Credentialing feels deceptively similar on the surface until you try to manage Medicaid and commercial payers side by side.

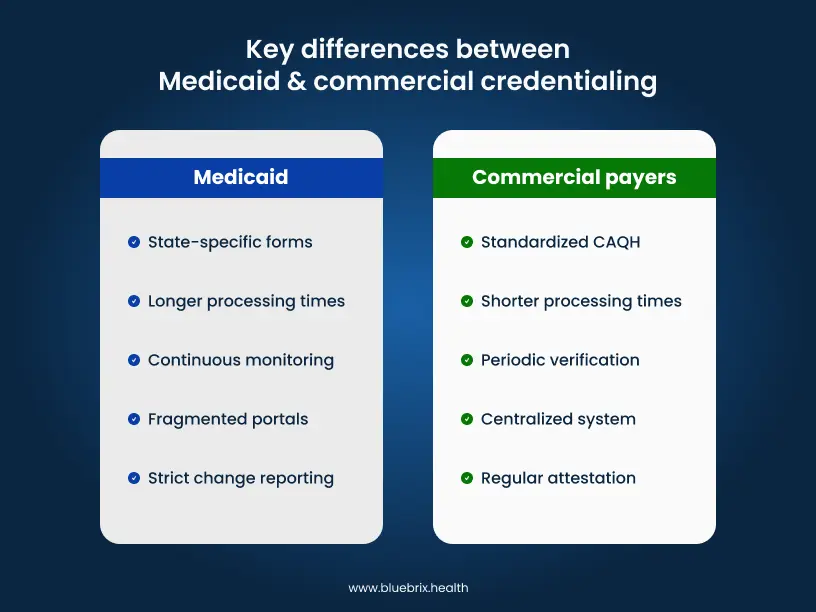

What many providers underestimate is that they are not navigating two variations of the same process. They are operating within two fundamentally different credentialing ecosystems, each built on distinct assumptions, validation models, and administrative controls. One prioritizes standardization and centralized data reuse. The other emphasizes state-level oversight, program integrity, and manual verification, often at the cost of speed.

A fully built and attested CAQH profile may satisfy every commercial payer on your list. Yet that same completeness carries little weight when you move into Medicaid credentialing. Different portals. Different forms. Different source verification rules. In many cases, different definitions of what “complete” even means. The result is duplicated work, fragmented timelines, and avoidable enrollment delays that directly impact provider go-live dates and revenue realization.

The real risk is operational drag. Missed revalidations, silent denials, stalled enrollments, and providers delivering care without reimbursement eligibility are all downstream consequences of treating Medicaid and commercial credentialing as a single workflow.

This guide breaks down the practical differences providers need to account for when credentialing across both payer types—what documentation truly matters, where timelines diverge, which mistakes trigger rejections, and how to run both tracks in parallel without creating bottlenecks.

Before we get into those differences, it’s critical to understand what has changed in 2025—because credentialing strategies that worked even a year ago are now quietly costing providers time, revenue, and compliance confidence.

Regulatory updates: what’s changed this year

- CMS enforces 90-day timelines with quarterly audits and digital verification mandates for high-risk providers.

- NCQA shortened verification to 120 days max with monthly OIG checks and strict 36-month re-credentialing.

- Texas/CA/FL added MCO portals, fingerprints, and digital forms like DHCS 6207—processing now 150+ days.

- CAQH profiles expire after 90 days; new telehealth/APCM fields with real-time PSV integration.

- National Provider Directory rollout (2026) standardizes multi-state license verification.

Now that you know what regulatory changes are affecting timelines, let’s break down exactly what documentation each system demands—and why they’re asking for completely different things.

Medicaid vs. commercial payer credentialing: key differences providers must know

Both Medicaid and commercial payers verify the same basic qualifications—your license is valid, your training is legitimate, you’re not excluded from federal programs. But how they verify this, what additional proof they demand, and where you submit everything differs so dramatically that treating them as similar processes guarantees delays and rejections.

