If you’re running a behavioral health clinic, you already know reporting is not just paperwork. It is the backbone of your reimbursement, compliance, and payer relationships. Medicaid, Medicare, and commercial insurers all expect you to deliver reports that prove medical necessity, show clinical quality, and document outcomes.

The problem is that these reports are complex, time-consuming, and different for every payer. When documentation falls short, claims get denied, audits are triggered, and revenue takes a hit. Imagine submitting claims for intensive outpatient sessions only to have them denied because your treatment plans weren’t updated or your progress notes didn’t tie outcomes back to goals. That denial puts your clinic on a payer’s radar for future reviews. That’s why compliance-ready reports are non-negotiable. They protect your revenue, keep your clinic audit-ready, and let you demonstrate real clinical value.

In this blog, we’ll break down the reports you need, the metrics payers look for, and how to build reporting workflows that actually work for you. This guide is designed for outpatient behavioral health practices, Certified Community Behavioral Health Clinics (CCBHCs), multi-payer clinics, Medicare-participating providers, and substance use disorder (SUD) treatment centers to help you stay compliant, audit-ready, and financially protected.

So, where do you start? It begins with the core reports every behavioral health clinic must have in place.

Which core compliance reports should every behavioral health clinic track?

Some reports are the price of admission in behavioral health. Without them, your clinic risks denials, compliance gaps, and missed reimbursements. These are the non-negotiables:

- Claims submissions: Every billed encounter must have clean claims with correct CPT/HCPCS and ICD-10 codes, session details, and charges. Incomplete claims are the number one cause of denials.

- Progress notes and clinical documentation: Notes should clearly show what happened in a session—time, location, patient concerns, interventions, and outcomes. Regulators lean heavily on these to confirm medical necessity.

- Treatment plans: Payers want to see defined goals, measurable outcomes, and progress updates. An outdated or missing plan is a fast track to denied claims.

- Medical necessity documentation: Every service has to show the “why”—why the patient needs this care, how severe the condition is, and what the expected outcomes are.

- Care coordination reports: Behavioral health is rarely a solo act. Reports should show how you’re coordinating with other providers, managing referrals, and tracking medication changes.

- Quality measures: Think beyond compliance to performance. Many payers now want data on patient access, engagement, and outcomes through measures like HEDIS or CCBHC.

Together, these reports build the foundation of compliance. Without them, you’re flying blind. But here’s the reality, you won’t stop at just these. Different payers and different stages of care demand additional, more detailed documentation. That’s where specialized reports come in.

When do you need specialized compliance reports in behavioral health?

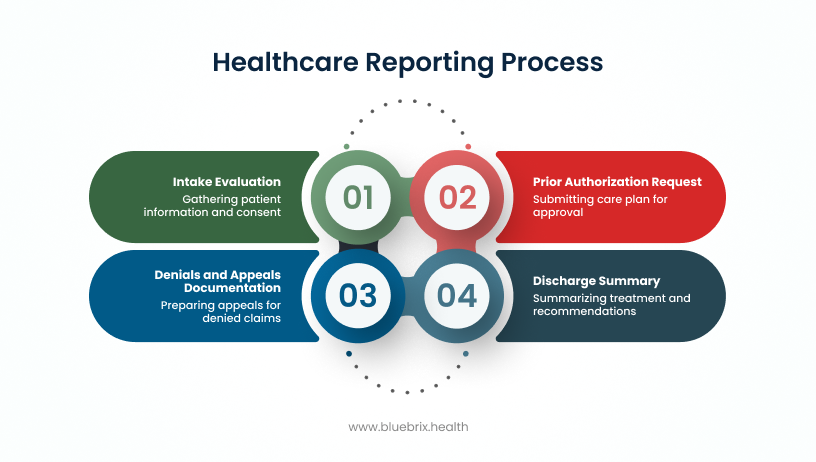

Here’s where they come into play:

- Intake evaluations: The first step is everything. A detailed intake evaluation captures demographics, eligibility, assessments, and signed consents. Without it, you’re setting yourself up for future claim issues.

- Prior authorization requests: Many payers won’t let treatment move forward until you’ve shown them why it’s necessary. A strong prior authorization request lays out the care plan, rationale, and expected benefits.

- Denials and appeals documentation: Denials happen—but how you respond matters. A clear, well-supported appeal can recover revenue and show payers that your clinic takes compliance seriously.

- Discharge summaries: Closing the loop on care isn’t optional. Discharge summaries give payers proof that treatment was completed responsibly and that you’re coordinating the next steps for patient care.

Specialized reports aren’t needed every day, but when they are, they’re your defense against financial loss and compliance exposure.

Now, even with your core and specialized reports in order, there’s another hurdle: external scrutiny. Regulators and payers won’t just take your word for it. That’s why regulatory and audit reports matter.

How do regulatory and audit reports keep your clinic ahead of scrutiny?

Specialized reports prove you’re handling individual cases the right way, but regulators and payers want more than snapshots. They expect to see that your entire clinic is consistently compliant and financially accurate. That’s where regulatory and audit reports step in.

