Impact of the 2026 CMS efficiency adjustment on practice revenue

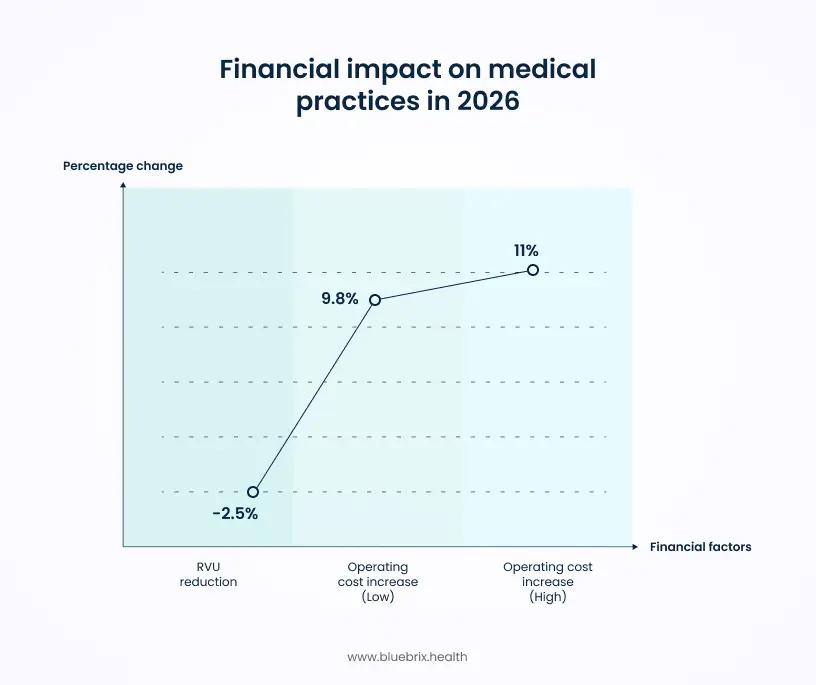

The 2026 Medicare Physician Fee Schedule (PFS) Final Rule delivered a backhanded compliment that will cost you thousands. Buried in the final rule is the new Efficiency Adjustment. CMS has finalized a -2.5% reduction to the work relative value units (RVUs) for nearly 7,700 non-time-based codes. The rationale is that improvements in medical technology should theoretically allow providers to perform procedures faster. However, this assumption creates a significant financial gap for practices facing real-world inefficiencies.

- Revenue Compression: While the conversion factor remains relatively flat ($33.40), the -2.5% RVU reduction effectively lowers reimbursement for diagnostics, imaging, and minor procedures.

- Rising Operating Costs: According to global medical trend reports, practice operating expenses (staffing, supplies, and software licenses) are projected to increase by 9.8% to 11% in 2026.

- The Net Result: Providers are facing a double squeeze—lower reimbursement per procedure combined with double-digit inflation in overhead costs.

Capitalizing on the +4% office-based payment shift

Despite the cuts, the 2026 Final Rule offers a distinct advantage for independent practices willing to retain services in-house. CMS finalized a policy that reduces Indirect Practice Expense payments for facility-based services by ~7% but increases payments for non-facility (office-based) services by roughly +4%.

To understand the +4% opportunity, you have to understand how CMS calculates your paycheck. Every time you bill a code (like a Level 4 Office Visit, 99214), CMS pays you for three things:

- Work: Your brain, time, and skill.

- Malpractice: Your liability insurance cost.

- Practice Expense (PE): The cost of renting the room, buying the computer, hiring the nurse, and keeping the lights on.

In 2026, CMS radically changed how they calculate #3 (Practice Expense).

The overhead logic

CMS realized that when you treat a patient in a Hospital (Facility), the hospital pays for the lights, the nurse, and the computer. You don’t. So, why should they pay you for that overhead?