Here’s what each system actually requires.

Documentation requirements: what each payer wants to see

Medicaid and commercial credentialing verify the same provider’s qualifications, but the paperwork they demand differs significantly. Medicaid leans on state-specific disclosure forms you won’t find anywhere else, while commercial payers built from a standardized CAQH foundation with insurer-specific additions.

Medicaid documentation: state rules vary widely

The baseline across all states: Every state Medicaid program requires your NPI, current state license, DEA certificate (if prescribing), and malpractice insurance. You’ll submit these through state portals—Texas uses PEMS, California runs Medi-Cal Provider Enrollment, New York operates eMedNY.

Where states diverge:

- Texas demands fingerprint background checks for certain provider types and detailed ownership disclosures for anyone holding 5% or more of your practice—including names, addresses, and social security numbers.

- California requires the DHCS 6207 Disclosure Statement covering every license you’ve ever held (even from other states), all legal names you’ve used, and any prior sanctions or exclusions.

- Florida mandates Level 2 background screening through AHCA plus HIV/AIDS training certification.

The documentation Medicaid wants commercial payers don’t:

Medicaid programs require ownership transparency that commercial payers rarely ask for: W-9s, IRS determination letters, operating agreements listing all stakeholders, and individual disclosure forms for each owner. Miss these, and your application stalls—even if your CAQH profile is perfect.

Commercial payer documentation: CAQH plus insurer additions

Nearly all commercial payers pull from your CAQH profile as the foundation. This central database includes your education, work history, licenses, board certifications, hospital privileges, malpractice coverage, and peer references. The catch is that you must re-attest every 120 days, or it goes inactive.

What the major players add:

- UnitedHealthcare scrutinizes your complete work history over the past five years. Any gap exceeding 30 days requires a written explanation—sabbatical, maternity leave, illness, whatever the reason. They also verify hospital privileges thoroughly and cross-check your practice’s Tax ID against IRS records if you’re part of a group.

- Aetna places heavy emphasis on hospital affiliation documentation. If you’re a specialist performing procedures, they want verification letters on hospital letterhead showing your specific privilege categories and effective dates—not just a list of where you have privileges. They also request detailed peer references from colleagues who’ve directly observed your clinical work.

- Cigna requires your professional liability insurance policy declarations page (the certificate of insurance isn’t enough), board certification maintenance documentation showing expiration dates for time-limited certifications, and extensive practice details including all NPIs and Tax IDs associated with your practice.

- Humana requests procedure volume data for procedural specialties, including annual procedure counts, available complication rates, and outcome metrics, plus verification of quality reporting like MIPS participation.

- Anthem Blue Cross Blue Shield (state-varying) often seeks documentation on cultural competency training, language capabilities, practice accessibility features, and acceptance of their utilization management protocols.

Timeline expectations: planning your credentialing calendar

Both Medicaid and commercial credentialing claim 90-day processing, but reality differs significantly. Understanding actual timelines helps you avoid the revenue gaps that catch most providers off guard.

Medicaid timelines: federal standards meet state reality

CMS mandates 90-day processing for complete applications, and 2025 enforcement includes quarterly state audits to improve compliance. But actual timelines stretch to 120-180+ days in most states due to backlogs, budget cycles, and verification delays.

State-by-state variations:

- Texas averages 90-120 days through PEMS, but add another 30-60 days if you need fingerprint background checks or have complex ownership structures requiring additional verification.

- California routinely exceeds 150 days through Medi-Cal Provider Enrollment, especially during volume surges when state hiring lags behind application increases.

- Florida averages 120-180 days once you factor in the Level 2 background screening through AHCA, which operates on its own timeline separate from the credentialing process.

- New York runs 100-150 days through eMedNY, with additional delays if you’re enrolling in multiple Medicaid managed care plans simultaneously.