Here’s what matters most:

- Compliance self-audits: Think of this as your internal dress rehearsal before the real audit. Self-audits help you spot errors in documentation, coding, or claims before an external review finds them. Catching problems early saves you from costly penalties.

- Value-based care reports: With more payers moving toward outcome-driven models, it’s not enough to show services were delivered, you have to prove they made a measurable difference. These reports track population health, engagement, and risk data tied to programs like CCBHC or Medicare Behavioral Health Integration.

Regulatory and audit reports aren’t just about satisfying oversight, they’re your opportunity to demonstrate that your clinic is proactive, not reactive. When you have these reports built into your workflows, you reduce audit risks and position your clinic as a strong candidate for value-based contracts.

Once you’ve got compliance reporting under control, the next challenge is making sure the processes behind those reports hold up. That’s where reporting workflows come into the picture.

What reporting workflows keep behavioral health clinics audit-ready?

Having the right reports is one thing—delivering them in the right way is another. Even the most detailed report can be rejected if the workflow behind it doesn’t meet payer and regulatory expectations. In other words, compliance is as much about process as it is about content.

Here are the workflow details that make or break compliance:

- Provider credentials and signatures: Every report must include the right provider identifiers and signatures. Missed details here can undo an otherwise perfect claim.

- HIPAA and documentation rules: Protecting patient privacy isn’t optional. From intake to discharge, your reporting must follow HIPAA rules and payer-specific retention requirements. Any slip can lead to breaches or loss of payer trust.

- Submission methods and formats: Each payer has its own playbook. Some want reports pulled directly from your EHR, others ask for Excel templates, and some insist on secure portal uploads. Submitting the wrong way slows you down and raises compliance red flags.

When workflows are sloppy, even good data won’t save you. But when you design workflows that anticipate payer requirements, you create a smoother path to reimbursement, fewer denials, and better payer relationships.

Now that you understand the mechanics of workflows, the next logical question is: what exactly do different payers expect from you? Let’s look at Medicaid, Medicare, and commercial insurance requirements side by side.

What reporting requirements do medicaid, medicare, and commercial payers expect?

Even with strong workflows, one-size-fits-all reporting doesn’t work. Each payer has its own rules, formats, and expectations. If you try to treat them the same, you’ll end up with denials, compliance gaps, and strained payer relationships.

Here’s what you need to know for the big three:

- Medicaid: States expect detailed, encounter-level documentation. Think of progress notes, treatment plans, discharge summaries, and medical necessity proof for every billed service. Many states also require encounter data reports and internal self-audits. Miss those, and you risk recoupments after audits.

- Medicare: Medicare is shifting toward value-based care. Beyond clean claims, you’ll need to show performance metrics like Behavioral Health Integration (BHI) reports, MIPS quality measures, and sometimes data on digital tools or care coordination activities. Medicare wants proof that care delivered led to better outcomes, not just that care happened.

- Commercial insurance: Commercial payers vary widely, but a few themes are consistent. They want standard claims plus documentation to back them up, proof of parity compliance under MHPAEA, and sometimes patient satisfaction or quality audit data. They’re especially focused on access, follow-ups, and treatment coordination.

The bottom line? Each payer plays by different rules. Clinics that build flexible reporting strategies for each payer type stay ahead of denials and avoid costly compliance flags.

But payer rules aren’t the whole story. To stay compliant, you also need to report on the financial, staffing, and operational data that gives payers the bigger picture. That’s where mandatory data elements come in.

What mandatory data elements do payers expect in compliance reports?

Payers don’t just want to see what services you delivered—they want the full story. That means pulling in financial, staffing, and operational data alongside clinical reports. These mandatory elements give payers a complete view of how your clinic is run.

Here’s what typically gets included:

- Provider information: Basic identifiers like facility details, NPIs, Medicaid or Medicare IDs, reporting period, and authorized signatures. Get this wrong, and the whole report can be rejected.

- Financial trial balance: A detailed breakdown of expenses, from overhead and capital assets to cost centers and service lines. Payers want to know exactly where the dollars go.

- Utilization statistics: Data on visits, patient days, service volume, and payer mix. This shows how care is being delivered across populations.

- Cost allocation: Transparent methods for distributing shared expenses across services. Each payer expects justification for how you allocate overhead.

- Revenue details: Revenue by payer type, adjustments, grants, allowances, and even bad debt. Medicare often wants gross charges, while Medicaid focuses on payer categories.

- Staff and ancillary data: FTE counts by credential, salary and wage data, contract labor, and benefits. This demonstrates how staffing supports care delivery.

- Certification and attestation: Signed confirmation that the data is accurate. Medicaid, Medicare, and commercial plans all require it, but the formats differ.

Mandatory data elements are where compliance meets operations. Any mismatch between what you report and what your internal records show can trigger audits or even repayment demands.

Now, collecting this data isn’t just about satisfying payers. To stay ahead, you need to track the right metrics that show not only compliance but also the value and efficiency of your care. Let’s look at the key compliance metrics that drive results.

Which metrics prove your clinic is truly compliance-ready?

Reporting the required data checks the box. But if you want to stay audit-ready and show real value, you also need to track the metrics that measure quality, efficiency, and financial health. These numbers tell the story behind your compliance.