- The 2026 Change: CMS slashed the Indirect Practice Expense allocation for facility-based services by roughly -7%. If you go to the hospital to treat a patient, your professional fee is lower because CMS assumes you have zero overhead.

- The 2026 Bonus: To balance this, they shifted that money to Office-Based (Non-Facility) settings. They effectively said, “If you treat the patient in your own clinic, we acknowledge you are paying the rent and the staff. We will pay you ~4% MORE.”

The 11% swing

The decision for a practice manager is no longer just clinical; it is financial. If you have a patient who needs a minor procedure, a diagnostic scan, or a complex consultation, you face a choice:

- Option A: Refer to Hospital/Facility. You lose the overhead payment. You face the -7% cut.

- Option B: Treat In-House. You capture the full Non-Facility rate, including the new +4% boost.

The spread between these two options is roughly 11%.

The strategic imperative

This policy effectively pays you to be independent. It penalizes practices that act merely as referral nodes to large hospital systems and rewards practices that act as comprehensive care hubs.

To capture this +4% bonus, practices must treat their clinic as a comprehensive care hub. This requires the internal infrastructure to handle complex diagnostics, Remote Patient Monitoring (RPM), and chronic care management without referring patients out. Relying on referral-engine legacy EHRs limits a practice’s ability to retain these high-value episodes of care.

How to Capitalize:

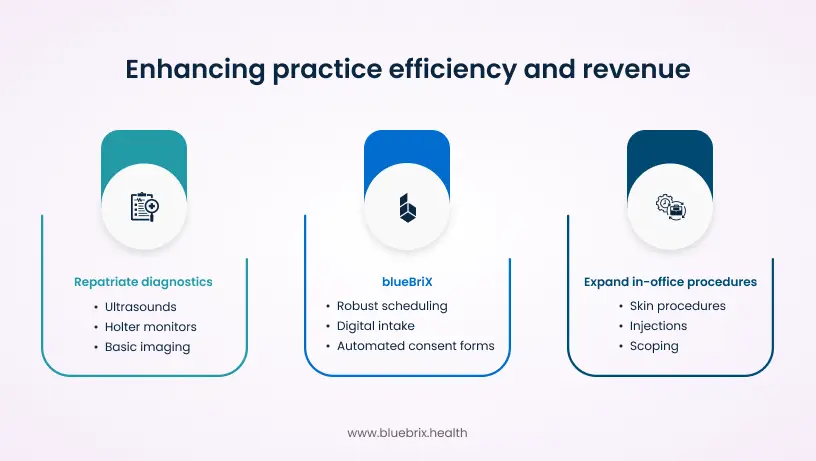

- Repatriate Diagnostics: If you are referring out ultrasounds, Holter monitors, or basic imaging, stop. Bring them in-house. The reimbursement for the technical component plus the higher professional fee now justifies the equipment cost.

- Expand In-Office Procedures: Review your CPT codes. Any procedure that can be safely performed in the office (skin procedures, injections, scoping) should never be scheduled in a facility setting in 2026.

- The blueBriX Enabler: You cannot safely bring these services in-house if you are using a paper-based or lite EHR. You need robust scheduling, pre-procedure digital intake, and automated consent forms to handle the increased operational complexity. blueBriX allows you to build the Hospital-Grade workflows required to capture the Office-Based bonus.

The bottom Line: In 2026, Place of Service isn’t just a box you check on a claim form. It is the single biggest multiplier for your margin. Own the site of service, and you own the revenue.

