How Much Revenue Are You Really Losing?

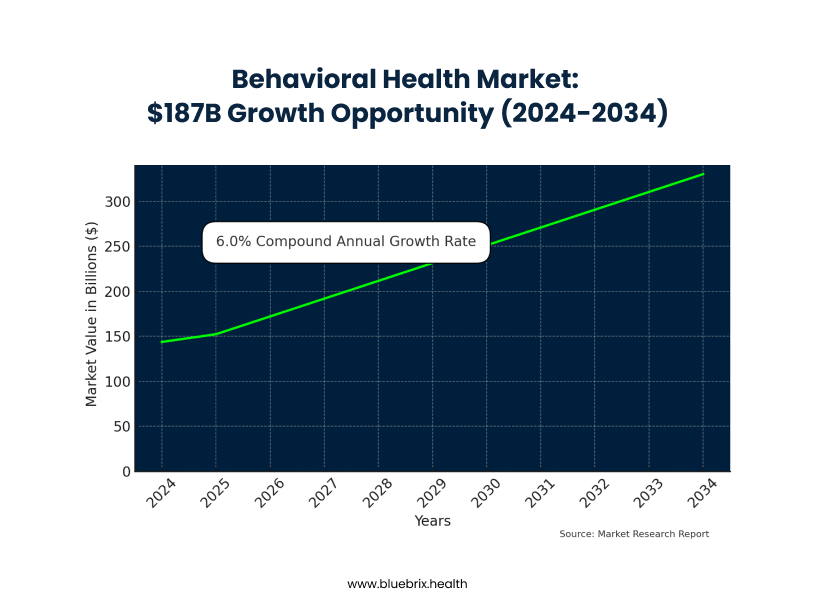

Imagine losing potential revenue because your front desk is stuck on hold with Blue Cross, desperately trying to verify a patient’s insurance. This frustrating scenario is a daily reality for behavioral health practices, leading to significant financial losses and administrative chaos. While the behavioral health market is booming, projected to grow from $143.74 billion in 2024 to $330.35 billion by 2034, your practice likely struggles with unique administrative burdens that other medical specialties don’t face.

Behavioral health is an administrative nightmare by design. Unlike standardized medical procedures, you navigate crisis interventions, diverse therapy modalities, medication management, and substance abuse treatments, each with complex, ever-changing insurance rules. Your claims are individually worth less, yet require just as much administrative effort, creating a “behavioral health penalty” where the overhead per dollar earned is crushing.

This administrative burden doesn’t just impact your bottom line; it drives patients away. A staggering 30% of potential patients abandon treatment before booking due to insurance uncertainties. This “patient exodus” means lost revenue, missed opportunities for early intervention, and a devastating ripple effect on your practice’s growth and mission.

The daily grind of manual insurance verification is killing your staff and mission. Your team spends hours on frustrating phone calls, battling outdated information and constant rule changes. This leads to a revenue cycle nightmare: denied claims, surprise bills for patients, eroded trust, and unpredictable cash flow. Inaccurate information, often due to human error, directly causes these denials, necessitating costly appeals and diverting staff from patient care. AI-powered insurance verification offers a transformative solution to these pervasive challenges

How AI Technology Could Transform Your Practice

Imagine walking into your practice tomorrow morning and seeing your front desk staff actually smiling. They’re not on hold with insurance companies. They’re not frantically scribbling notes about confusing benefit explanations. Instead, they’re welcoming patients, scheduling appointments, and handling the human interactions that actually matter.

This vision is what drives the development of AI-powered insurance verification technology.

The Promise of Real-Time Verification

The technology potential is significant: Advanced AI systems are being developed to process insurance verification in seconds rather than minutes or hours. The goal is to provide complete, accurate benefit information including exact copays, deductibles, session limits, pre-authorization requirements, and real-time policy status.

