ABA billing does not usually fail in obvious ways. Most practices know the codes, follow supervision rules, and believe their documentation is solid. The real problems surface weeks later, when clean-looking claims stall, denial rates creep up, or payers start asking questions no one expected. What feels like a billing issue is often an operational one hiding in plain sight.

In 2026, ABA reimbursement is no longer just about submitting the right CPT code. Claims are evaluated in context. Payers cross-check session notes against supervision logs, authorization limits, EVV data, and provider credentials across multiple systems. A single mismatch, like a modifier applied correctly in theory but unsupported by documentation elsewhere, can quietly push a claim into denial or audit territory. When this happens at scale, cash flow slows even though care delivery has not changed.

This is why revenue integrity has become a frontline concern for ABA leaders, not a back-office clean-up task. It affects whether sessions continue uninterrupted, whether clinicians stay focused on care instead of rework, and whether a growing practice can expand without accumulating compliance risk. This guide breaks down how ABA billing actually breaks in the real world and how providers can rebuild it into a system that supports both financial stability and clinical trust.

Why does ABA revenue integrity matter more in 2026 than ever before?

For years, ABA billing problems were manageable. A few denials, some delayed payments, and teams found ways to absorb the impact. In 2026, that buffer no longer exists. Payers and regulators are no longer reviewing ABA claims in isolation. They are analyzing behavior at scale.

State medicaid programs and commercial payers now rely heavily on analytics to compare supervision levels, unit utilization, session intensity, and documentation patterns across providers. When those patterns drift, even slightly, practices get flagged. Recent OIG audits have shown how quickly this escalates, uncovering tens of millions in improper ABA payments driven less by intent and more by systemic documentation and credential mismatches across high-volume claims.

At the same time, reimbursement rules have tightened. Weekly unit tracking, stricter authorization enforcement, EVV expansion, and payer-specific credential requirements mean practices are operating inside narrower margins for error. A missed supervision log or an untracked authorization cliff no longer causes a small denial. It creates downstream delays that affect payroll timing, clinician capacity, and leadership focus.

What makes 2026 especially unforgiving is scale. The more RBTs, BCBAs, locations, and payers a practice manages, the harder it becomes to keep authorizations, supervision, and documentation perfectly aligned across systems. Revenue integrity has become the deciding factor between sustainable growth and slow operational breakdown. That reality leads directly to the next question: where does ABA billing actually fail inside otherwise competent organizations?

The hidden ways ABA billing breaks inside well-run ABA practices

Most ABA billing failures do not come from negligence or lack of expertise. They happen inside practices that are clinically strong, staffed with qualified BCBAs and RBTs, and confident in their processes. On the surface, everything looks compliant. Underneath, small operational gaps quietly compound until payers start pushing back.

One common break point is supervision. Practices may meet the required oversight percentage in reality, but supervision proof lives in a different place than session notes. When claims for 97153 or 97155 are reviewed, payers do not infer intent. They look for explicit, timestamped links between the RBT session, the supervising BCBA, and the documented clinical decision-making. If those elements do not line up perfectly, the claim fails even though the care was appropriate.

Another failure point shows up around authorizations and unit limits. As practices grow, scheduling often becomes disconnected from authorization tracking. Sessions continue past weekly or total caps because no one sees the cliff coming in time. These overages are not random. They tend to cluster around high-utilization clients and busy clinicians, which makes them stand out immediately in payer analytics and increases audit risk.

Credentialing and modifier logic create a quieter but equally damaging problem. In team-based ABA care, the billing NPI, rendering provider, modifier, and taxonomy must all tell the same story. When systems are not synchronized, claims can technically be correct but contextually wrong. That mismatch drives denial rates that feel unpredictable and exhausting to manage.

The reason these issues persist is not effort. It is fragmentation. When scheduling, documentation, supervision logs, and billing checks operate as separate workflows, even strong teams lose consistency at scale. Understanding these failure patterns sets up the real solution, not more training, but a shift in how revenue integrity is designed into daily operations.

What actually causes high ABA denial rates despite correct coding?

High denial rates in ABA are frustrating because they often occur even when CPT codes are technically correct. The issue is that payers do not evaluate ABA claims as isolated billing events. They evaluate them as evidence of a compliant care model playing out over time.

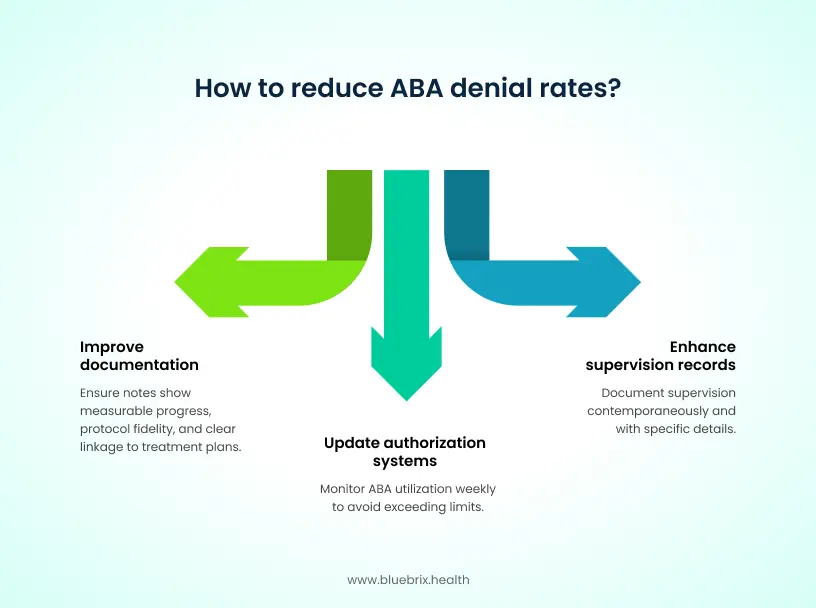

One major driver is documentation depth, not documentation volume. Session notes may be complete, signed, and timely, yet still fail to prove medical necessity. Payers expect to see measurable progress, protocol fidelity, and clear linkage between the treatment plan and what happened in that specific 15-minute unit. When notes rely on generic language or repeat the same phrasing across sessions, analytics flag them as low confidence, especially for high-volume codes like 97153