What extends your timeline

Incomplete applications are the biggest culprit—missing one ownership disclosure form can add 45-60 days while you wait for the deficiency notice, resubmit, and get back in the queue. High-risk specialties (pain management, psychiatry with controlled substance prescribing) face additional scrutiny. State budget cycles also matter—avoid submitting near fiscal year-end when staff are overwhelmed.

Many states offer retroactive billing 90 days back from your approval date, so you can see Medicaid patients before full credentialing completes—but verify this with your specific state, as policies vary.

Commercial payer timelines: committee schedules control everything

NCQA-accredited plans target 60-90 days for straightforward applications, but 120-180 days is common once you account for credentialing committee meeting schedules and additional verification requirements.

What the major players actually take:

- UnitedHealthcare typically processes in 60-90 days when your CAQH profile is current and complete. They’re generally faster than most. However, any work history gaps requiring written explanations add 30 days while they review and verify your documentation.

- Aetna averages 90 days for primary care but stretches to 120-150+ days for specialists. Why? They conduct deep-dive hospital privilege verifications, contacting each facility directly for confirmation. More privileges = longer timeline.

- Cigna runs about 75 days for clean applications but bottlenecks at 120 days when reviewing high-volume practices or procedural specialists who require additional peer reference verification and outcome data review.

- Humana processes in 90-120 days but can extend to 150+ for Medicare Advantage plans, which have stricter quality standards and additional verification requirements beyond standard commercial credentialing.

- Anthem BCBS timelines vary by state (each Blue plan operates semi-independently), but generally expect 90-120 days, with longer waits in states with more rigorous state insurance department oversight.

The committee bottleneck:

Most commercial payers convene credentialing committees monthly to review and approve applications. If your complete application arrives the day after their meeting, you’re waiting nearly 30 days just to get on the agenda—plus processing time before and after. This explains why identical applications to the same payer can have 30-day timeline differences based purely on submission timing.

Primary source verification: different standards, different intensity

Medicaid and commercial payers verify your credentials directly from issuing sources, but Medicaid applies deeper compliance scrutiny while commercial payers prioritize efficiency through centralized databases.

Medicaid verification: state-led and continuous

State Medicaid programs contact state medical boards to verify your license, the DEA for controlled substance registration, and educational institutions to confirm your training. They also query the National Practitioner Data Bank (NPDB) for malpractice payments or adverse actions.

The exclusion monitoring difference:

What sets Medicaid apart is continuous exclusion monitoring. States check the OIG List of Excluded Individuals and Entities (LEIE) and System for Award Management (SAM) databases not just at credentialing, but monthly or weekly throughout your enrollment. If you’re excluded while seeing Medicaid patients, states can recoup all payments made during that period.

Site Visits:

Unlike commercial payers, Medicaid may conduct unannounced site visits for high-risk specialties (pain management, behavioral health), providers with complaint histories, or random compliance audits. Reviewers examine patient charts, controlled substance logs, and verify you’re practicing at your registered address.

Commercial payer verification: CAQH-centered efficiency

Commercial payers pull primary source verification through CAQH, which automatically verifies licenses through state boards, confirms education via the AMA Masterfile, and checks DEA registration. Payers supplement with CVOs that query NPDB and run OIG/SAM checks at initial credentialing and re-credentialing cycles (every 2-3 years)—not continuously like Medicaid.

Payer-specific deep dives:

- Aetna verifies hospital privileges through direct contact or official letters from facilities, confirming specific categories, effective dates, and any restrictions beyond basic existence.

- UnitedHealthcare contacts previous employers to verify work history, particularly for gaps exceeding 30 days, requiring documented explanations from former administrators.

- Cigna verifies board certifications directly through ABMS, checking whether your certification is current and time-limited, plus contacts your malpractice carrier to confirm coverage amounts and ensure no lapsed periods.

- Humana cross-checks CMS sanctions databases and state insurance department records, especially for Medicare Advantage credentialing with stricter federal standards.