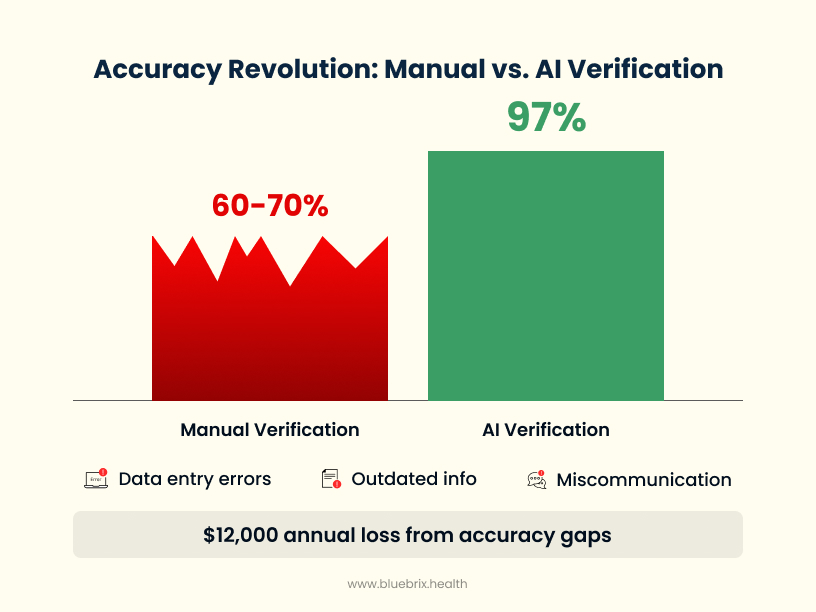

Current research shows that AI systems can potentially achieve over 97% accuracy in benefit verification , compared to the 60-70% accuracy typical with manual processes. This represents a fundamental shift from guessing to knowing.

Proactive Intelligence That Could Prevent Problems

The most promising AI systems don’t just verify benefits—they’re designed to predict and prevent the problems that typically blindside practices.

Pattern recognition technology aims to analyze historical claims data and identify patterns that lead to denials before claims are even submitted. The concept is that machine learning could learn that certain diagnosis codes get scrutinized more heavily by specific insurers, that particular service combinations trigger automatic reviews, and that certain patient demographics face different approval criteria.

Automated claim scrubbing represents another frontier where Natural Language Processing could review documentation and flag potential issues before submission. The technology could potentially notice when a diagnosis doesn’t align with the treatment plan, when session notes don’t support the billed service level, or when required prior authorizations are missing.

Continuous monitoring systems could track policy updates in real-time and alert practices to changes that affect their patients . Instead of finding out about policy changes when claims get denied, practices could receive immediate notifications about coverage updates.

