS-DRG and Medicaid’s or commercial insurer’s APR-DRG) uses different reimbursement criteria and coding requirements, coders must demonstrate dual (or even multiple) competency:

- They must understand the specifics of each DRG system, recognizing differences in grouping logic, severity adjustments, and documentation demands.

- Coders must ensure accurate, payer-specific documentation and code assignment—mistakes here can lead to denied claims, revenue loss, compliance issues, or regulatory penalties.

- The constant switching between systems requires ongoing education and a strong grasp of updates and payer policies, making the coder’s role at a mixed-payer facility both challenging and uniquely valuable.

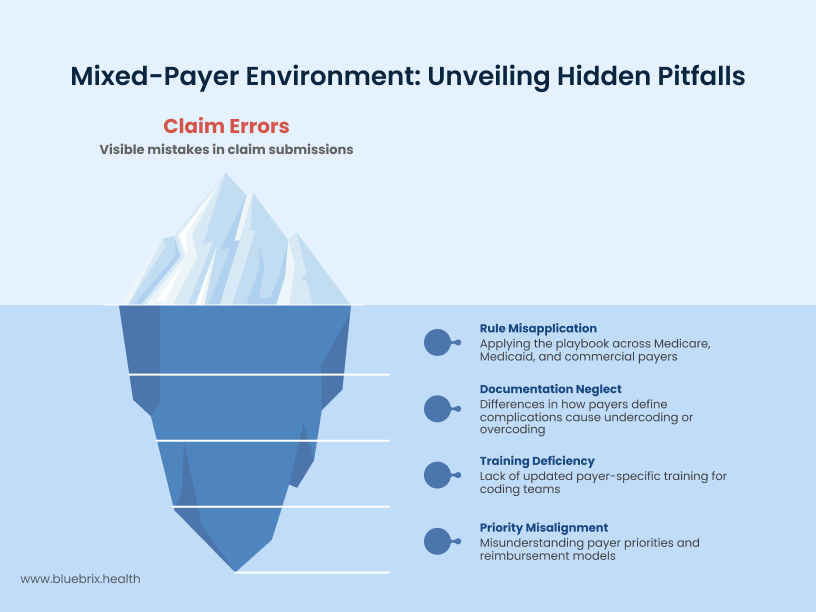

Mixed-Payer Environment: Common Pitfalls and Assumptions

Operating in a mixed-payer environment can easily lead to several pitfalls as follows:

- Assuming “one set of rules”: Applying Medicare rules to commercial or Medicaid cases (or vice versa) is a common error that can result in misgrouped claims and lost revenue.

- Overlooking documentation details: What’s considered a complication or comorbidity (CC/MCC) in one system may not be recognized in another, leading to unintentional undercoding or overcoding.

- Neglecting payer-specific training: With DRG systems evolving and payer contracts frequently updating requirements, failing to stay current can leave coding teams unprepared.

- Misunderstanding payer priorities: For example, commercial insurers may focus more on cost containment, whereas government payers may emphasize compliance or risk adjustment.

Demystifying DRGs: A Quick Primer

This primer outlines the fundamental differences between MS-DRG and APR-DRG, explaining how these distinct systems are used to group patient cases and determine payment with their own playbook.

MS-DRG (Medicare Severity-Diagnosis Related Group): The Federal Standard

Purpose and Primary Users

MS-DRG is Medicare’s primary payment system for hospital inpatient stays. Many commercial insurers also use this system. Instead of paying based on length of stay or individual services, MS-DRG groups similar cases together and pays a set amount for each group.

Resource-Based Payment and Severity

The system recognizes that patients with similar diagnoses don’t always need the same resources. A heart attack patient who recovers quickly requires different care than one who develops complications. MS-DRG accounts for this by grouping patients based on their condition, Severity of Illness (SOI), and expected resource use. More complex cases with higher severity levels get higher payments.

Complications and Comorbidities Impact

MS-DRG considers additional health conditions that make care more challenging. These include complications that develop during the stay and existing conditions patients bring with them. The system classifies these as Complications/Comorbidities (CCs) or Major Complications/Comorbidities (MCCs). When patients have CCs or MCCs, their case moves to a higher-paying category because these conditions require more resources and attention.