Application platforms and processes: navigating different systems

Medicaid fragments across state portals while commercial payers centralize through CAQH. Managing both requires organized tracking to avoid platform-related delays.

Medicaid application systems

Every state operates its own credentialing portal with different interfaces and tracking capabilities. Texas uses PEMS with real-time dashboards. California runs Medi-Cal Provider Enrollment, communicating mainly through emails. New York operates eMedNY with separate pathways for fee-for-service versus managed care. Florida Share serves most providers, though rural areas still accept paper applications.

Beyond state portals, most states contract with 3-5 Medicaid managed care organizations requiring separate credentialing. In Texas, you credential through PEMS for state Medicaid, then separately through Amerigroup, UnitedHealthcare Community Plan, Molina, and Superior HealthPlan. Each MCO has unique logins and requirements.

Portal quality varies dramatically. PEMS offers detailed status tracking. Medi-Cal sends sporadic emails. Some MCO portals provide no visibility—you call provider services every few weeks hoping for updates. A tracking spreadsheet becomes essential to manage multiple applications across different systems.

Commercial payer systems

CAQH ProView serves as the universal foundation. Build one profile, attest every 120 days, and most commercial payers pull from it automatically—Aetna, UnitedHealthcare, Cigna, Humana, and hundreds more. CAQH handles primary source verification in the background, checking your licenses and education before payers even review your application.

Despite CAQH standardization, major payers maintain supplement portals for additional requirements:

- Aetna: Uses Availity for uploading hospital privilege verification letters and tracking real-time application status with detailed progress indicators

- UnitedHealthcare: Operates Provider Express for submitting work history gap explanations, W-9 forms, and monitoring credentialing committee review schedules

- Cigna: Runs CignaforHPS for uploading board certification documentation, professional liability policy declarations, and specialty-specific requirements

- Humana: Uses its Compass portal for Medicare Advantage credentialing, quality program enrollment, and Stars ratings participation.

Commercial portals offer superior user experience—real-time updates, mobile apps, automated alerts when applications advance, and live chat support. This contrasts sharply with Medicaid’s fragmented communication and limited visibility.

Ongoing maintenance and re-credentialing: keeping your status active

Credentialing isn’t one-and-done. Both Medicaid and commercial payers require ongoing maintenance, but their approaches differ—Medicaid varies by state with strict change reporting, while commercial payers standardize through CAQH with regular attestation requirements.

Medicaid maintenance requirements

States set their own schedules, typically every 3-5 years. For example, Texas re-credentials every 3 years through PEMS. California operates on 5-year cycles. New York requires re-credentialing every 3 years for most providers. Missing your re-credentialing deadline can suspend your Medicaid billing privileges until you complete the process.

Most states require you to report changes within 30 days. What triggers mandatory reporting: practice address changes, ownership changes affecting anyone holding 5%+ stake, adding or removing providers from your group roster, license renewals or lapses, malpractice insurance changes, or criminal convictions.

Failing to report ownership changes is particularly risky—states audit these regularly and can recoup payments if your ownership structure doesn’t match what’s on file. Some states also require updated site documentation when you move locations or add practice sites.

State-specific requirements

Beyond re-credentialing, states mandate ongoing compliance documentation. Florida requires HIV/AIDS training certificate renewals. California requires updated tuberculosis clearances. Texas may require updated background checks for certain provider types. Track these separately from your re-credentialing cycle since they often operate on different timelines.

Commercial payer maintenance

Commercial maintenance centers on CAQH re-attestation every 120 days. The 2025 update tightened this—profiles now go inactive after 90 days without attestation, and payers like Aetna and UnitedHealthcare immediately reject inactive profiles. Set a recurring 90-day calendar reminder and attest even if nothing changed. This single action maintains your credentials across dozens of commercial payers simultaneously.

