By 2026, ACO REACH (Realizing Equity, Access, and Community Health) will be in its final performance year. CMS has already signaled that this is not a wind-down period. It is a stress test. The 2026 updates harden the model’s financial methodology so that organizations are rewarded only when they can manage risk with discipline, not when they benefit from generous benchmarking or loose coding rules.

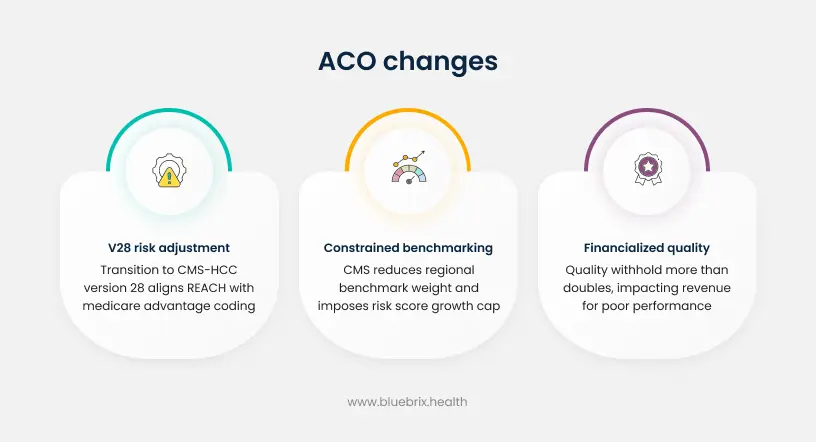

Three non-negotiable financial shifts define this new environment:

- The V28 risk adjustment cliff: The full transition to the CMS-HCC Version 28 model for Standard and New Entrant ACOs aligns REACH with the tighter coding rigor already phasing into Medicare Advantage.

- Constrained benchmarking: CMS is reducing the weight of the regional benchmark (shifting Standard ACOs to a 60/40 blend favored toward historical baselines) and imposing a cumulative cap of 3% on risk score growth from 2019 through 2026.

- Financialized quality: The quality withhold more than doubles, jumping from 2% to 5% of the benchmark. This effectively financializes performance failure—poor quality scores now carry a punitive revenue impact that can wipe out shared savings.

For executives, the message is simple. Historical advantages from favorable regional benchmarks, aggressive coding, or modest quality withholds will not carry organizations through PY 2026. The results from PY 2023 already show that while 73 percent of ACOs achieved positive net savings, performance varied widely and savings were concentrated among ACOs that mastered complex populations and operational execution, particularly High Needs ACOs with net savings rates above 13 percent.