APR-DRG (All Patient Refined-Diagnosis Related Group): Beyond Medicare

Purpose and Primary Users

APR-DRG serves a broader patient population than MS-DRG. While Medicare focuses primarily on elderly patients, APR-DRG is designed for Medicaid programs, commercial insurance plans, and state-specific healthcare programs. This system handles the full spectrum of patients—from pediatric cases to complex adult conditions across different insurance types. The “All Patient” designation reflects its ability to appropriately group and price cases regardless of patient age or payer type.

Dual Assessment Framework

APR-DRG goes beyond traditional severity measures by incorporating two critical factors: Severity of Illness (SOI) and Risk of Mortality (ROM). While SOI measures how sick the patient is and what resources they’ll likely need, ROM estimates the probability of death during the hospital stay. This dual assessment provides a more complete picture of patient complexity and helps predict both resource consumption and clinical outcomes.

Four-Level Severity and Risk Scale

Both SOI and ROM are measured on four-point scales ranging from minor to extreme. A patient might have moderate severity of illness but low mortality risk, or high severity with high mortality risk. This granular classification creates more precise payment categories. Instead of broad groupings, hospitals receive reimbursement that reflects the true complexity of each case. The result is a more accurate match between patient needs, resource consumption, and payment levels.

Head-to-Head: Key Distinctions Between MS-DRG and APR-DRG

Here’s a breakdown of the key differences between MS-DRG and APR-DRG—who uses them, how they measure patient severity, how they classify cases, and what that means for hospital payments. Understanding these differences helps hospitals ensure accurate coding and billing, especially when working with multiple insurance types.

System Names and Purpose

MS-DRG stands for Medicare Severity Diagnosis Related Groups and is mainly used for Medicare inpatient hospital payment classification. APR-DRG, or All Patient Refined Diagnosis Related Groups, is designed for all patients (Medicare and non-Medicare) with refined risk stratification.

Classification Approach

MS-DRG groups patients by principal diagnosis, procedures, age, discharge status, and complications/comorbidities. APR-DRG takes base APR-DRGs and subdivides them into 4 severity of illness and 4 risk-of-mortality subclasses.

Severity and Risk Modeling

MS-DRG considers severity of illness but with less detail and doesn’t specifically model risk of mortality, whereas APR-DRG provides explicit and detailed severity levels for greater clinical nuance and includes explicit modeling of risk of mortality.

System Size and Scope

MS-DRG contains approximately 750 groups and primarily covers hospital inpatient services. On the other hand, APR-DRG includes over 3,000 groups (4 severity × 4 mortality subclasses per base group) and applies to all payers and care settings, including pediatric and neonatal.

Comorbidity Handling

MS-DRG considers comorbidities but in a limited manner with moderate granularity. APR-DRG extensively includes comorbidities and complications for risk adjustment with high granularity.

Usage and Adoption

MS-DRG is used by Centers for Medicare & Medicaid Services (CMS) for reimbursement and is widely adopted for Medicare billing, whereas APR-DRG is used for quality measurement, outcomes research, and payment, with increasing adoption across clinical, research, and payer settings.

The “When” Factor: Guiding Principles for DRG Assignment

Let’s take a closer look at key concepts—like different payers’ rule books, the role of data analytics, and the importance of accurate documentation—that shape how hospitals manage coding and payments, especially when navigating multiple insurance plans.

Payer-Specific Rules

Different insurance companies—like Medicare, Medicaid, or private insurers—set their own rules for how medical cases should be grouped and billed. Whenever you assign a DRG, you start by following the specific guidelines for that payer. For example, what counts as a complication or how you sort diagnoses might differ between Medicare and a commercial insurer, so knowing which payer will cover the bill always comes first.

Know Your Payer Contracts

Beyond payer rules, hospitals often have contracts with insurers that spell out special requirements or payment arrangements. These contracts can affect how cases are coded, which DRG is assigned, and what is reimbursed. Knowing the details—sometimes hidden in the “fine print”—can prevent costly mistakes or lost payments. In short, always check for any extra rules in your hospital’s contracts with payers.

Data Analytics for Better DRGs

Hospitals use data analysis tools to spot patterns in how DRGs are assigned, paid, or denied. By looking at past cases and trends, teams can improve how they group cases, catch mistakes early, and maximize correct payments. For instance, if the data shows certain diagnoses are often under-documented, coders can focus on getting better information up front.