Re-credentialing cycles

NCQA standards require full re-credentialing every 36 months (3 years) with complete primary source verification repeated—licenses, education, board certifications, malpractice history, and OIG/SAM checks. Payers also run monthly OIG monitoring between re-credentialing cycles to catch any exclusions.

Real-time change reporting:

Commercial payers expect immediate updates for significant changes:

- Aetna requires notification within 30 days when hospital privileges change, renew, or expire

- UnitedHealthcare wants updates within 15 days for work location changes, new specialties, or roster changes

- Cigna requires real-time reporting of malpractice claims filed against you, even before settlement

- Humana demands immediate notification of any license disciplinary actions or sanctions

Unlike Medicaid’s structured 30-day windows, commercial payers emphasize “real-time” or “prompt” reporting—interpret this as within 2 weeks to stay safe.

Everything covered so far applies to most providers, but your specialty adds layers of complexity that can extend timelines by months. Here’s what changes based on what you practice.

Specialty-specific considerations: How your practice type affects the process

Your specialty shapes credentialing differently across Medicaid and commercial payers. Here’s how each practice type navigates both systems.

Specialists

Medicaid:

- For high-risk procedures (like heart surgery), states check your special training certificates and hospital permission letters. TX/FL also ask for your procedure numbers and success rates last year.

- Carved-out services complicate process—behavioral health, dental, or specialty services may credential through separate MCOs with independent timelines.

- Medicaid verifies every board certification you list—primary and subspecialties like cardiology-oncology through state boards.

Commercial:

- Hospital privileges verified for each specific procedure you perform—colonoscopy, interventional cardiology, surgical procedures.

- Required to show outcome rates like complication rates, procedure volumes, patient satisfaction scores, specialty registry participation.

- All subspecialty certifications verified through ABMS, including whether you’re maintaining active certification

- Expect 30-60 additional days compared to primary care due to detailed privilege verification

Behavioral health providers

Medicaid:

- States require additional background checks beyond standard credentialing

- Must verify specialty training in trauma care, suicide prevention, and cultural competency

- For provisionally licensed therapists, must document supervisor credentials, agreements, and supervision hours

- Some states require completely separate credentialing through behavioral health-specific managed care organizations

Commercial:

- Companies like Optum, Magellan, and Beacon handle behavioral health separately with their own portals, timelines, and requirements

- Must complete a behavioral health supplement in CAQH covering treatment approach, specialties, and prescribing authority

- Supervision requirements are less strict than Medicaid but still verified

- Many commercial behavioral health networks aren’t accepting new providers, making it harder to join panels

Allied health providers (NPs, PAs, Nurse Midwives)

Medicaid:

- Scope of practice verification varies by state—full practice authority states allow independent credentialing; restricted states require collaborative physician agreements

- Collaborative agreements scrutinized heavily—must include supervisor’s license, DEA, scope limitations, and supervision frequency

- State practice act alignment verified—if state expanded NP scope recently, Medicaid updates contracts faster than commercial payers

- PAs must document supervising physician’s Medicaid enrollment—if supervisor isn’t enrolled, credentialing stalls

Commercial:

- Independent credentialing in full practice authority states, but many payers still require collaborative agreements regardless of state law

- Incident-to billing documentation if billing under physician NPI—employment relationship, supervision availability, scope of services (UnitedHealthcare particularly strict)

- PA supervising physician must be credentialed with same payer—application pauses until supervisor completes credentialing

- Scope of practice may be licensed but not contracted—review payer fee schedules to confirm expanded scope services are covered and reimbursed

- CAQH profiles for NPs/PAs require additional fields on supervision, prescribing authority, and scope limitations

Now that you understand the processes, let’s talk about what actually goes wrong. These mistakes cause 80% of credentialing delays and denials—and most are completely avoidable.

Common pitfalls and how to avoid them

These are the mistakes that cause most credentialing delays. We’ve seen practices lose six months of revenue because of issues that take five minutes to fix—if you know about them upfront.