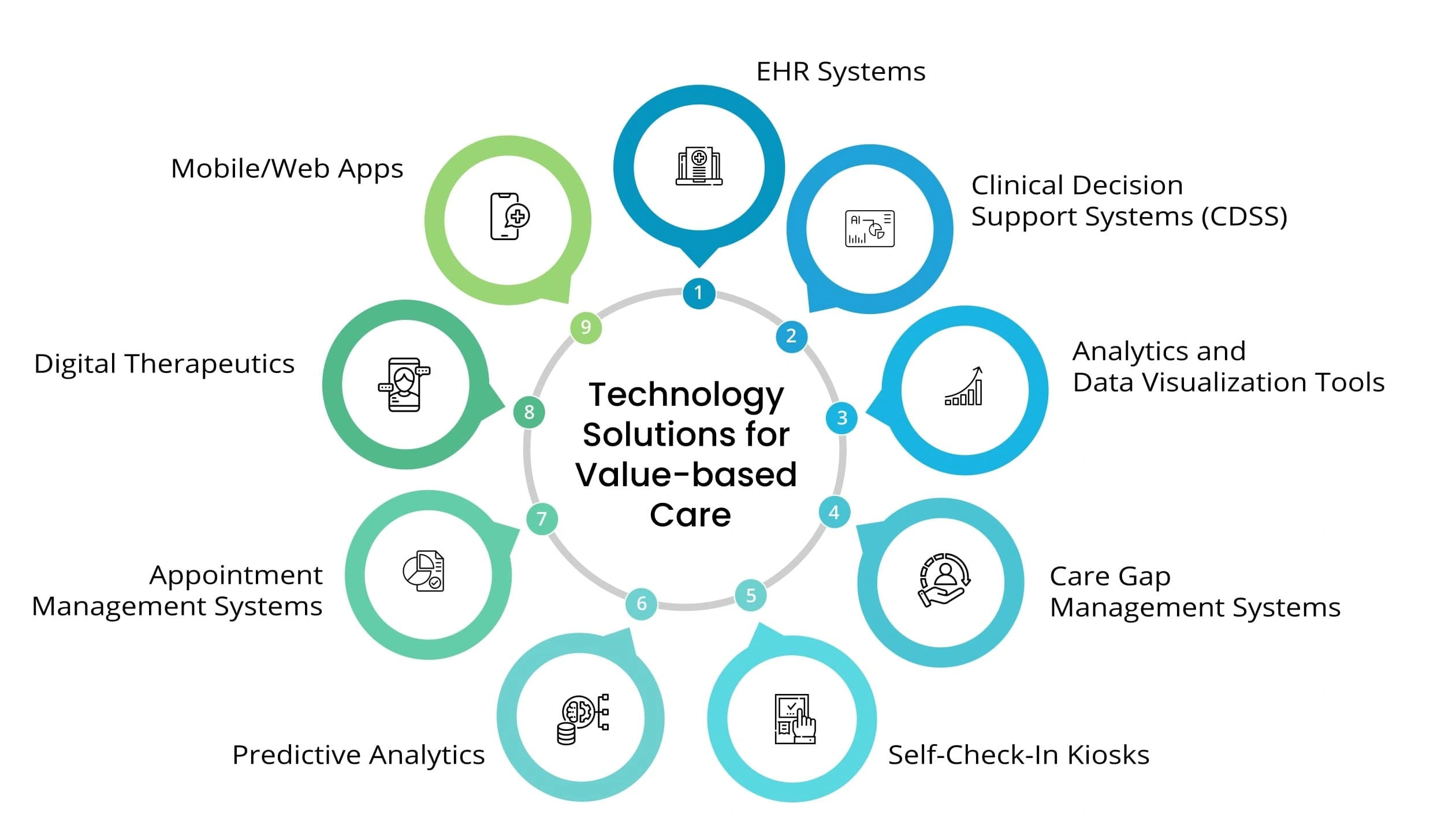

The next phase is less about deciding whether to participate in advanced value-based care and more about how to industrialize the operating model. That requires a technology stack that can sustain accurate V28 coding at the point of care, manage utilization in real time, and translate quality requirements into everyday workflows rather than episodic clean-up work at year end.

The investment case is not limited to the remaining years of ACO REACH. CMS has made clear that lessons from REACH are feeding into the broader Innovation Center strategy and future high-risk tracks within MSSP and other models. The infrastructure that allows an organization to survive PY 2026 is likely to be the same infrastructure it will need for whatever comes next.

The new financial calculus: Analyzing the ACO REACH 2026 policy shifts

Performance Year 2026 changes turn the financial mechanics of ACO REACH from “supportive” to “selective.” Understanding those mechanics, and their operational implications, is now a board-level requirement.