Here are the metrics that matter most:

- Clinical quality metrics: Engagement rates (how many patients complete intake and stick with treatment), screening rates for conditions like depression or substance use, measurable outcome improvements (like PHQ-9 score reductions), care coordination activities, and timely follow-ups after discharge. These prove you’re delivering care that meets medical necessity and drives results.

- Financial and utilization metrics: Cost per patient or episode, revenue per visit, denial and appeal rates, and days in accounts receivable. These show whether your clinic is financially sustainable and efficient.

- Operational efficiency metrics: Provider productivity, no-show and cancellation rates, time to prior authorization, and documentation timeliness. These reflect how well your clinic runs day to day.

- Payer-specific metrics: Each payer has its own focus—Medicaid looks at access and population outcomes, Medicare zeroes in on quality and collaborative care, while commercial insurers monitor parity compliance and patient satisfaction.

Metrics take you from reactive compliance (“we submitted the report”) to proactive management (“we can prove our care is effective, efficient, and value-based”). And here’s the reality: if these metrics aren’t tracked, your clinic risks more than just denied claims. Thefallout can be financial, reputational, and operational. Let’s talk about what happens when clinics fall short.

What happens if your clinic falls short on compliance reporting?

Picture this: your clinic submits claims to Medicaid for intensive outpatient services. The codes and session details look fine, but treatment plans are outdated and progress notes are incomplete. Medicaid auditors catch the gaps, deny the claims, and demand repayment of past reimbursements. Suddenly, you’re not just losing revenue—you’re also flagged for a broader compliance review.

It doesn’t stop with Medicaid. Commercial insurers may withhold payment until you prove parity compliance. Medicare may penalize you for missing required quality metrics. And in every case, the financial hit is only part of the problem. The bigger issue is credibility. Once a payer labels your clinic as non-compliant, future contracts, reimbursements, and participation in value-based models all come under threat.

The message is clear: falling short on compliance costs far more than a few denied claims. It can disrupt operations, drain resources, and damage your reputation.

The good news? You don’t have to manage this on your own. The right technology can turn compliance reporting from a burden into a strategic advantage.

How can technology like blueBriX protect your clinic from compliance risks?

The challenge is that most clinics try to juggle payer requirements, siloed systems, and manual processes. That’s a recipe for missed details, denials, and unnecessary stress.

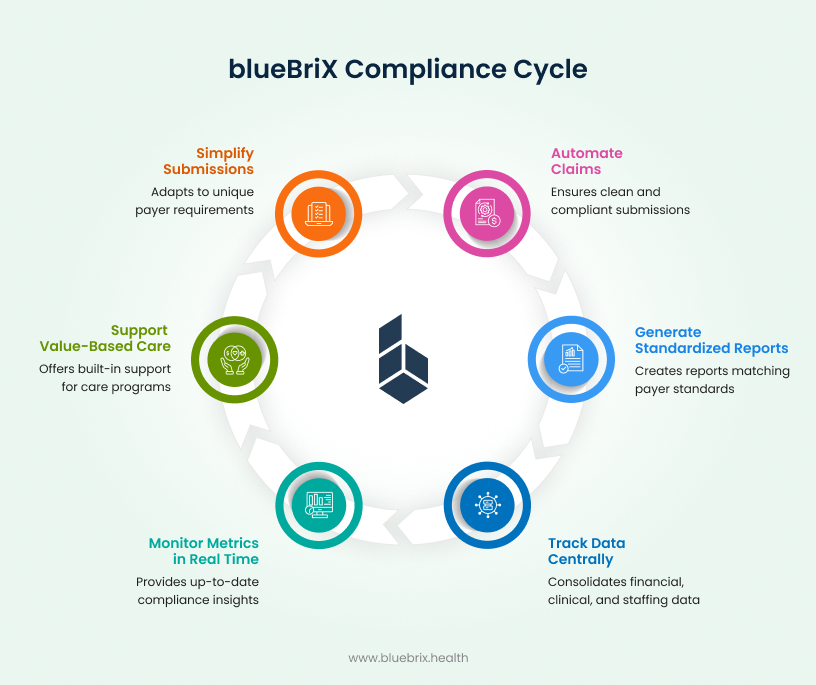

This is where blueBriX makes the difference. Purpose-built for behavioral health, blueBriX takes the guesswork out of compliance by unifying reporting across Medicaid, Medicare, and commercial payers. Instead of piecing together spreadsheets and chasing signatures, your clinic gets a platform that ensures every required element is captured, validated, and audit-ready.

With blueBriX, you can:

- Automate claims and documentation: Every claim goes out clean, complete, and compliant.

- Generate reports that match payer standards: From treatment plans to discharge summaries, all standardized and ready for submission.

- Track mandatory data in one place: Financial, clinical, and staffing data pulled together accurately.

- Monitor metrics in real time: See where you stand with compliance before a payer ever asks.

- Stay ready for value-based care: Built-in support for programs like MIPS, BHI, and CCBHC.

- Simplify submissions across payers: Adapt automatically to each payer’s unique requirements.