ROI analysis: The cost of third-party vendors vs. In-house tech

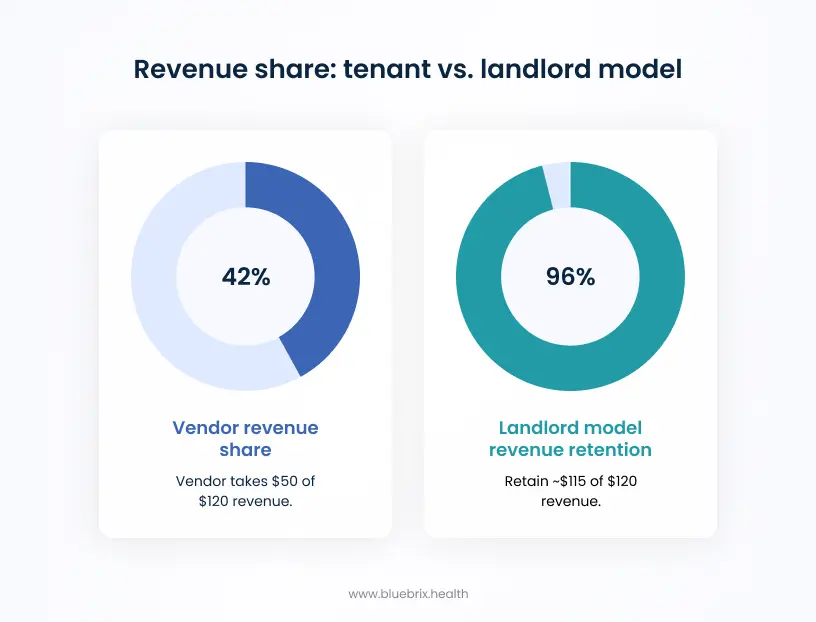

Many practices utilize third-party companies to manage RPM, Chronic Care Management (CCM), or Revenue Cycle Management (RCM). These vendors typically operate on a revenue-share model, often taking 40–50% of collections.

In a tightening margin environment, this outsourced model is mathematically unsustainable. In 2026, the single biggest controllable expense on your P&L is the Vendor Tax.

The CEO’s choice: two business models

1. The “tenant” model (revenue share)

- The deal: You use a third-party vendor to manage your Remote Monitoring program.

- The economics: You generate $120/month per patient in gross revenue. The vendor takes $50 (42%) off the top. You are left with $70.

- The risk: You own none of the infrastructure. If the vendor raises prices or goes under, your revenue stream vanishes. You are building their business, not yours.

2. The “landlord” model (In-house with blueBriX)

- The deal: We build the workflow on your own infrastructure using blueBriX’s pre-built modules.

- The economics: You generate $120/month per patient. You pay a flat software license fee (a fraction of the cost). You retain ~$115 of the margin.

- The upside: You own the patient data and the workflow. You are building a tangible digital asset that increases your practice’s valuation.

The bottom Line: In a year where margins are tightening, the difference between keeping $70 and $120 per patient is the difference between surviving and scaling.

3 strategies to offset fee schedule cuts using custom workflows

To survive the efficiency adjustment and capture the office-based bonus, you need to evict the middlemen. Here is the operational blueprint:

1. Automating patient intake to reduce administrative burden

CMS assumes you are automated. Make it true.

Legacy EHRs require an average of 62 clicks to document a complex encounter. That is an inefficiency tax on your time. What you can do instead is, use blueBriX to build Intelligent Intake forms. Patients complete history/ROS on their phones, and blueBriX maps that data directly into the chart fields. No manual transcription. No scanning. You actually achieve the speed CMS is billing you for.

2. Maximizing G2211 and RPM revenue retention

2026 expands the G2211 complexity add-on code to home visits. Combined with RPM, the home is now a high-margin site of service. But instead of buying a disjointed Telehealth App and a separate RPM Portal, use blueBriX to build a unified patient companion app. Trigger G2211 compliance automatically based on visit duration and complexity, and bill RPM codes directly from the patient’s daily log-ins.

3. Deploying advanced primary care management (APCM) tools

The new APCM codes are designed to pay you for total patient management. These codes require tracking aggregate patient data that standard EHRs struggle to visualize. blueBriX allows you to build custom Care Management Dashboards that flag APCM-eligible patients and track their monthly requirements automatically, ensuring you never miss a billable event.