Full transition to V28 and alignment with Medicare Advantage rigor

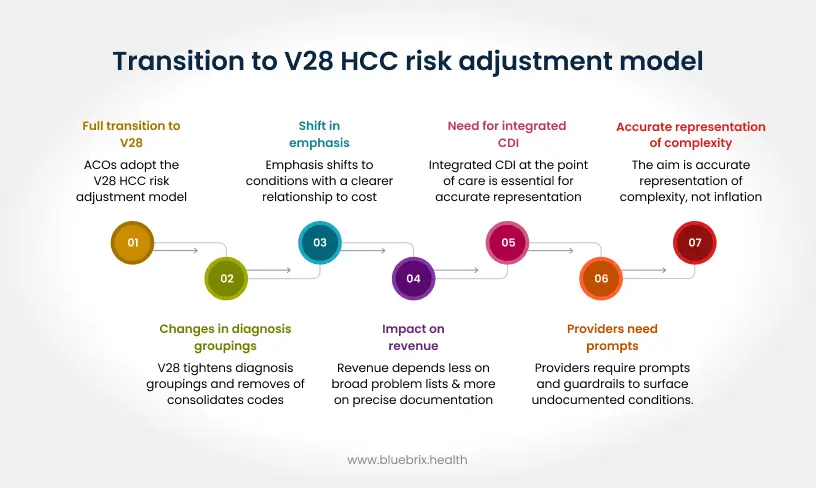

The most visible change is the full transition to the V28 HCC risk adjustment model for Standard and New Entrant ACOs. V28 tightens diagnosis groupings, removes or consolidates codes that previously carried weight, and shifts emphasis toward conditions that have a clearer relationship to cost.

In practical terms, this means that revenue tied to risk adjustment will depend less on broad problem list maintenance and more on precise, well-documented conditions that truly drive utilization. Clinicians cannot rely on historical patterns of coding to maintain benchmarks. ACOs that continue to treat risk adjustment as a retrospective exercise, handled by chart reviews months after the encounter, will struggle as the model matures.

Operationalizing V28 therefore requires integrated clinical documentation improvement (CDI) at the point of care. Providers need prompts and guardrails inside their native workflows that surface suspected but undocumented conditions, suggest specificity where needed, and suppress patterns that could be flagged as suspect coding. The aim is accurate representation of complexity, not inflation. Systems that treat CDI as a separate, parallel process will be too slow for PY 2026 dynamics.

Tighter benchmarking and constrained risk score growth

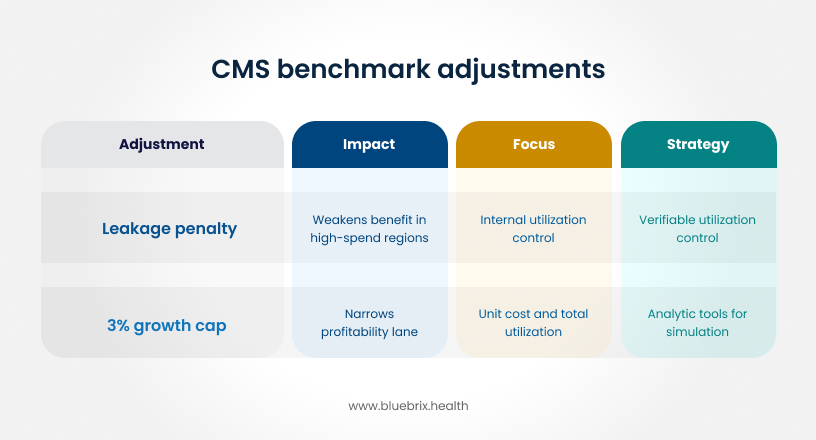

CMS is simultaneously adjusting how benchmarks are built. The regional component of the benchmark is being reduced, shifting more weight toward each ACO’s own historical performance (e.g., the 60/40 shift for Standard ACOs).

The leakage penalty:

This change weakens the benefit of operating in a high-spend region. Previously, efficient ACOs in inefficient regions could arbitrage the difference. Now, the benchmark increasingly reflects the ACO’s own history, increasing the value of verifiable, internal utilization control. If an ACO cannot control where its patients go (patient leakage), it cannot control the unit costs that now dominate its benchmark.

