America’s $400 billion Medicare Advantage market is showing cracks in unexpected places.

The numbers don’t lie, but they do tell a complicated story. Four years of Medicare Advantage star rating data reveal an industry grappling with a fundamental tension: how to deliver consistent quality care while managing explosive growth across an increasingly complex healthcare landscape.

The Centers for Medicare & Medicaid Services (CMS) star ratings represent more than bureaucratic scorekeeping. They determine billions in quality bonus payments and shape how 26 million Americans choose their health coverage. More importantly, they offer a window into whether Medicare Advantage, which now covers 48% of Medicare beneficiaries, is delivering on its promise of better coordinated, higher quality care.

The answer, based on performance trends from 2022 through 2025, is nuanced and troubling.

The preventive care crisis

Perhaps most concerning is the steady erosion in preventive care measures. Breast and colorectal cancer screening averages have fallen from 3.9 stars in 2022 to approximately 3.4 stars in 2025. Diabetes management metrics, including crucial eye exams and blood sugar control, have declined by roughly half a star over the same period.

This isn’t a minor statistical blip. It represents a systemic failure in member engagement at precisely the moment when early intervention could prevent costly complications. The financial implications are staggering: each percentage point improvement in diabetic eye exams alone can prevent millions in downstream medical costs across a large Medicare Advantage population.

The decline suggests that rapid plan enrollment growth has outpaced the infrastructure needed to maintain meaningful member relationships. Plans have become proficient at acquiring members but struggle to keep them engaged in their own health management between acute episodes.

The coordination paradox

While preventive care deteriorates, post-acute care coordination is improving. Medication reconciliation, readmission reduction, and care transitions have climbed from the mid-2s to approximately 3.0-3.2 stars. Emergency department follow-up protocols show similar gains.

This split reveals something important about Medicare Advantage operations: plans excel at managing crises but struggle with prevention. They’ve built sophisticated systems to coordinate care after hospitalizations when stakes are high and workflows are standardized but haven’t translated this competence to routine wellness management.

The irony is profound. Medicare Advantage’s core value proposition is preventive care and care coordination, yet plans are succeeding at expensive reactive coordination while failing at cost-effective prevention.

The member experience plateau

Member satisfaction metrics tell their own story of institutional strain. “Getting Needed Care” and “Rating of Health Plan” show modest declines, while “Getting Care Quickly” remains stagnant around 3.1 to 3.4 stars. These aren’t dramatic drops, but they represent concerning trends in an industry built on customer satisfaction.

The pattern suggests that Medicare Advantage plans are becoming victims of their own success. As enrollment grows, maintaining the personal touch that originally differentiated them from traditional Medicare becomes increasingly difficult. Members are encountering longer wait times, more complex prior authorization processes, and less responsive customer service.

Appeals and complaints processing, which are often the first indicators of operational stress, also show similar warning signs. Slight declines in timeliness and decision review quality suggest that back-office operations haven’t scaled with membership growth.

The innovation imperative

What’s most striking about these trends is how they illuminate Medicare Advantage’s innovation challenges. An industry that has mastered actuarial science and risk adjustment seems to struggle with basic member engagement and preventive care delivery.

Part of the problem is technological. Most Medicare Advantage plans operate on legacy systems designed for claims processing, not member engagement. They can identify high-risk members with sophisticated algorithms but lack the digital infrastructure to engage those members consistently between doctor visits.

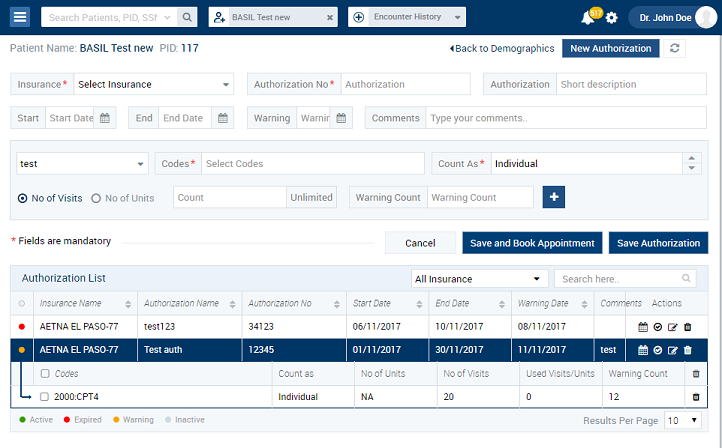

The solution isn’t more technology, but a better integration of existing systems. Plans need platforms that connect clinical data with member behavior, social determinants with care management, and provider networks with member preferences. The goal isn’t more data, but more actionable insights delivered at the point of member interaction. This is the foundational principle behind the blueBriX platform.

The quality bonus stakes

These performance trends have immediate financial implications. Quality bonus payments, which can represent 20% or more of a plan’s government revenue, are directly tied to star ratings. A plan that slides from 4 to 3.5 stars can lose hundreds of millions in bonus payments, as Elevance Health recently discovered in their high-profile legal battle over rating methodology.

More importantly, declining performance threatens Medicare Advantage’s political sustainability. The program’s rapid growth has created scrutiny from policymakers concerned about costs and quality. Consistent declines in basic preventive care measures provide ammunition for critics who argue that Medicare Advantage plans prioritize profits over patient outcomes.

The view from the ecosystem: regulators, providers, and beneficiaries

The internal tensions revealed in star ratings are not isolated. They ripple across the entire Medicare Advantage ecosystem, impacting key stakeholders in ways that compound the challenge for plans.