The Critical Distinction: Provider-Side vs. Payer-Side AI

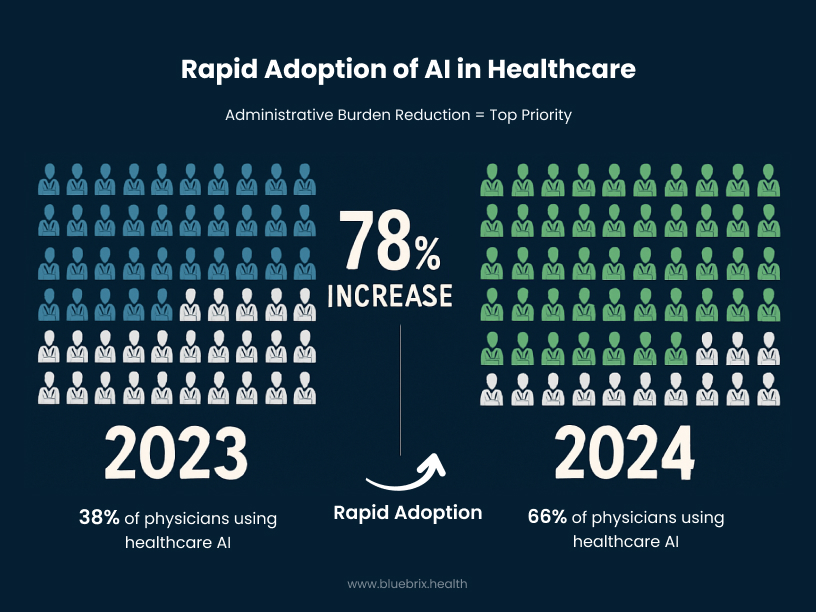

The healthcare industry is experiencing rapid AI adoption. Currently, 66% of physicians report using healthcare AI, representing a 78% increase from 2023 (2 in 3 physicians are using health AI—up 78% from 2023 | American Medical Association). Importantly, 57% of physicians identified reducing administrative burdens through automation as the most promising application for AI.

Industry-Wide Results Suggest Significant Potential

While individual vendor results vary, industry research suggests substantial opportunities for improvement. A Black Book Research report found that 83% of healthcare organizations reported AI-driven automation reduced claim denials by at least 10% within the first six months of implementation (Black Book Research Releases First Industry-Wide Evaluation of AI-Driven Revenue Cycle Management Solutions). KLAS Research indicated that AI-powered analytics could potentially reduce claim denials by up to 50% (AI In Revenue Cycle Management Market Size Report, 2030 – Grand View Research).

Studies show that healthcare organizations implementing AI in revenue cycle management report various levels of cost savings, with 35% reporting savings of 10% or more. Some organizations have documented time savings of thousands of hours monthly through automation of administrative tasks (A healthcare giant is using AI to sift through millions of transactions. It’s saved employees 15,000 hours a month. – Business Insider Nederland).

Behavioral Health-Specific Opportunities

Research specifically focused on behavioral health suggests unique opportunities for improvement. Studies indicate that behavioral health organizations could potentially see 20% increases in claim approval rates and 15% reductions in time to receive payments through AI-driven solutions. Mid-sized hospitals have documented 30% reductions in denials within the first quarter of implementing AI-driven revenue cycle management.

The potential for staff satisfaction improvement appears significant, with some studies suggesting reductions in administrative burnout when repetitive tasks are automated.

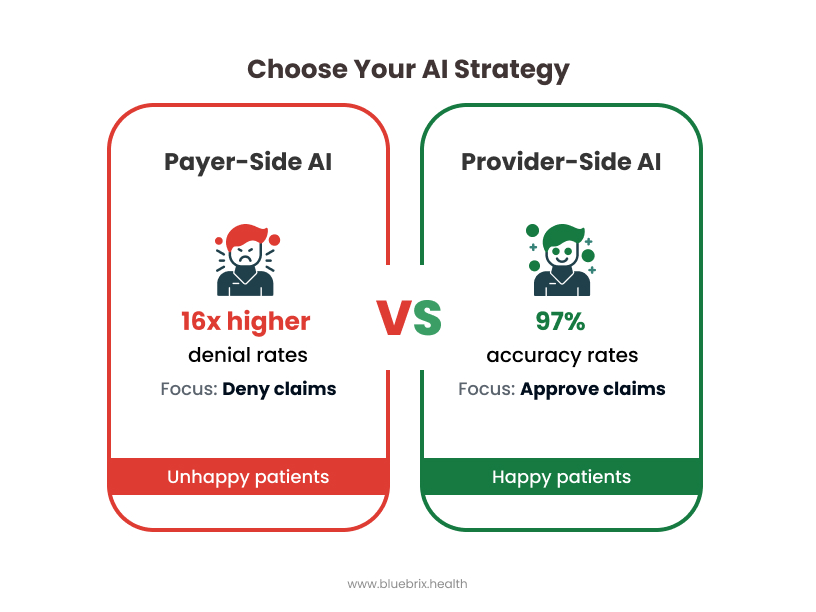

The Critical Distinction: Provider-Side vs. Payer-Side AI

You might be thinking, “Wait, isn’t AI in healthcare controversial? I’ve heard horror stories about AI denying claims.”

You’re absolutely right to be cautious, but it’s important to distinguish between different applications of AI.