Good Documentation Means Accurate Coding

Getting the right DRG and therefore the right payment depends on clear, complete, and accurate documentation in the patient’s medical record. This means all diagnoses, complications, procedures, and relevant details must be written down carefully by doctors and nurses. Good notes lead to accurate coding; missing or unclear information can cause underpayment or even rejected claims.

The High Cost of Misalignment: Risks and Repercussions

Coding misalignment can lead to under-reimbursement, compliance risks, bad data, and wasted resources. We’ll quickly walk through how each of these can impact a hospital’s finances, reputation, and day-to-day operations.

Under-reimbursement and Missed Revenue

When coding doesn’t match what actually happened in the patient’s care, the hospital might get paid less than it should. For example, if a treatment or complication isn’t coded properly, insurance companies may pay only part of the bill or deny it altogether. This means the hospital loses money it has already spent on care. Even small mistakes add up—denied or underpaid claims can cost hospitals millions every year, making it harder to keep up with expenses and invest in better patient services.

Compliance Risks and Regulatory Penalties

Inaccurate coding or billing can trigger audits (deep reviews) by insurance companies or government agencies. If auditors find mistakes—especially if they look like fraud or if the hospital has overbilled—there can be severe consequences: financial penalties, demands to pay back money, or even legal trouble. Repeated coding problems can lead to increased attention from regulators, putting hospital operations and reputation at risk.

Data Integrity Issues and Skewed Performance Data

Good data depends on accurate coding. If codes are wrong, it affects reports on hospital quality, infection rates, or patient outcomes can also be wrong. This can make the hospital look better or worse than it really is, affecting its reputation with patients, business partners, and government programs. Poor data can also mess up planning and may result in public ratings that discourage patients from coming to the hospital.

Rework and Resource Drain

When claims are denied or payments delayed because of coding errors, hospital staff must go back to fix and resubmit the paperwork. This “rework” takes time and energy away from patient care and other important jobs. If coding problems happen a lot, it can lead to a constant drain on resources, lower staff morale, and overall inefficiency in how the hospital runs.

Strategies for Achieving DRG Coding Accuracy and Alignment

Getting DRG coding right takes more than just skilled coders—it requires strong documentation, smart tools, and continuous improvement. We will explore practical strategies like coder training, CDI programs, tech tools, and audits that help hospitals stay accurate, compliant, and financially healthy.

Comprehensive Coder Education and Training

Getting DRG coding right starts with having coders who actually know what they’re doing. Some hospitals go deep—they train coders to become specialists in specific areas like cardiology or surgery. These experts can catch the subtle details that make the difference between accurate and inaccurate coding.

Other hospitals prefer the cross-training approach, where coders learn multiple areas so they can jump in wherever help is needed. The smart move? Most successful hospitals use both strategies. They have specialists for complex cases and cross-trained coders for flexibility. Either way, ongoing training isn’t optional—DRG rules change, medical terminology evolves, and coders need to stay current.

Robust Clinical Documentation Improvement (CDI) Programs

Doctors and nurses document everything they need for excellent patient care, but the coding world has its own specific requirements that don’t always align with clinical documentation needs. Clinical Documentation Improvement programs solve this problem by creating a bridge between clinical care and accurate coding. CDI teams work directly with physicians to clarify documentation—was this condition present when the patient arrived, or did it develop during the stay? Is this a complication or an existing chronic condition? These distinctions directly impact DRG assignment and payment. When documentation is clear and complete, coders can do their job accurately.

Smart Tools for Better Coding

Technology isn’t replacing human coders, but it’s making them more accurate and efficient. DRG validation software acts like an intelligent assistant, double-checking code assignments and flagging potential errors before claims go out the door. Think of it as spellcheck for medical coding—it catches mistakes that human eyes might miss.

Analytics tools take this further by tracking patterns across thousands of cases. If certain types of diagnoses are consistently under-documented or specific DRGs are frequently denied, the data reveals these trends. Hospitals can then address systemic issues rather than fixing problems one case at a time.