The 3% growth cap:

Layered on top of this is the tightening of risk score growth constraints. For Standard ACOs, CMS is imposing an additional cumulative cap of 3% growth in risk scores between 2019 and 2026. This is a hard ceiling. Financially, it creates a narrower lane for profitability: if risk scores cannot rise indefinitely to offset spending, then the path to margin depends entirely on controlling unit cost and total utilization. Organizations must invest in analytic tools that can simulate these caps before the performance year begins, allowing finance teams to project cash flow under “capped” scenarios.

The 5% quality withhold and the economics of performance failure

The quality withhold increase from 2 percent to 5 percent may sound incremental, but PY 2023 results show how influential quality mechanics already are. CMS reported that the quality withhold, net of high-performance pool payouts, reduced CMS payouts by more than 50 million dollars in 2023. For ACOs, that same construct will now be applied at more than double the previous rate.

Because REACH consolidates quality measurement into a small set of core measures, including unplanned admissions, timely follow-up (TFU), advance care planning, and CAHPS experience scores, the financial exposure is concentrated. A weak discharge process or poor access to primary care no longer only shows up in clinical dashboards. It directly affects settlement checks.

The logical response is to treat quality as a continuous operational signal rather than an annual report. That requires real-time eCQM capture, automated identification of gaps in follow-up, and linking those gaps to specific teams and locations. Organizations that still rely on manual chart reviews at quarter end will struggle to earn back a full 5% in a competitive field where many peers are already performing at or above a 79% Total Quality Score.

Operational mastery: strategic responses to tighter constraints

Financial rules alone do not create savings. The 2023 REACH results show that performance is driven by the ability to manage complex populations, reduce avoidable utilization, and coordinate care across settings.

Mitigating utilization risk through superior care coordination

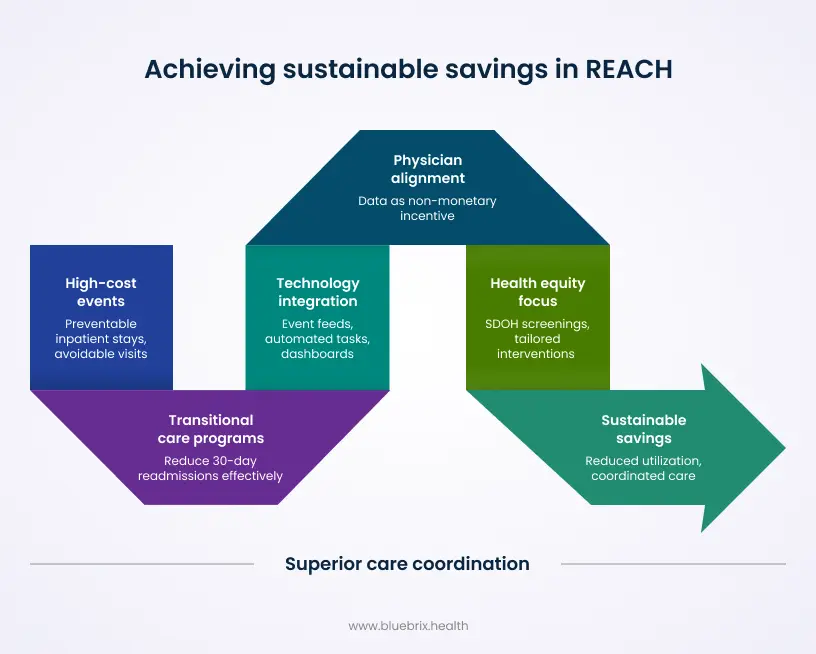

The primary driver of sustainable savings in REACH remains the avoidance of high-cost events that add little clinical value: preventable inpatient stays, avoidable emergency visits, and destabilizing transitions of care. High-performing ACOs use structured Transitional Care Management programs to reduce 30-day readmissions, with protocols that link discharge alerts to outreach, follow-up visits, and medication reconciliation within tight windows.