Medicaid-specific pitfalls

Missing state-specific disclosure requirements: Each state requires different information upfront—some need detailed ownership structures, others want background on all staff with patient access. Miss one disclosure, and your application gets rejected or delayed for months.

Incorrect tax identification numbers for group vs. Individual: Using your personal TIN when you should use your group’s NPI (or vice versa) is one of the most common mistakes. This mismatch causes claims denials even after you’re technically credentialed.

Overlooking managed care plan credentialing: Being credentialed with state Medicaid doesn’t automatically credential you with the managed care plans that actually pay the claims. You must credential separately with each MCO—Anthem, UnitedHealthcare, Centene—which many providers discover only after seeing patients.

Failing credential practice locations separately: If you practice at multiple locations, many states require separate credentialing for each address. Seeing patients at an uncredentialed location can trigger audit penalties and claim denials retroactively.

Not understanding ownership disclosure thresholds: Some states require disclosure of anyone owning 5% or more of your practice; others set the bar at 10%. Getting this wrong flags your application for additional review and delays approval by weeks or months.

Commercial payer pitfalls

CAQH profile errors that cascade to multiple payers: CAQH feeds your information to dozens of commercial payers. One mistake such as wrong NPI, outdated license, incorrect address—gets replicated across every payer pulling from your profile, causing mass credential rejections.

Incomplete hospital affiliation documentation: If you have hospital privileges, payers want proof like a letter from the medical staff office, your appointment letter, or current privilege documentation. “I have privileges at XYZ Hospital” without supporting documents isn’t enough and will stall your application.

Not updating CAQH regularly (the 90-day inactivity issue): If you don’t log into CAQH and attest your information is current every 90 days, your profile goes inactive. Payers can’t pull your data, and you won’t know until applications start getting rejected.

Mismatched information between individual and organizational profiles: Your individual CAQH profile says one address, but your group practice profile lists another. Or your personal NPI doesn’t match what’s listed under the group. These mismatches cause payers to reject applications or delay processing while they request clarification.

Failing to link individual providers to group practice correctly: You and your group are both credentialed separately, but if you’re not properly linked in the payer’s system, claims submitted under the group NPI with your individual rendering NPI get denied. This requires manual corrections and resubmissions for every claim.

If you’re credentialing as part of a group practice, you face an additional layer of complexity that solo providers don’t deal with. The NPI/TIN connection issues here cause more claim denials than almost anything else.

Group practice credentialing: tax ID and ownership disclosure variations

Type 1 NPIs identify individual providers, while Type 2 NPIs identify organizational entities. However, state Medicaid systems require explicit documentation linking providers to their practice groups. Without this connection established in the payer’s system, claims submitted under the group’s tax identification number will be rejected, even when providers are properly credentialed.

The solution involves submitting employment verification—typically W-2 forms or employment contracts—to your state Medicaid enrollment department. Processing takes approximately 2-6 weeks. This step is essential because improperly processed claims can result in significant recoupments when payers identify payment errors retrospectively.

Ownership disclosure across payer types

Medicaid requires disclosure of all individuals holding 5% or greater ownership stakes in a practice. This federal requirement mandates updates within 35 days of any ownership changes.

Commercial payers vary considerably in their requirements. While some request ownership information during initial credentialing, many have minimal ongoing disclosure requirements. Review individual payer contracts to understand specific obligations.

Managing ownership transitions

When ownership structures change—through partner buyouts, new investor additions, or member exits—multiple reporting obligations are triggered simultaneously. Medicaid and Medicare maintain strict timelines, while commercial payer requirements range from 30-day notifications to updates only at recredentialing intervals.

State-level considerations

Beyond payer requirements, states increasingly mandate beneficial ownership reporting to identify ultimate controlling parties, even when ownership flows through complex corporate structures. These state requirements operate independently of credentialing processes and vary significantly by jurisdiction.

Despite perfect applications and complete documentation, denials still happen. When they do, here’s exactly how to fight back—because the appeal process differs dramatically between Medicaid and commercial payers.