The Problem with Payer-Side AI

When insurance companies use AI to make prior authorization decisions, it creates concerning scenarios. Research shows these systems can produce denial rates up to 16 times higher than typical (Physicians concerned AI increases prior authorization denials), delay patient care for 90% of providers, lead to treatment abandonment for 82% of patients, and contribute to negative clinical outcomes including hospitalization, life-threatening events, and even complications in some cases (How AI is leading to more prior authorization denials | American Medical Association).

This represents antagonistic AI—technology designed to minimize approvals to reduce insurance company costs.

The Promise of Provider-Side AI

When practices use AI internally for verification and preparation, the technology serves a different purpose. The goal is ensuring claims are accurate before submission, reducing denial likelihood through better preparation, accelerating approval processes by submitting clean claims, and maintaining human oversight for all clinical decisions.

This represents “augmented intelligence”—AI that enhances team capabilities without replacing clinical judgment. The technology supports rather than denies care, helping ensure patients get needed services without administrative roadblocks.

Implementation Considerations for Behavioral Health Practices

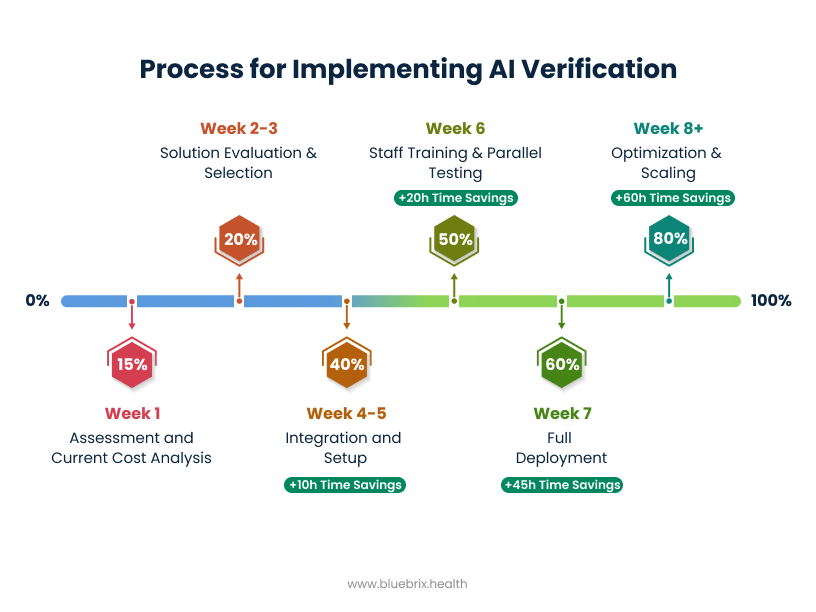

If you’re considering AI-powered insurance verification, here are key factors to evaluate.

Assessment Phase

Start by calculating the true cost of your current verification process. Track how many hours your staff spends on verification weekly, calculate your current denial rate and time spent on appeals, document the number of patients who don’t schedule due to insurance uncertainty, and estimate your annual revenue loss from verification-related issues.

Technology Requirements

Look for solutions offering real-time verification with high accuracy rates, seamless integration with your existing EHR and practice management systems, comprehensive HIPAA compliance and security features, continuous policy monitoring with real-time updates, and customizable workflows that match your specific behavioral health needs.

Behavioral health has unique requirements that generic healthcare AI may not address effectively. Your technology partner should understand the nuances of mental health billing and coverage requirements.

Implementation Strategy

Modern AI solutions should integrate smoothly with existing systems without disrupting current workflows. Staff training should be minimal, and practices should see immediate improvements in verification speed and accuracy.

Consider starting with basic verification automation and expanding to additional AI capabilities including predictive denial prevention, automated appeals processing, patient cost estimation tools, and comprehensive revenue cycle analytics.