Supervision is another frequent trigger. Many practices provide the required oversight but do not document it in a way that survives payer review. Supervision logs that are delayed, loosely worded, or disconnected from the session timeline weaken the claim narrative. When a BCBA modification code or RBT treatment code lacks contemporaneous supervision proof, payers treat it as a compliance failure, not a clerical miss.

Authorization logic also plays a role. In 2026, several payers track ABA utilization weekly rather than cumulatively. When systems are not set up to monitor that shift, claims exceed weekly limits without anyone realizing it. These denials feel sudden, but from a payer’s perspective they are predictable and preventable.

What ties these causes together is context loss. Correct coding without aligned documentation, supervision, and authorization data still reads as risk to a payer. To reduce denials meaningfully, practices must move upstream and address how these elements connect long before a claim is submitted.

The three pillars of ABA revenue integrity that prevent denials before they happen

Reducing ABA denials is not about fixing claims faster. It is about preventing risk from entering the system in the first place. Practices that consistently maintain low denial rates tend to operate around three foundational pillars that tie daily clinical activity directly to reimbursement readiness.

The first pillar is proactive authorization management. In 2026, authorizations are no longer passive approvals that sit in a file until they expire. They function as live constraints that shape scheduling, staffing, and care intensity. When authorizations are tracked in real time and connected to the calendar, practices avoid the quiet accumulation of over-cap sessions that later get denied. Without that visibility, even experienced teams unknowingly deliver services that cannot be reimbursed

The second pillar is documentation that maps cleanly to the code being billed. In ABA, this means more than complete notes. It means session documentation that explicitly demonstrates protocol fidelity, measurable progress, and clinical decision-making for that specific unit of time. When documentation templates and workflows are standardized around payer expectations, claims stop relying on interpretation and start standing on evidence.

The third pillar is timely submission and structured denial management. Claims submitted within a tight window after service delivery carry less risk because supporting documentation is fresh, supervision logs are complete, and discrepancies are easier to correct. When denials do occur, mature practices route them immediately to the right owner, whether clinical, authorization, or billing, rather than cycling them through generic queues.

Together, these pillars shift revenue integrity upstream. Instead of reacting to payer decisions, practices shape how claims are perceived before they are ever reviewed. This prevention mindset becomes even more important when denial triggers are understood in detail.

How an outsourced RCM partner shifts ABA billing from cleanup to prevention?

Most ABA practices do not struggle because their clinical teams lack discipline. The challenge is the sheer volume of rules tied to Medicaid policies, EVV, supervision, authorizations, and payer-specific billing logic. In-house teams relying on spreadsheets and manual checks cannot consistently catch those issues before claims go out the door.

This is where an outsourced RCM team makes the difference. Instead of asking providers to build internal billing intelligence, blueBriX assumes responsibility for monitoring authorization usage, validating documentation, and enforcing payer requirements before services are billed. The work is done proactively by specialists who understand how payers score compliance and where claims typically fail.

A service-led model also simplifies documentation expectations. Rather than leaving clinicians to interpret medical-necessity standards or risk repeating generic phrasing, the RCM team reviews notes, flags gaps early, and ensures supervision alignment long before an audit is possible. The goal is to give providers clarity, not more administrative labor.

The same preventive mindset applies to claims preparation. Before a claim is submitted, blueBriX reviews rendering credentials, modifier rules, EVV alignment, and weekly unit limits, so preventable denials do not pile up downstream. If a claim still gets questioned, the RCM team owns the follow-up, escalation, and evidence gathering, instead of pushing the burden back to clinical staff.

This approach turns RCM into an operational safety net. Cash flow becomes more predictable, clinicians reclaim time from retroactive paperwork, and leadership no longer has to assign internal staff to chase issues that external experts can manage faster and more consistently. In other words, outsourced RCM stops being a cleanup function and becomes a guardrail that protects reimbursement before risk ever reaches a payer.

What measurable impact does strong revenue integrity actually deliver?

When revenue integrity is working, the results show up clearly, not just in billing reports but across the organization. Practices with aligned authorization tracking, documentation standards, and submission workflows consistently reduce denial rates and shorten accounts receivable cycles.

Clean claim rates rise because fewer claims enter review with missing context. Denials tied to supervision, modifiers, and unit caps drop sharply once those checks are enforced upstream. Many practices see a meaningful reduction in rework, allowing billing teams to focus on exceptions instead of volume. Faster reimbursement stabilizes payroll cycles and reduces reliance on credit or cash buffers during high-growth periods

There is also a clinical impact. When clinicians are not pulled into repeated documentation corrections or retroactive supervision requests, they spend more time on care quality and treatment planning. Leadership gains confidence to expand services, add clinicians, or enter new payer contracts knowing that growth will not amplify compliance risk.

At this point, revenue integrity stops feeling like a defensive strategy. It becomes a growth enabler. That shift sets up the final question every ABA leader eventually asks.