Denial and appeal processes: what happens when things go wrong

Denials happen. Sometimes it’s a missing form, sometimes it’s more complicated. Here’s how to handle them depending on who denied you.

Medicaid appeals

- The process: Each state runs its own hearing process. You’ll typically have 30-60 days to file an appeal, though this varies. Some states give you 90 days, others just 30. Check your denial letter for the exact deadline.

- What you need: Your complete application, the denial letter, and documentation addressing whatever they flagged. If they denied you for incomplete ownership disclosure, submit the missing owner information with your appeal.

- Reality check: Medicaid appeals succeed when you’re fixing a paperwork problem. If there’s a substantive issue—like sanctions history or license problems—appeals are harder to win.

- Group credentialing twist: When a group gets denied, you need to show why the entire organization should be approved, not just individual providers. This often requires corporate documentation and compliance attestations.

Commercial payer appeals

- Start internal: Every commercial payer has a reconsideration process. Submit your appeal to their credentialing department first. Many denials get overturned here when you provide missing information.

- Escalation options: If internal appeals fail, you can file a complaint with your state insurance department. This gets the payer’s attention, especially if they’re violating state prompt-pay or credentialing laws.

- Peer review: Some denials involve clinical concerns. Request peer review if your credentials are being questioned by another physician. This gives you a fairer hearing.

- Contracting leverage: If you’re part of a larger group or have existing relationships with the payer, mention this. Payers sometimes reconsider when they realize you’re already in their network under a different arrangement.

- NCQA standards: If the payer is NCQA-accredited, their own standards may support your appeal. Reference specific NCQA credentialing standards that support your case.

Reading this far makes one thing clear: credentialing across both tracks is a full-time job. Most practices can’t sustain this administratively while maintaining patient care. That’s where specialized credentialing partners become worth the investment.

Streamline credentialing: partner with RCM specialists

Juggling PEMS, CAQH, and MCO portals overwhelms even experienced teams. Specialized RCM service partners handle multi-payer tracking, ownership disclosures, and timeline predictions—freeing providers for patient care.

What top partners deliver:

- Single dashboard monitors all systems (state portals + commercial)

- Auto-flags TIN/NPI mismatches, 5% ownership gaps, CAQH lapses

- Pre-populates payer-specific forms (Aetna privileges, UHC gaps)

- Predicts committee dates, appeals deadlines

Why blueBriX stands out: proven RCM expertise

20+ years of specialized experience working with over 500 practices across the US—behavioral health groups, multi-specialty clinics, and primary care organizations. We understand the nuances between Medicaid and commercial payer requirements because we’ve navigated them thousands of times.

Our credentialing approach

Simultaneous multi-payer enrollment

We don’t credential one payer at a time. Your providers get enrolled across PEMS, Medi-Cal, eMedNY, and managed care organizations like Amerigroup and Molina concurrently. This parallel processing approach achieves first-time approvals 45% faster than industry averages, which means your providers join networks sooner, and you can expand payer contracts immediately.

Proactive compliance monitoring

Credentials lapse when practices miss renewal deadlines. Our automated alert system tracks 90-day CAQH attestation windows, ownership change requirements, and license expiration dates. You receive timely reminders that prevent credential lapses—which means no claim rejections due to inactive provider status and no interruptions to your revenue cycle.

Integrated EDI setup

Credentialing is only half the equation. We establish payer connections and configure EDI setups simultaneously so you can submit claims on Day 1 of network participation. This integration eliminates the typical lag between credentialing approval and actual claim processing, accelerating your cash flow.

Comprehensive regulatory compliance

We maintain audit-ready documentation that satisfies Medicaid’s 5% ownership disclosure requirements, ongoing OIG exclusion monitoring, and state-specific regulatory mandates. Our compliance tracking protects you from penalties, retrospective recoupments, and the operational disruptions that come with non-compliance findings.