Technology is essential to support that level of consistency. A REACH organization needs event feeds from hospitals, automated creation of post-discharge tasks, and dashboards that highlight patients who are approaching risk thresholds. The same tools can monitor and reduce “leakage,” when attributed beneficiaries receive care outside the preferred network, which erodes the link between investment in care management and benchmark performance.

The physician alignment equation and data as a non-monetary incentive

Check distributions and shared savings bonuses matter, but they are often too infrequent and too opaque to change day-to-day behavior. In contrast, high quality, patient-level data can be a powerful non-monetary incentive for physicians.

The barrier is usually fragmentation. Many REACH participants operate on multiple EHRs, with carve-outs for specialists, post-acute partners, and behavioral health providers. Without a unifying layer that aggregates and normalizes data, physicians see only a slice of the patient’s journey. That makes it hard to connect their decisions to downstream outcomes.

An effective strategy is to deliver concise, clinically oriented views inside the physician’s existing workflow. Instead of separate portals, ACOs can surface risk scores, care gaps, recent utilization, and attribution status directly in the encounter screen or daily schedule. When those views are trusted and easy to access, they become part of how clinicians plan their day, not a separate reporting exercise. Over time, that kind of embedded insight reduces burnout by giving clinicians a clearer sense of impact rather than a stream of retrospective reports.

Operationalizing health equity and social determinants of health

REACH includes explicit equity requirements, and CMS has framed health equity as a central goal across all Innovation Center models. The organizations that will succeed in PY 2026 are already treating equity as an operational input, not a compliance checkbox.

Standardized SDOH screenings for housing, food insecurity, and transportation can feed directly into predictive risk models. When these factors are included alongside clinical and utilization data, the models can highlight patients for whom small, targeted interventions may prevent cascading problems, such as missed dialysis sessions or uncontrolled hypertension.

For underserved segments, care teams can then design tailored interventions: transportation benefits for frequent no-shows, community health worker outreach for isolated seniors, or behavioral health integration for patients with serious mental illness. High-performing REACH ACOs already demonstrate that focusing on high-complexity, high-need patients can generate outsized savings per beneficiary relative to the broader population.

The technology blueprint: selection criteria for PY 2026 success

By PY 2026, most organizations will have some form of analytics, care management tools, and reporting in place. The question is no longer whether technology exists, but whether it can actually move the levers that matter under the new rules.

Unified data architecture and interoperability as the foundation

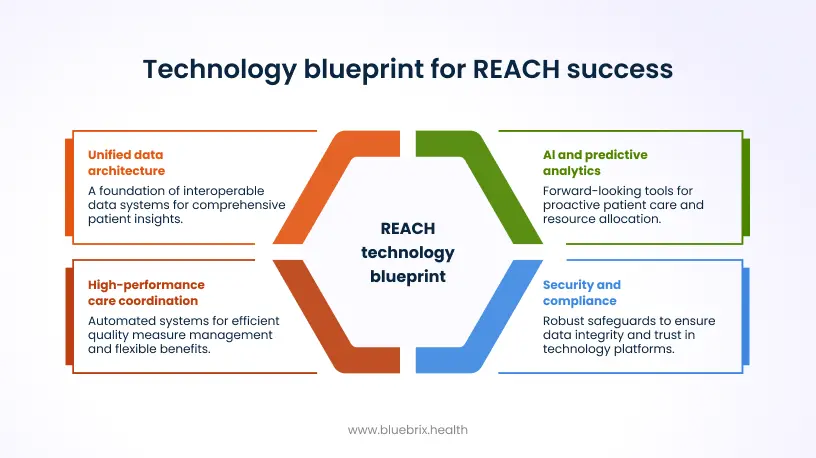

Success in REACH depends on seeing the whole patient, across time and settings. That is impossible if claims, clinical data, pharmacy fills, and social risk information remain in separate systems. A practical blueprint starts with a unified data repository that ingests EHR data, Medicare claims feeds (CCLF), care management notes, and third-party feeds into a normalized, patient-centric model.

