About blueBriX

Empowering Value-Based Care with Foundational Technologies

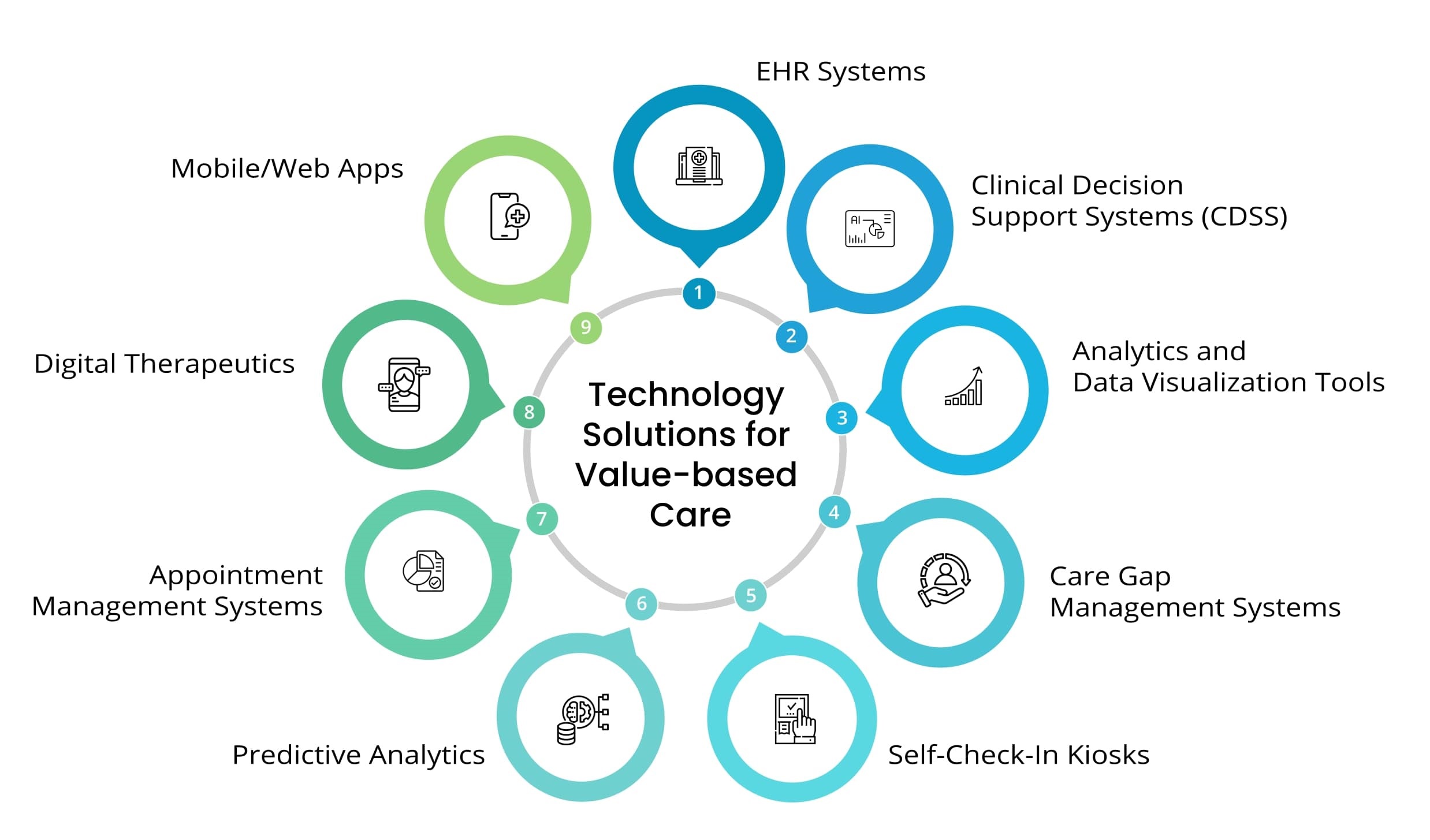

blueBriX is a powerful platform that offers the building blocks for digital health, enabling you to quickly launch differentiated digital health applications without starting from scratch. We provide the essential technologies that value-based care organizations need to thrive. Our comprehensive solutions span care and clinical models, operational and business models, patient engagement, remote patient monitoring, advanced data analytics and more. Everything you need for success in value-based care is seamlessly integrated into our blueBriX platform.

Learn More