Regular Auditing for Continuous Improvement

Smart hospitals don’t wait for payers to find their mistakes—they find them first. Regular internal audits review coding accuracy, looking for missed opportunities and potential errors. Maybe coders are consistently missing secondary diagnoses that could bump cases into higher-paying DRGs. Maybe certain types of complications aren’t being captured properly.

When auditors find these patterns, they create feedback loops with coders and clinical staff. This isn’t about blame—it’s about improvement. The goal is catching and fixing problems before they impact revenue or compliance. Hospitals that audit regularly stay ahead of issues rather than constantly reacting to them.

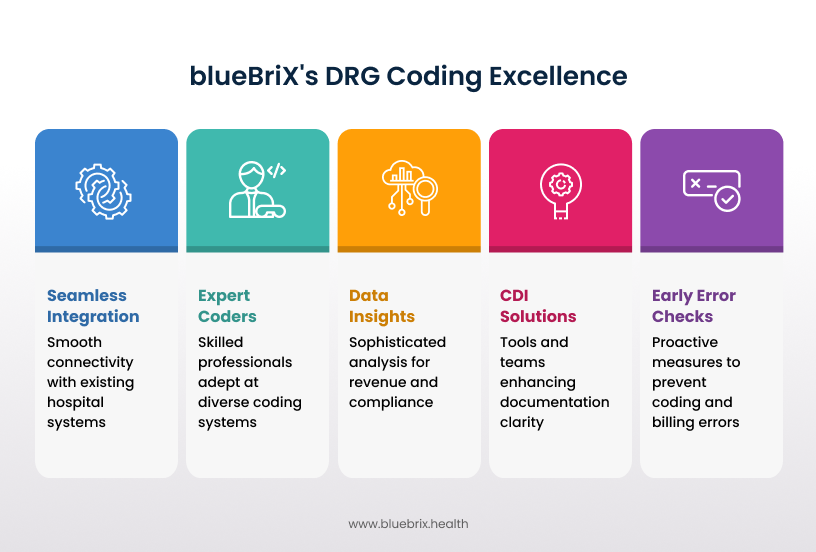

Partnering for Precision: How blueBriX Elevates Your DRG Coding

Precision in DRG coding takes the right mix of expertise, technology, and timing—and that’s exactly where blueBriX comes in. With specialized coders, real-time checks, and seamless support, we help hospitals boost accuracy, protect revenue, and stay ahead of compliance risks.

Let’s dive in!

Expert Coders for All Kinds of Payers

blueBriX has a team of coding experts who know all the different coding systems insurance companies use—including both Medicare (MS-DRG) and commercial/Medicaid (APR-DRG) rules. No matter what type of insurance your patients have, we make sure every case is coded correctly, so your hospital gets paid what it deserves and avoids headaches with denied claims.

Advanced CDI Solutions for Enhanced Documentation

Sometimes, medical records are missing important details or are unclear, which can cause coding mistakes. blueBriX brings in special tools and teams to help doctors and nurses document every detail clearly and completely. This way, coders can do their job accurately, reducing missed revenue and ensuring insurance pays out properly.

Early Coding and Billing Error Checks

blueBriX doesn’t wait for problems to show up after the fact. We actively check coding and billing as cases happen like catching errors or missing information early. By fixing issues before claims go out the door, we help you avoid delays, denials, or lost payments.

Data-Driven Insights to Optimize Reimbursement and Compliance

Our sophisticated data tools look at your hospital’s coding and billing trends. We spot patterns—like common mistakes or potential areas for more revenue—so your team can work smarter and improve over time. This also helps make sure you’re following all the latest rules, avoiding compliance risks.

Seamless Integration with Your System

blueBriX isn’t just an outside service—we connect directly with your team, systems, and workflows, so everything runs smoothly. Our support feels like having extra skilled hands-on deck, freeing up your staff and boosting efficiency without any extra hassle.

Mastering DRG Coding in a Nutshell

Juggling MS-DRG and APR-DRG systems isn’t just complex—it’s costing you money every day through missed opportunities, denials, and compliance headaches. The hospitals winning in this mixed-payer environment aren’t working harder, they’re working smarter by integrating expert coding, robust CDI programs, and intelligent technology that catches issues before they become problems. That’s the kind of support blueBriX offers helping your team stay on track with billing while focusing on what really matters: great patient care.

Let’s talk about how we can help you get there. Connect today!