Ignore your customers: Reid Hoffman and VC influence

I respect Reid Hoffman. He and the “PayPal mafia” have fundamentally changed the way most of us think about building and scaling businesses. But I do think they have made the whole business of building businesses a winner takes all game which can only be achieved with massive amounts of VC money. This is only good for a select few.

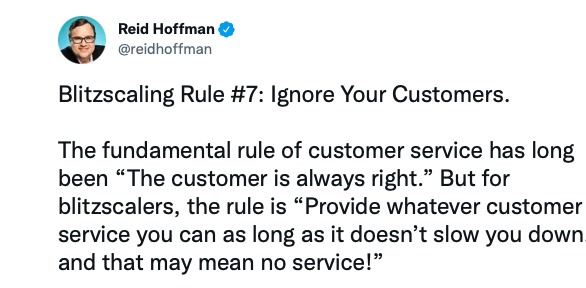

Businesses, he says, is like jumping off a cliff and assembling a plane while in freefall. Agreed. And if you need to Blitzscale, there are certain rules that he puts forward. One of them being that you can ignore customers if it slows you down.

The theory goes that you add more customers than the ones you lose. If you keep your churn low, you are fine. Like a Ponzi scheme, wouldn’t you say. So long as you have new investors you are fine. But when the new investors stop you go bust. The market collapse of 2022 and its effect on VC funding clearly illustrate that : dominoes are collapsing all around us.

So how do you keep adding more customers? Use the next rule: “You raise as much capital as possible:” That means capital becomes the primary driver of business. Never mind that your product sucks and your customers are unhappy.

This is where the disservice occurs. Reid and his mafia have brought an oversized importance for venture capital in entrepreneurship. Companies have no courage to bootstrap these days. Every business idea (pitch deck) is geared towards how they can impress a VC. If a VC says no, the dream is lost. If the VC says yes, then they have arrived. It is as if the VC is the north star. It is late in the game when they realize that money is but one factor in the equation.

We also find that many of the visionaries lose substantial ownership interest in those startups that get VC funding. After several rounds of funding, the share of the founder is reduced to low 2 digits. This is a meaningful reward if your company is valued at several billion dollars. A billion-dollar startup is called a “Unicorn.” There is a reason why it is named thus: the rarity of such startups.

For Mr. Hoffman and his mafia, the idea is to build very very large monopolies. Peter Theil, in his book, puts forth the concept that successful companies are necessarily monopolies, and they need to be rewarded as such. Again, agree with the concept. Creation is unique. Going from zero to one begets a monopoly.

The primary audience for the theory of the PayPal mafia are those entrepreneurs who are trying to build Unicorns. The problem with that is not everyone is trying to or can build one. Neither do they have the connections nor the proximity to Sandhill Road. In other words, their theories are not for just good companies, but great ones.

The great should not become the enemy of the good. The small to medium businesses of the world provide the bulk of the employment and prosperity of most nations. So, should every small business adapt these rules? How many of them can raise the money that Silicon Valley based companies can? Can they afford to ignore their customers?

Customers should be heard, entrepreneurs should be rewarded, capital should have its rightful place in the growth of a company, not an oversized one. A balanced economy and society depend on having a greater number of successful good companies.