Measuring Success: The KPIs That Matter

Track your potential transformation with metrics that reflect real business impact. Monitor verification time per patient, verification accuracy rate, claim denial rate reduction, staff hours saved weekly, patient booking completion rates, and revenue cycle cost as percentage of collections.

The most important metrics: Staff satisfaction and patient experience improvements. When your team stops dreading insurance calls and patients get clear answers upfront, the difference should be immediately apparent.

The Competitive Landscape Is Evolving

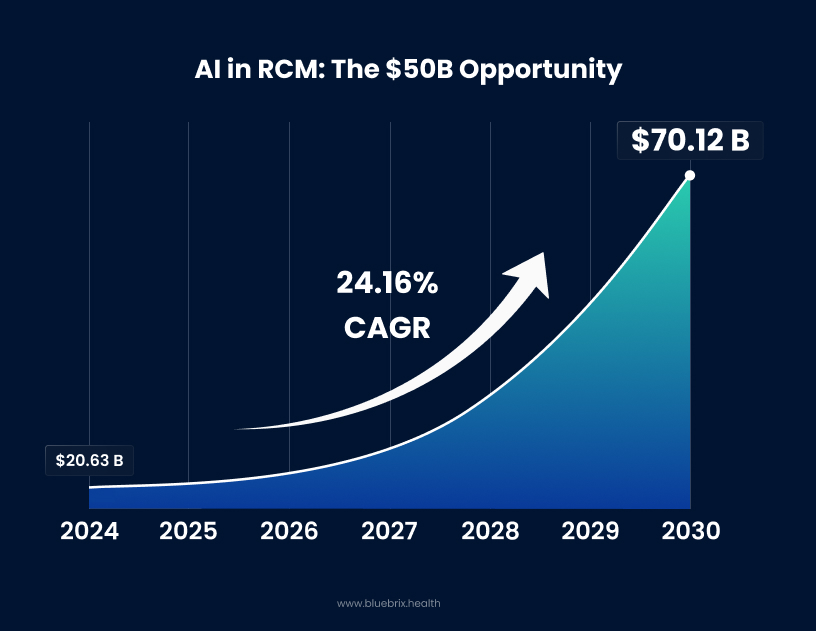

Healthcare AI adoption is accelerating rapidly. The AI in revenue cycle management market is growing at 24.16% annually and is projected to reach $70.12 billion by 2030. Currently, 70% of healthcare organizations are implementing AI technologies beyond experimental phases (Healthcare AI adoption up, but data and integration challenges persist).

Early adoption could provide competitive advantages: better patient acquisition rates in a price-sensitive market, improved staff retention in a field prone to burnout, higher profit margins in an industry with traditionally thin margins, and enhanced reputation for efficiency and transparency.

The opportunity window may be limited. As more practices implement AI verification, having accurate, real-time insurance information could become standard expectation rather than competitive advantage.

The Choice That Defines Your Practice’s Future

You’re at a crossroads that could define your practice for the next decade. You can continue wrestling with manual verification processes that frustrate your staff, confuse your patients, and drain your revenue. Or you can explore AI solutions that could transform administrative burden into competitive advantage.

This isn’t just about operational efficiency—it’s about fulfilling your mission. You became a behavioral health provider to help people heal, not to spend your days fighting with insurance companies. Every hour your staff spends on hold with insurers is an hour not spent supporting patients who need your help.

Your patients are depending on you to explore better solutions. In a field where seeking help requires enormous courage, you can’t afford to let administrative friction become another barrier to care. When someone finally decides to call your practice, you need to be ready with clear answers and smooth processes.

Your staff deserves better than administrative burnout. The behavioral health field already demands enormous emotional energy from your team. Don’t compound that with frustrating, repetitive administrative tasks that technology could potentially handle better, faster, and more accurately.

Your practice deserves predictable profitability. You can’t plan for growth, invest in new services, or attract top talent when your revenue cycle is unpredictable and your administrative costs are spiraling out of control.

The technology is rapidly developing. The market opportunity is clear. The question is whether you’ll explore these emerging solutions or wait for others to lead the transformation.