- The Regulatory squeeze: The decline in star ratings is not simply a passive outcome; it is the direct result of an increasingly demanding regulatory environment. The CMS has been consistently raising the bar through more rigorous cut-point methodologies and by increasing the weight of consumer-centric measures. This means that a plan must not only maintain its performance but continually improve just to stand still. This regulatory pressure is a key driver of the quality paradox, forcing plans to navigate a moving target where yesterday’s performance is not enough for tomorrow’s bonuses.

- The Provider burden: Physicians and health systems are at the front lines of this operational strain. While the write-up notes the paradox of improving post-acute care, it’s important to recognize that providers often bear the administrative burden of this process. The growth in prior authorization requests and complex claims processes—often tied to a plan’s need to manage costs—creates significant friction. This burden can strain provider-plan relationships and can ultimately contribute to the very member satisfaction issues noted above, as it may delay or complicate access to care.

- The Beneficiary’s dilemma: For the beneficiary, Medicare Advantage’s value proposition is built on the promise of coordinated, high-quality care with extra benefits. However, the data suggests a troubling trade-off. As plans struggle to scale, members may find that the “personal touch” disappears, replaced by long wait times and bureaucratic hurdles. The Star Ratings decline in preventive care metrics signals a failure to deliver on the most fundamental promise: keeping people healthy and out of the hospital in the first place. The result is a growing sense of frustration and declining trust, which is now being formally captured in satisfaction surveys and complaints.

This confluence of pressures from regulators, providers, and members makes the current Medicare Advantage landscape a high-stakes, high-risk environment. The question is no longer just how to grow, but how to do so sustainably while meeting the demands of every party in the ecosystem.

A blueprint for a better system: moving from paradox to progress

The data makes one thing clear: the current Medicare Advantage system, while a success in growth, is not optimized for sustainable, high-quality care. To reverse these troubling trends and secure the program’s future, a fundamental shift in strategy is required. This isn’t just about small tweaks; it’s about rebuilding the foundation in direct response to the market’s most pressing policy discussions.

- Integrate siloed operations, inspired by interoperability mandates: The greatest single barrier to seamless care is the lack of connection between a plan’s administrative, clinical, and member-facing teams. A truly effective system breaks down these silos, using a single, comprehensive platform to connect claims data with clinical histories, member demographics with social determinants of health, and provider performance with quality metrics. This is more than a best practice; it’s a necessity as CMS continues to push for greater interoperability and the transition to electronic data capture and reporting (ECDS) for HEDIS measures. These moves signal a future where claims-based reporting alone will be insufficient, and real-time, integrated data is the only path to compliance and success.

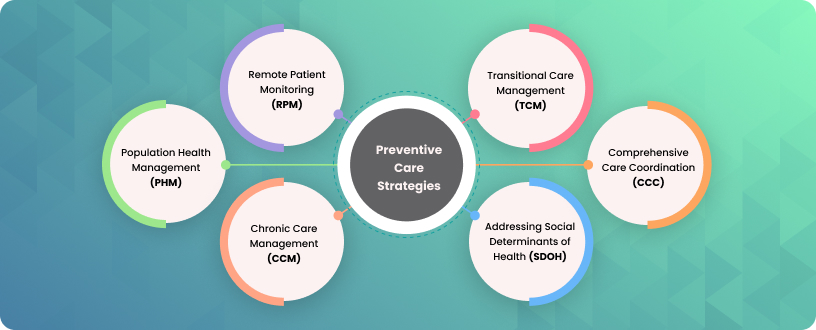

- Prioritize proactive engagement aligned with CMS priorities: The decline in preventive care stems from a failure to engage members effectively. A better system would leverage advanced analytics and AI to identify high-risk members and those with care gaps. It would then automate and personalize outreach across multiple channels to deliver the right message at the right time. This approach directly addresses CMS’s renewed focus on health equity and outcome-based measures. The shift from a “reward factor” to the new “Excellent Health Outcomes for All” (EHO4all) program and the weighting changes for patient experience measures make it essential for plans to not just report on care, but to proactively improve it for all populations, especially those with social risk factors.

- Align and incentivize the ecosystem amidst fee schedule changes: The current system often pits plans against providers, with competing administrative requirements and misaligned incentives. A more effective approach would use a shared data platform to align goals and streamline workflows. This is crucial as CMS proposes new payment rules, such as site-of-service adjustments, to ensure payment parity and reduce hospital consolidation. For MA plans, this means building a system that can effectively manage care transitions and provider collaboration to avoid penalties and improve outcomes, while for providers, it means having the tools to navigate a complex, value-based landscape and demonstrate their contribution to quality metrics.

- Build for regulatory change, not around it: The CMS Star Ratings methodology is constantly evolving. Plans that build their operations around static, legacy systems will always be a step behind. The recent decline in quality bonus payments and the finalization of new measures for 2026 and beyond—like the Kidney Health Evaluation for Patients with Diabetes—prove that the bar for quality is constantly rising. A forward-looking system is architected for flexibility, with the ability to model changes in cut points, predict the impact of new measures, and provide real-time performance insights. This turns regulatory change from a threat into a competitive advantage.

This blueprint for a better system is not theoretical. The technology to achieve it exists. The financial incentives are already in place. But are the industry leaders are ready to make the necessary investments to move from managing a troubled market to building a better one?