Interoperability is not just a matter of supporting standards such as FHIR and existing exchange networks. It also means mapping data into a structure that can support V28 risk adjustment, quality measure calculation, and utilization analytics without repeated one-off projects.

When evaluating platforms, executives should ask whether new data sources can be added with minimal disruption to clinician workflows, and whether upgrades to the EHR or practice management systems will break downstream analytics.

AI and predictive analytics that move beyond retrospective RAF

Traditional RAF workflows look backwards, focusing on closing documentation gaps for the previous year. Under V28 and the risk score caps, this rear-view approach has diminishing returns. The focus must shift to forward-looking prediction and prevention.

Modern AI and machine learning tools can combine clinical, utilization, and SDOH data to forecast avoidable events, stratify patients by near-term admission risk, and recommend the most effective interventions. Instead of merely flagging missing codes, the system can cue clinicians to address uncontrolled conditions, care gaps, or behavioral health issues during the visit.

The same predictive capabilities can guide resource allocation. For example, a limited pool of nurse care managers can be assigned to patients whose predicted benefit from outreach is highest, rather than spread evenly across the panel.

Enabling high-performance care coordination under a 5% quality withhold

Because the increased quality withhold is tied to a small set of measures, technology needs to focus on the mechanics that move those measures. This includes:

- Automated Alerts: Real-time triggers for discharge and ADT events.

- Workflow Prompts: Automated tasks for timely follow-up and medication reconciliation.

- eCQM Efficiency: Automated data capture for quality submission, reducing the manual burden of reporting.

Flexible benefit integration is another lever. Telehealth, remote monitoring, and home-based care can be configured as targeted interventions for high-risk patients, rather than generic add-ons. A unified platform can help determine when a video visit will prevent an unnecessary ED trip, when home health can avoid a readmission, and how those decisions affect both quality scores and total cost of care.

Security, compliance, and vendor vetting as a trust requirement

Finally, no CFO or CIO will approve a large-scale platform without confidence in its security posture. HIPAA compliance is the starting point, not the finish line. Executives should review physical, administrative, and technical safeguards, including disaster recovery capabilities, encryption standards, and the vendor’s track record for incidents and remediation.

Because REACH involves sensitive data on alignment and beneficiary communications, the platform must also support compliant outreach, documentation of consent, and clear governance over data use. Those trust elements are especially important if the organization plans to leverage the same infrastructure in future MSSP, CMMI risk contracts or commercial value-based contracts.

Future outlook and quantifying ROI: sustaining value beyond 2026

REACH is scheduled to end after PY 2026, but it is unlikely to be the last word on high-risk accountable care. The program itself evolved from the Global and Professional Direct Contracting Model, and CMS has a pattern of folding successful elements from demonstrations into permanent programs such as MSSP.

The 2026 rule set, with V28, risk caps, and a higher quality withhold, can be seen as a preview of the expectations that will govern future advanced tracks. Organizations that build their analytics and coordination engines to succeed under these rules are effectively buying an option on future models. They will be able to pivot more easily into new CMS offerings or apply the same infrastructure to Medicare Advantage and commercial risk contracts, where similar concerns about coding integrity and utilization are already evident.

From a CFO’s perspective, the ROI equation has two main components. The first is shared savings and reduced downside exposure. CMS reported that in PY 2023, 96 out of 132 REACH ACOs earned positive net savings, with an average net savings rate of 4.1 percent and top-performing High Needs ACOs achieving net savings above 13 percent. Those figures set a realistic upper bound for what is achievable when governance and systems are aligned.

The second component is avoided cost, both direct and indirect. Direct avoided cost includes reductions in preventable admissions, ED visits, and readmissions. Indirect value comes from lower staff burnout, fewer manual workarounds to calculate quality performance, and more predictable financial results. Executives can model these effects by combining historical utilization data with projected improvements in key metrics such as readmission rates, follow-up compliance, and quality scores.